by William Gregozeski, CFA

China Ruifeng Renewable Energy Holdings Limited [HK:0527 (“Ruifeng Renew”)] is a holding company with ownership interests in three energy-related businesses. Its current focus is on wind farm operations, via its majority holdings in Hongsong, a long established wind farm, and Langcheng, a greenfield wind farm (after various purchases and sales of ownership interests it will own 85.36% of the two wind farms on a beneficial level and 68.17% on a direct equity level. These wind farms have a current installed capacity of 398.4MW, and are expected to increase to 1,190.4MW by the end of 2017. It also owns a power grid construction business that installs transmission lines and related energy infrastructure for the State Grid and Southern Grid, as well as installs turbines and transmission infrastructure for its wind farms. The Company also owns a wind turbine blade assembly plant in Chengde, where it builds blades for AVIC Huiteng Windpower, one of the large turbine blade manufacturers in China.

Hongsong was established in 2001 as the first wind farm in Hebei Province with its installation of 2.4MW of capacity, which was comprised of four Goldwind [HK:2208, OTC:XJNGF] turbines, making Hongsong one of Goldwind’s earliest customers. Since then, Hongsong has completed eight phases of capacity expansion, each adding 49.5MW of capacity using 492 Goldwind turbines. Hongsong’s current installed capacity stands at 398.4MW, with the expectation that 49.5MW will be added annually through 2017, bringing its final installed capacity to 596.4MW. Hongsong is taxed at the full 25% rate, however all new phases of installed capacity (starting with Phase 8) will enjoy a full tax exemption for three years, followed by a 50% reduction for the following three years, after which it will pay the full tax rate.

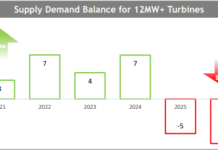

Langcheng was established in 2005 to develop a 594MW wind farm in Hexigten Qi in Inner Mongolia. With the initial infrastructure in place, the Company intends to begin installing wind turbines in 2014, aiming to add three phases of 49.5MW each year through 2017. Like Hongsong, each new phase of installed capacity will enjoy a full tax exemption for three years, followed by a 50% reduction for the following three years, after which it will pay the full tax rate.

Ruifeng Renew enjoys a number of benefits from its ownership of Hongsong and Langcheng. The two wind farms are located 30km apart, which allows for shared management and shared substation distribution; Hongsong currently has the infrastructure to support the distribution of up to 596MW of wind power, which will be ramped up to meet the expected increase capacity over the next three years. The Company’s Power Grid Construction business is expected to install the turbines and distribution systems, which will help reduce the capital expenditure of each phase of increased capacity, while creating additional revenue for that business. The most recent expansion, Phase 9 at Hongsong, cost approximately RMB270 million and we estimate future phases of increased capacity will cost RMB 270 to RMB 300 million, below the market rate for other producers, which enables management to obtain funding for most of the expansion with near PBOC rate bank debt.

Management intends to add capacity in 49.5MW increments, as any wind farm addition of 50MW must apply for a license from the NDRC (National Development and Resource Commission) at the national level, whereas capacity additions below 50MW can receive license approval from the regional arm of the NDRC. The expectation is that all turbine purchases will be from Goldwind, the third largest wind turbine manufacturer in the world, who grants the Company favorable pricing on turbines due to the longstanding relationship between Hongsong and Goldwind.

Ruifeng Renew’s Wind Farm Operations generate revenue primarily from the sale of turbine-generated electricity sold to the State Grid Corporation of China, the seventh largest company in the world according to Forbes. The State Grid does not enter into formal power purchase agreements (PPAs) with individual producers, but rather commits to buy electricity put on the grid at a fixed price set twice a year, which is currently RMB 0.43/kWh. Renewable energy producers also receive RMB 0.11/kWh in subsidy revenue from the Finance Ministry, resulting in a total energy tariff of RMB 0.54/kWh. The average wind farm in China operated for 2,000 hours in 2013, up from 1,900 hours in 2012, but still well below the historic average of roughly 2,250 hours at Hongsong and the expected 2,300 to 2,350 hours at Langcheng.

Based on the information above, and put in the context of the growth drivers of the energy and wind power market in China as described in our last article, we believe Ruifeng Renew is ideally positioned to build shareholder value in the coming years.

William Gregozeski, CFA is the Director of Research at Greenridge Global, a provider of institutional-based sell-side services to underfollowed Asian-based companies and special situation stocks. The author of this article, Greenridge Global and its affiliates do not have a beneficial ownership in the companies mentioned herein or any other disclosable conflicts of interest.