Not A Bankster

By Jeff Siegel

In the long, slow recovery from the 2008 financial collapse, the banking industry has increasingly been regarded as a buglight for the untrustworthy.

The Libor (London Interbank Offered Rate) scandal brought banking corruption to the front of the news, and showed the world a huge ethical hole that had burned through the middle of major banks.

In a 2012 essay entitled “Is Banking Unusually Corrupt, and If So, Why?” Financial analyst, Circuit Court judge and University of Chicago Law School Lecturer Richard A. Posner laid out the reasons why the system might foster unethical behavior.

“The complexity of modern finance, the greed and gullibility of individual financial consumers, and the difficulty that so many ordinary people have in understanding credit facilitate financial fraud, and financial sharp practices that fall short of fraud, enabling financial fraudsters to skirt criminal sanctions,” Posner said.

The public embraced a depression-era term to show its feelings of distrust and disgust.

“Banksters.”

A portmanteau of “bankers” and “gangsters,” the term was first used in 1933, but embraced anew when people saw what had become of their assets. Trust in banks sank.

Seventy-eight percent (78%) of people surveyed in the Consumer Banking Insights Study believed big banks were fully to blame for the financial crisis of 2008 and the subsequent recession. Thirty one percent (31%) of those people said they didn’t trust big banks with their money even though they were already customers of one.

Smaller banks and credit unions started to become more attractive to disaffected customers as a result, and America’s credit unions recently passed 100 million members, according to the Credit Union National Association (CUNA).

“[It’s] the unique structure – not-for-profit, member-owned cooperative – of credit unions that gives them the ability to offer better rates and member-focused service,” CUNA said in a statement in August.

Beyond local banks and credit unions, Americans looking to bank differently have yet another option: the B Corp Bank.

A bank with a philosophy

Benefit Corporations and Certified B Corps are companies that are committed to responsibility beyond providing shareholder value. They have to uphold certain environmental standards, labor standards, and tax standards; and are bound to provide something more than just profit.

We recently took a look at B Corps and liked what we saw.

With more than 1,000 corporations submiting to B Corp certification, a select group of banks has begun to gravitate toward the philosophy, too. Earlier this summer, the sixth bank attained Certified B Corp status.

It’s a public company, too.

Portland, Oregon’s Capital Pacific Bank (OTCBB:CPBO) was founded in 2003 as a local bank to serve the needs of local businesses. In the intervening decade, it has grown into a full-scale financial institution that also has a mission of sustainability and community involvement.

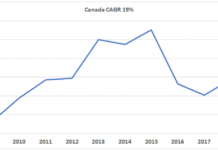

B Labs has given CPB a score of 98 out of 200 on the B Corp certification scale. The lowest score allowed to keep certification is an 80, so it is closer to the low end of the scale than the high. However, it’s only been certified for a couple of months, so its score can improve with each monthly review. It’s also on par with the Business Development Bank of Canada, another Certified B Corp bank.

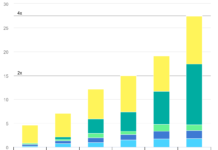

At the end of 2013, CPB had $239 million in total assets, and net income of $1.8 million, or $0.69 per share, the highest annual earnings in the company’s history. It had double digit growth in both deposits and loans, and an 8.8% return on equity for the year. It closed out the year with a book value per common share of $8.36.

“Many banks are dealing with sluggish loan growth due to lackluster demand, low-interest rates, and increasing regulatory and compliance costs,” Mark Stevenson, CEO and President of Capital Pacific Bancop wrote in the company’s annual report to shareholders. “Unlike many of our peers, we’ve been successful in achieving growth in our loans, deposits and net interest income in spite of these headwinds, and our profits have grown to record levels, putting us among the top performing banks in the Pacific Northwest.”

It’s also worth noting that Capital Pacific Bank has only one single physical location. This was chosen to diminish its footprint and streamline its operations, and it shows that CPB is in tune with broader trends.

Branch closures in the U.S. hit its all-time highest level in 2013, with 1,487 branch locations closing over the course of 2013. This is the most significant decline ever recorded by SNL Financial, a financial market analysis firm.

Since the crisis of 2008, banks have increased their efforts in mobile and online banking services to cut any overlap in service. If a customer can deposit his checks and manage his finances online, he would have no reason to go to his local branch and waste several hours of his precious time.

Time is money, after all.

So Capital Pacific bank is keeping it small and local, while adhering to more stringent regulations outlined by B Labs. It’s a new kind of bank for a post-crash economy. And from a free market perspective, I like seeing this kind of alternative.

Jeff Siegel

Full Disclosure: I currently own shares of SCTY.

Jeff Siegel is Editor of Energy and Capital, where this article was first published.