Tom Konrad CFA

Plummeting oil prices, global economic weakness, and the Republicans’ win in the US midterms have delivered a triple-whammy to clean energy stocks over the last few months. Many of the stock declines are justified more by headlines than fundamentals. My 10 Clean Energy Stocks for 2014 model portfolio has suffered, especially the riskier growth stocks. The strong dollar has been a further drag on the six foreign stocks.

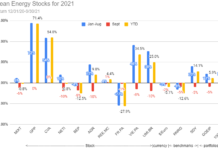

Since the last update at the start of October, the model portfolio is down 4.6%, for a loss since its December 27th, 2013 inception of 3.8%. In local currency terms, it would have returned a slight gain of 0.5% since inception. For comparison, the most widely held clean energy ETF, PBW, lost 12% since the start of November, and is down 14.9% since the portfolio inception. My broad market benchmark, IWM, is up 2% and 4.2%, respectively. Individual stock performance is shown in the chart below.

Because I believe the declines of most clean energy stocks are not justified by fundamentals, I personally will not be selling any of these stocks at current prices. That said, many clean energy stocks have declined even more drastically than these and now present better values than some in my 2014 list. To keep my 2015 model portfolio manageable, I have to drop some to make room. In this article, I will discuss the four stocks I am considering dropping from next year’s model portfolio, and why.

Individual Stock Notes: Sad To See Them Go

(Current prices as of December 19th, 2014. The “High Target” and “Low Target” represent my December predictions of the ranges within which these stocks would end the year, barring extraordinary events.)

2. PFB Corporation (TSX:PFB, OTC:PFBOF).

12/26/2013 Price: C$4.85. Low Target: C$4. High Target: C$6.

Annualized Dividend: C$0.24.

Current Price: C$4.44. YTD Total C$ Return: -3.5%. YTD Total US$ Return: -10.9%

While I’m very optimistic that green building company PFB Corp continue the recovery it has staged from its mid-October low, I’m dropping the company from the model portfolio because its low liquidity and Toronto listing makes it difficult for many US investors to buy. If you already own it, I suggest you keep it. Although PFB may face headwinds from a slowing housing market, the company benefits from low oil prices, which drive the price of the chemicals used to make the expanded polystyrene in its building products. If oil prices rebound, that should benefit the Canadian dollar, which should provide a tailwind for US based investors.

4. Primary Energy Recycling Corp (TSX:PRI, OTC:PENGF).

12/26/2013 Price: C$4.93. Low Target: C$4. High Target: C$7.

Annualized Dividend: US$0.28 (suspended after buyout announcement.)

Current Price: C$6.27. YTD Total C$ Return: 31.4% . YTD Total US$ Return: 21.3%

On December 19th, a consortium led by Fortistar completed the acquisition of waste heat recovery firm Primary Energy Recycling for US$5.40 per share (approximately C$6.27). It was partly because I thought such a buyout was likely that I included Primary Energy in this year’s list.

8. Power REIT (NYSE:PW).

12/26/2013 Price: $8.42. Low Target: $7. High Target: $20. Dividend currently suspended.

Current Price: $8.65 YTD Total US$ Return: 2.7%

The fate of solar and rail real estate investment trust Power REIT still hinges on the outcome of litigation with the lessees of its rail asset. This case will likely go to trial in the first quarter of 2015. While I believe both that the facts of the case favor Power REIT, and that, even if the case goes entirely against the company after a lengthy and expensive trial and appeals process, it will not be catastrophic for Power REIT. The lessee’s goal in the case is to maintain the status quo when Power REIT attempted to foreclose.

Power REIT’s CEO tells me that the judge was hard to gauge during the most recent hearing, and I have no reason to change the rough valuation I gave for Power REIT during the last update. That conservatively gave PW an expected value per share of about $10.75.

I was thinking about dropping Power REIT from the 2015 list mostly because of illiquidity, which causes large swings such as the recent decline for very little reason. Since the last couple months have seen such a decline, I’ll probably keep it in the 2015 list unless a Santa Claus rally brings it closer to my valuation.

10. Alterra Power Corp. (TSX:AXY, OTC:MGMXF).

12/26/2013 Price: C$0.28. Low Target: C$0.20. High Target: C$0.60. No Dividend.

Current Price: C$0.33 YTD Total C$ Return: 17.9% . YTD Total US$ Return: 8.8%.

Renewable energy developer and operator Alterra Power has delivered well in 2014, despite the weak Canadian dollar. Although I think it is still considerably undervalued, I am considering dropping it from the list simply because its advance and other stocks’ declines make it relatively less attractive, but I’ll keep it in my own portfolio because I think it has farther to run.

Conclusion

With the recent sharp declines by many big name clean energy stocks, now is a great time for people with money to invest in the sector. Although it’s always nice to see bargains, it can be a bit painful to sell other stocks which may have also fallen to invest in the new opportunities. Fortunately, followers of my annual model portfolio will have at least some cash from the buyout of Primary Energy to deploy next year.

As for the other three stocks I may drop from the 2015 list, I plan to hold them and will probably write about them again, even if I’m no longer covering them in my monthly updates.

Disclosure: Long HASI, PFB/PFBOF, CSE/MCQPF, ACCEL/ACGPF, NFI/NFYEF, AMRC, MIXT, PW, AXY/MGMXF.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

nice outcome for alterra stockholders

Agreed, worked out well for me. Although I have mixed feelings about all this consolidation… I keep having to find replacement stocks because my holdings are buying each other.