By Tom Konrad, Ph.D., CFA

An 80% Weasel Coefficient

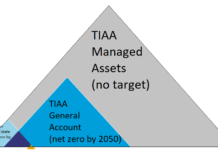

Some activists, including a friend of mine, recently had a conversation with representatives of TIAA to try to persuade them to divest from fossil fuels. The conversation was mostly cordial, but predictably did not get anywhere.

One of the activists summed up the response from TIAA as “a non-response with a weasel coefficient of at least 80%.” Regarding the weasel coefficient, he also asked,

Can anyone explain to me what “our overarching strategy which targets climate-risk adjusted returns over the long-term” means in plain English?

Well, yes. Yes I can.

Climate Risk Adjusted Returns

When an investment manager says she is targeting “climate risk adjusted returns,” she is saying:

- Climate change is real, and it presents real risks which will impact investment returns.

- Those climate risks are knowable, and she has useful estimates of how those risks affect companies.

- She will use that knowledge to make money for her clients over the long term while not taking undue risk.

- (Implicitly) Morality and doing the right thing have no place in her investment strategy. Her investment strategy is amoral.

- She is afraid of saying all this in plain English because number 2 above is clearly false, and 4 is embarrassing to any person who considers herself to be a moral individual.

Known Unknowns

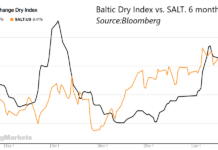

Climate risk is clearly a known unknown. We know that the climate is already changing, and it’s changing at an increasingly rapid pace. These changes are causing large and growing economic disruptions, but just how fast they will grow is largely unknown. An even larger near-term climate risk will be the political efforts to mitigate climate change. How quickly will we phase out fossil fuels? What new regulations will affect a company’s operations in the next 4 years?

Finally, there is divestment risk. Will the divestment movement accelerate, leaving other investors unwilling to buy your fossil fuel stocks from you at anything near their current value?

I personally believe that climate risks are large, growing, and essentially unpredictable. The TIAA manager who said “our overarching strategy which targets climate-risk adjusted returns over the long-term” is either overconfident, lying to herself about these risks, or lying to everyone else.

Most likely, it’s just massive overconfidence.

Overconfidence is a common affliction among those who manage large sums of other people’s money. People who have control of large sums of money or power usually tell themselves that they deserve that money or power on the merits of their superior skills or judgement. There are very few people for whom this is actually true.

Amoral Investing

The implicit point about TIAA’s strategy being amoral is simply an observation that targeting “climate-risk adjusted returns” does not leave any room for discriminating between investing in things that are good for people, society, or the planet, and things which are harmful. This amoral philosophy was memorably summed up by the villain of the 1987 film Walls Street with the words “Greed is good.”

Greed, in this case, is another way of saying “targeting returns” a.k.a. making as much money as possible. TIAA and unfortunately most money managers believe that their entire moral obligation to their clients is satisfied by making as much money as possible for the risk they are taking on, regardless of the collateral damage. If the collateral damage is shooting baby pandas, they are OK with that, because “greed is good.” If the collateral damage is destroying the planet, they are OK with that as well.

It’s Not Just TIAA

It’s somewhat unfair to single out TIAA here, in that many investment managers are even worse. Many just “target risk-adjusted returns over the long term.” In other words, they are amoral investors who do not even acknowledge that climate risks are real.

If you are a moral person, or a person who believes that not all such risks can be quantified, just acknowledging that climate risks are real should not be enough for you. A moral person should make sure that whoever invests her money should also do so in a manner that conforms to her morality. A person who knows that climate risks are unknowable should not trust her money to someone who thinks that those risks can be quantified and managed, rather than avoided.

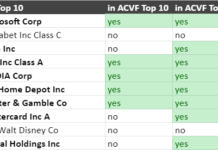

If you invest through mutual funds, a great resource for finding funds that avoid fossil fuel risks altogether is fossilfreefunds.org. There are also a growing number for investment advisors all over the country who will manage your money while keeping in mind both your moral choices and the risks that climate change poses. Or, since you are probably reading this on AltEnergyStocks.com, you can do it yourself.

Don’t be Gordon Gekko. He was the villain.