Green Bonds Mid-Year Summary 2017

by the Climate Bonds Team

Climate Bonds looks at the last six months numbers, the trends and our tips for the rest of 2017

Green Bonds Mid-Year Summary 2017

Headline figures for the Half Year (H1)

2017 issuance to H1: USD55.8bn

Records broken: Quarter 2 (Q2) is the largest quarter of issuance on record at almost USD30bn

82 green bond deals issued in the quarter from 74 issuers

Over 50% of issuers were first time issuers

Green Bond transactions accounted for 3% of global bond market transactions in Q2 2017

Top 5 largest issuers of H1:

Republic of France (USD7.6bn),

EIB (USD2.8bn),

...

Yieldcos: Boom, Bust, and (Now) Beyond

The Yieldco model is not broken. But investor expectations have changed. by Tom Konrad Ph.D., CFA The Yieldco bubble popped almost exactly a year ago after a virtuous cycle turned vicious. Last May, I explained how these public companies (which own solar farms, wind farms and similar assets) could grow their dividends at double-digit rates despite no internal growth or retained earnings. This “weird trick” can work so long as the Yieldco’s stock price is rising, allowing it to sell stock at higher valuations and increase the amount of money invested per share. As long...

Trash Stocks Trashed: An Income Opportunity?

Tom Konrad CFA Dumpster diving for high yielding gems. An earlier version of this article was written at the end of July and published on my Forbes blog, before the August market implosion. I've updated it here to reflect the new stock prices and some recent company news. Renewable energy has many advantages over fossil energy. One of the most important is that it's renewable. As supplies of Oil and other fossil fuels are used up, they become harder and more expensive to extract, while renewable energy is generally getting cheaper over time,...

Are YieldCos Overpaying for Their Assets?

Tom Konrad CFA YieldCos buy and own clean energy projects with the intent of using the resulting cash flows to pay a high dividend to their investors. Several such companies, often captive subsidiaries of listed project developers, have listed on U.S. markets since 2013. So far, YieldCos have been a win-win: The developers that list YieldCos have gained access to inexpensive capital, and income investors have gotten access to a new asset class paying stable and growing dividends. So far, they have also gained from significant stock price appreciation. The seven U.S.-listed YieldCos are up...

Second Largest Quarter For Green Bonds Ever

Third quarter reflects strong growth and new market entrants

Overview

The green bond market has kept its strong pace in Quarter 3 2017, reaching a total of USD27.7bn from July to September.

On September 28th, the total amount of green bonds issued in 2017 ytd (USD83.2bn) overtook last year’s total issuance of USD81.6bn.

We covered the big moment in our Blog Post here.

Lots of new issuers

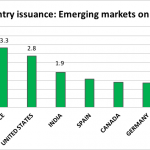

The top sources of issuance were:

Mexico - USD4bn

China - USD3.9bn

France - USD3.3bn

U.S. - USD2.8bn

India - USD1.9bn

Mexico was a surprising addition to the number one spot, after issuing no green bonds in Q1 or Q2 this year.

Big...

Income From Hydroelectric Power

by Debra Fiakas CFA Are you an investor hungry for current income? Is there a green line of global warming fear running through your investment selections? I have stock that fulfills both requirements. Brookfield Renewable Energy Partners (BEP: NYSE) is a renewable power producer with assets in Canada, the U.S. and Brazil. Brookfield generates over 5,900 megawatts of power each year from plants running on river water, wind or natural gas. Another 2,000 megawatts is apparently under development in Canada and Brazil. What Brookfield does best is hydroelectric production. The company claims over 170...

Green Bond Market Heats Up After Slow Start To 2015

$7.2 billion of green bonds issued. Market shows signs of maturity, including more currencies, and non-investment grade bonds. Emerging market green bonds are ramping up, while green munis are booming. by Tess Olsen-Rong, Climate Bonds Market Analyst The first three months of 2015 (Q1) have seen 44 green bond deals totalling $7.2bn of issuance. After relatively low issuance in January the amount of green bonds issued has been climbing each month, with March three times bigger than January. This year will be the biggest year ever for green bonds: there’s a healthy pipeline of bonds in the...

US Yieldcos Will Survive

by Susan Kraemer As unrealistic expectations of dividend growth are scaled back, yieldcos are now on a more sustainable path. Weaknesses in the US yieldco model came into sharp relief this summer as share prices fell along with oil and gas stocks. This was in part due to investor confusion about energy stocks but also in response to a flaw in US yieldco expectations. Manager of the Green Global Equity Income Portfolio and AltEnergyStocks.com editor Tom Konrad Ph.D., CFA had warned of the looming potential for exactly this kind of market correction in a conversation a...

Enviva: Wood Pellets Into Dividends

by Debra Fiakas CFA Last week Enviva Partners, LP (EVA: NYSE) reported financial performance for its wood pellets business in its quarter ending September 2015. Sales totaled a whopping $116.6 million, representing a 53% increase compared to $40.5 million in the same quarter last year. The big jump in revenue resulted from higher volumes to larger customers. Distributable cash flow totaled $12.6 million compared to $8.2 million in the year ago period. Quarter performance made possible a declared cash distribution of $0.44 per common unit, which is 7% higher than the minimum quarterly distribution. At its...

The Green Bond Trend

DTE Energy Company (DTE: NYSE) recently priced a ‘green bond’ issuance of $525 million to support renewable energy and energy efficiency. The thirty-year bonds provide a coupon payment at 4.05%. DTE is planning to buy solar arrays and wind turbines with its newly flush cash kitty. The capital raise is of significance less for its size and purpose and more for the fact that a U.S. electric utility company is tapping this unusual financing vehicle.

True enough, green bonds are nothing new. Created to fund projects with environmental or climatic benefits, the first green bonds were issued in May 2007 by the European Investment Bank (EIB). The...

Unlocking Solar Energy’s Value as an Asset Class

by James Montgomery

2014 is predicted to be a breakout year for solar financing, as the industry eagerly pursues finance innovations. Many of these methods aren't really new to other industries, but they are potentially game-changing when applied in the solar industry.

Recent Green Bonds: Toyota Hybrids, SunRun, Efficient Homes and Data Centers

by the Climate Bonds Team Last month Toyota closed their second green bond for a whopping $1.25bn. Standard auto loans backed the issuance with proceeds to be used for electric and hybrid car loans; that means it’s more like a corporate green bond, where proceeds from a bond backed by existing (non-green) assets are directed green loans still to be made. Sunrun issued $111m of solar ABS, and a small unlabelled energy efficiency ABS was also issued by Renew Financial and Citi for $12.58m. Sunrun and Citi/Renew Financial are examples of ABS where the assets backing the issuance...

Investors Expect Rapid Growth At Pattern Energy Group

Tom Konrad CFA Pattern Energy's Gulf Wind Farm in Armstrong, Texas Disclosure: Long BEP. Pattern Energy Group (NASD:PEGI, TSX:PEG) completed a very successful Initial Public Offering (IPO) on the Nasdaq and Toronto stock exchanges on September 27th. Not only did the shares price at $22, near the top of the expected range, but the underwriters exercised their full over allotment option to purchase 2.4 million shares in addition to the initial 16 million offered. Total proceeds from the offering were $404.8 million. Most of the proceeds went to Pattern Energy Group, LP (PEGLP) in consideration for a...

Three Clean Energy Stocks That Won’t Keep You Up At Night

Tom Konrad CFA If you want to green your portfolio, but the wild swings of First Solar (NASD:FSLR), Tesla (NASD:TSLA), SolarCity (NASD:SCTY), and even clean energy ETFs like Powershares Wilderhill Clean Energy (NYSE:PBW) are a bit too much to let you sleep at night, you’re not alone. A reader recently suggested I write about more green stocks like Waste Management (NYSE:WM), which readers can own and not worry about too much. I thought it was an excellent suggestion; I’ve recently been writing much more about much more exciting or terrifying stocks, because there is simply a lot more...

Yieldcos: Calling The Bottom

by Tom Konrad Ph.D., CFA On a podcast recorded on September 14th, I said I thought that Yieldco stocks had bottomed at the end of September. Two weeks later, that call still looks like a good one (see chart.) I'm starting to hear optimistic noises from other Yieldco observers, although the general tone remains quite bearish. Why do I think September 29th was the likely bottom? End of quarter. Some institutional investors such as mutual funds reshuffle their portfolios at the end of the quarter so that they don't have...

What Yieldco Managers Are Saying About The Market Meltdown

by Tom Konrad Ph.D., CFA Note: This article was first published on GreenTechMedia on Noveber 27th. In the last six months, YieldCos have fallen from stock market darlings to pariahs. YieldCos are companies that buy clean energy projects such as solar and wind farms, and use the majority of free cash flow from these projects to pay dividends to investors. Many are listed subsidiaries or carve-outs of large developers of clean energy projects. Last year, investors repeatedly punished leading solar developers and manufacturer First Solar and SunPower for their reluctance to launch YieldCos. When...