Wall Street Banks Promote New Green Bonds Framework

by Sean Kidney Earlier this month CitiBank (NYSE:C) and Bank of America Merrill Lynch (BoAML; NYSE:BAC) launched, via a special EuroWeek report on ‘sustainable’ capital markets, a “Framework for Green Bonds“. This is potentially a big development. In the paper the two banks laid out a ‘vision’ for the green bonds market and called for a Green Bonds Working Group of issuers, dealers and investors to be formed to drive the evolution of the nascent market. The paper calls for debate about the green bond market, especially about...

Three New Green Bonds

by Sean Kidney The International Finance Corporation (IFC) is planning to issue $1bn Green Bonds per annum. Hawaii is setting up a bond-funded green bank Germany’s PNE Wind is planning a €100m corporate bond Trade Finance magazine reports that the IFC is planning to issue $1bn a year of Green Bonds. After talking with IFC folk in Washington DC last week I think I can say that the resounding success of last month’s first $1bn IFC Green Bond is making them think much more ambitiously than before. We think they should also...

Developments in the Solar Corporate Bond Market

by Corporate Bonder The global bond market is huge. Data from the Bank for International Settlements shows that the total size of the global debt securities market (domestic and international securities) was $99.5 trillion as at June 2011, of which $89.9 trillion were notes and bonds. Governments accounted for $43.7 trillion of outstanding debt securities, financial organizations $43.8 trillion, corporations $11.0 trillion and international organizations $1.0 trillion. Against that, Bloomberg has estimated that there are $230bn outstanding of fixed-interest securities that meet their “green bonds” definition. And of course the IEA talks of $1 trillion of investment a...

Green Bond Update: Wind Company Bonds

by Corporate Bonder Market Overview Data compiled by the Bank for International Settlements indicate that the total size of the global debt securities market (domestic and international) was $98.7 trillion as at September 2011, of which $89.9 trillion were notes and bonds. Governments accounted for $44.6 trillion of outstanding debt securities, financial organizations $41.9 trillion, corporations $11.2 trillion and international organizations $1.0 trillion. The focus of this report is on corporate borrowers. US corporations are the largest debt issuers, accounting for 46% of corporate debt globally, followed by the Eurozone with 20%, Japan 9%, China 6%, and...

Solar Investing Grows Up

Tom Konrad CFA Disclosure: Long HASI, BEP. Short PEGI calls, NYLD calls. When I was asked in an interview last month what I thought 2014 would hold for green tech finance, I said 2014 would be the year that “renewable energy finance comes of age.” What I mean is that a new type of renewable energy investment is proliferating. Solar, other renewables, and energy efficiency investments are no longer limited to risky growth plays like Tesla Motors (NASD:TSLA.) There are now a number of yield focused investments available to small investors. As of last year,...

Climate Bonds 2016 Highlights

by the Climate Bonds Team

A record year with green bond issuance of USD 81bn, up 92% on 2015 figures

The Trends

A maturing of the green bonds market, diversification across issuers, products and use of proceeds are the main trends identified in our Green Bonds Highlights 2016 summary.

The Big Numbers

92% – growth on 2015 making 2016 the most prolific year to date

USD 11.8bn – November issuance, the largest month on record

24 – number of countries with green bond issuers

27% – proportion of Chinese issuers

241 – number of labelled green bonds issued (median size USD133.7m)

>90 – number of new issuers

>50 – number...

Comparative Valuation of 15 Yieldcos

Tom Konrad CFA Compared to the peak of the Yieldco bubble in May, many Yieldcos have dropped by more than half, and most by more than a third. Some of this decline is because rapid dividend growth depends on an endless supply of cheap investor capital which is another way of saying that we can have rapid dividend growth or high dividend yields, but not both. Part of the decline was due to the realization that many Yeildcos (most notably Terraform Power (TERP), Terraform Global (GLBL), and Abengoa Yield (ABY)) were not immune to...

No Longer Just Growth: Investing in Renewable Energies for Yield

by Robert Muir Given the determined investor quest for yield as the Federal Reserve maintains the benchmark Federal Funds rate at zero, and the resurgence of attention being paid to alternative energy generation, mainly solar, and to a lesser extent wind and hydro, it’s no wonder Yield Co’s have gained so much investor interest lately. In the near to mid-term, the enthusiasm may be justified. Supported by Power Purchase Agreements, energy infrastructure financing and leasing contracts, and electricity transmission and distribution concessions, all with credit-worthy counter-parties, Yield Co’s are designed specifically to pay out a large portion of...

Enviva: Wood Pellets Into Dividends

by Debra Fiakas CFA Last week Enviva Partners, LP (EVA: NYSE) reported financial performance for its wood pellets business in its quarter ending September 2015. Sales totaled a whopping $116.6 million, representing a 53% increase compared to $40.5 million in the same quarter last year. The big jump in revenue resulted from higher volumes to larger customers. Distributable cash flow totaled $12.6 million compared to $8.2 million in the year ago period. Quarter performance made possible a declared cash distribution of $0.44 per common unit, which is 7% higher than the minimum quarterly distribution. At its...

Solar Bonds For Small Investors

By Beate Sonerud SolarCity (NASD:SCTY) is issuing US$200m of asset-linked retail bonds, with maturities ranging from 1-7 years and interest rates from 2-4%. Wells Fargo is the banking partner. While the bonds are registered,SolarCity expects the bonds to be buy and hold, and not traded in the secondary markets. The bond is issued for small-scale investors, with investment starting at US$1000, giving this bond issuance a crowdfunding aspect. Choosing such a different structure allows SolarCity to diversify their investor base – the company stresses that small-scale investors are a complement, not substitute, for large-scale institutional investors. While...

Are YieldCos Overpaying for Their Assets?

Tom Konrad CFA YieldCos buy and own clean energy projects with the intent of using the resulting cash flows to pay a high dividend to their investors. Several such companies, often captive subsidiaries of listed project developers, have listed on U.S. markets since 2013. So far, YieldCos have been a win-win: The developers that list YieldCos have gained access to inexpensive capital, and income investors have gotten access to a new asset class paying stable and growing dividends. So far, they have also gained from significant stock price appreciation. The seven U.S.-listed YieldCos are up...

Unlocking Solar Energy’s Value as an Asset Class

by James Montgomery

2014 is predicted to be a breakout year for solar financing, as the industry eagerly pursues finance innovations. Many of these methods aren't really new to other industries, but they are potentially game-changing when applied in the solar industry.

Atlantica Q1, Buying Hannon Armstrong

By Tom Konrad, Ph.D., CFA

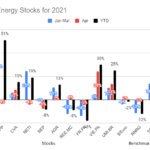

Here are two more updates from last week on Patreon. Also, I realize I neglected to publish the monthly performance chart for my 10 Clean Energy Stocks model portfolio here at the start of the month, so here it is as well:

Atlantica Sustainable Infrastructure Earnings

(published May 11th)

Atlantica Sustainable Infrastructure (AY) released its first quarter earnings announcement and financial statements on May 6th.

Atlantica is one of the higher yielding Yieldcos, 5.3% at the new quarterly dividend rate of $0.43 and a $32.50 stock price. The dividend is safe, since most of Atlantica's debt is fixed rate,...

Pattern Energy Investors Enjoy The Breeze

by Debra Fiakas CFA This week Pattern Energy Group’s (PEGI: Nasdaq), the independent wind power generator, is scheduled to report sales and earnings for the quarter ending September 2015. The company has cultivated a strong following among analysts for a company its size. Nine estimate contributions have gone into a consensus estimate of $87.2 million in sales for the quarter, resulting in a net loss of a penny per share. If achieved the sales hurdle would represent 22% growth over the same quarter last year. A penny loss may not seem impressive, but it is substantially better than...

Solar Rooftop Lease Securitization A Ground-Breaking Success

Sean Kidney Last week we blogged that SolarCity (SCTY) and Credit Suisse were about to issue a new $54.4 million, climate bond – a rooftop solar lease securitization. It’s out: BBB+, 4.8%, 13 years. The long tenor is interesting – and great. And S&P’s BBB+ rating suggest those credit analysts may be beginning to understand solar. This bond has been long-awaited by the green finance sector, who are hoping it’s the harbinger of things to come. I did get the chance to look at the S&P opinion. Their rating reflected, as they put it, their views on over-collateralization (62%...

How Much Can YieldCo Dividends Grow?

Tom Konrad CFA U.S.-listed YieldCos seem to offer the best of two worlds: high income from dividends, combined with high dividend per share growth. YieldCos are listed companies that own clean energy assets, and like the real estate investment trusts (REITs) and master limited partnerships (MLPs) they are modeled after, they return almost all the income from their investments to their shareholders in the form of dividends. Unlike REITs and MLPs, however, U.S.-listed YieldCos have management targets to deliver double-digit per-share dividend growth. YieldCos shown are NRG Yield (NYLD), Abengoa Yield (ABY), TerraForm Power...