Five Green REITs

by Tom Konrad Ph.D., CFA

Why Green Buildings are Profitable Buildings

Buildings are responsible for approximately a third of greenhouse gas emissions, so making buildings more efficient and switching them to renewable sources of energy is an essential part in addressing climate change.

Fortunately, new technologies such as cold climate heat pumps, heat pump water heaters, induction stoves, as well as the ever falling cost of renewable electricity and improvements to insulation and building envelopes often provide opportunities to improve buildings while achieving extremely attractive investment returns from the energy and maintenance savings alone.

Because of the great financial returns, building owners who...

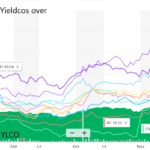

Yieldco Valuations Look Attractive

By Tom Konrad Ph.D., CFA

Despite a run-up in the fourth quarter of 2023, it has been a long time since valuations of clean energy stocks have been this cheap. Perhaps it is worries about hostility towards clean energy under a new Trump administration, or disappointment at the slow implementation of the Inflation Reduction Act. Whatever the cause, prices are low, and many clean energy stocks are likely to produce good returns even if the political climate turns further against them.

This is especially true for companies that are less dependent on favorable policy or subsidies. For instance, Yieldcos, high...

The Clear Way to Buy Clearway

By Tom Konrad, Ph.D., CFA

A reader of my recent article on Yieldcos asked which share class of Clearway Energy was the better to buy for tax purposes: Class A shares (CWEN-A) or Class C Shares (CWEN).

For tax purposes, they are identical. They pay the same dividend, and it is treated the same no matter which share class you buy. The reason many large investors often trade CWEN rather than CWEN-A is because it is more liquid. As I write on Jan 23rd, Yahoo! Finance puts the 3 month average share volume for CWEN at 1,372,714, while the corresponding number...

Buyer’s Guide To Community Solar in New York

by Tom Konrad Ph.D., CFA

An updated version of this article is available here.

After a painfully long wait, community solar (also called shared solar) is finally coming to New York state. After years of regulatory uncertainty, the state Public Services Commission (PSC) has put enough of the enabling regulations in place for a number of developers to move forward.

What is Community Solar?

A community solar installation is a large scale (typically 1 to 3 MW, or the size of about 150 to 800 residential solar installations) in which subscribers can sign up to lease or purchase a share of the production...

CAFD: Don’t Let The Joke Be On You

Tom Konrad CFA Sunpower and First Solar are indulging in nerd jokes. Their YieldCo, called 8point3 Energy Partners had its initial public offering on June 19th. The name is an astronomy nerd joke and a reference to the time it takes the sun's rays to reach the Earth, 8.3 minutes. Last week, we found out that its ticker symbol is CAFD, a "financial nerd joke" because it stands for "cash available for distribution." CAFD is an important YieldCo metric, but it's not a perfect one. If you're not a financial nerd but are interested in...

Royalties: a Financial Innovation for Renewable Energy

The following interview with RE Royalties (RE.V, RROYF) CEO Bernard Tan was conducted in September by AltEnergyStocks.com Editor Tom Konrad. Links and ticker symbols were not included in his original responses, but added by AltEnergyStocks.com as a resource for readers.

Q: What exactly is a renewable energy royalty?

A renewable energy royalty is a stream of cash flows generated by a renewable energy project. When the project generates electricity and sells its electricity, we receive a percentage of the revenues from the electricity sales, otherwise known as a gross revenue royalty. We receive that gross revenue royalty, on average, for about...

Comparative Valuation of 15 Yieldcos

Tom Konrad CFA Compared to the peak of the Yieldco bubble in May, many Yieldcos have dropped by more than half, and most by more than a third. Some of this decline is because rapid dividend growth depends on an endless supply of cheap investor capital which is another way of saying that we can have rapid dividend growth or high dividend yields, but not both. Part of the decline was due to the realization that many Yeildcos (most notably Terraform Power (TERP), Terraform Global (GLBL), and Abengoa Yield (ABY)) were not immune to...

List of High Yield Alternative Energy Stocks

This is a list of renewable and alternative energy stocks with dividend or distribution yields above 4%. The list includes most Yieldcos (high distribution companies that own renewable energy operations), but is not limited to Yieldcos. Some Yieldcos may be excluded if their yield is below 4%.

Atlantica Yield plc (AY)

Algonquin Power & Utilities Corp. (AQN, AQN.TO)

Bluefield Solar Income Fund Ltd. (BSIF.L)

Brookfield Renewable Partners L.P. (BEP)

Clearway Energy, Inc. (CWEN,CWEN-A)

Companhia Energética de Minas Gerais (CIG)

Covanta Holding Corporation (CVA)

Crius Energy Trust (KWH-UN.TO, CRIUF)

Enviva Partners, LP (EVA)

Foresight Solar Fund plc (FSFL.L)

GATX Corporation Series A (GMTA)

Global X YieldCo ETF (YLCO)

Greencoat UK Wind PLC (UKW.L)

Green...

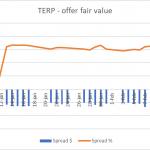

Why is Terraform Power Trading at a Premium to the Brookfield Renewable Merger Value?

Tom Konrad, Ph.D., CFA

A reader asked:

Read your recent article on Pattern Energy (PEGI). Great summary and thoughts.

Would like to ask your view on TERP potential takeover by BEP (via shares swap) and whether you reckon the recent run-up on TERP is too excessive?

It's a good question, and one that Robbert Manders on Seeking Alpha did a thorough analysis of here. For the details of the merger, I refer you to his work.

While his analysis is careful and complete, I disagree with his conclusion. TERP shares are not trading at a significant premium to the merger value. The reason is...

Are Aspiration’s Deposits Really Fossil Fuel Free?

Fossil Fuel Free Claims

If you are reading this, you've probably also seen advertisements for Aspriation's “Fee-free and fossil fuel free” banking services. Like the advertisements the company's product page encourages visitors to “Earn high interest on what you save with an account that is fee-free and fossil fuel free.“

As a professional green money manager, I know that “fossil fuel free” is in the eye of the beholder. For many mutual funds, “fossil fuel free” simply means avoiding the 200 largest fossil fuel companies, but investing in the 201st largest fossil fuel company, even if its primary business is mining...

10 Clean Energy Stocks for 2020: Updates on GPP, HASI, CVA

by Tom Konrad, Ph.D., CFA

Market Decline

Last week I warned "The risks in today's stock market outweigh the possibility of future potential gains." Looks like we're seeing those risks manifest in short order. The last couple days' decline have me looking at a few stocks to start adding to my positions again, especially MiX Telematics (MIXT) discussed on June 2nd and Green Plain Partners (GPP), discussed below.

Note that this pullback could easily be very early days of a much larger market decline. We might even see the market fall far enough to test the March lows... any of my buying...

Buyer’s Guide to New York Community Solar

By Ishaan Goel

WHY COMMUNITY SOLAR?

A home solar system is a great investment, with financial returns far in excess of any financial investment that has comparable risk. It’s also a tangible step a homeowner can take to help the environment.

Unfortunately, most New Yorkers (and Americans in general) can’t install home solar. They may be renters, or have roofs that are too old or shaded. Or they may not be able to afford the up-front cost, or not have enough income to take advantage of the tax credits.

That is why New York’s electricity regulator, the Public Service Commission, created community solar:...

Should Pattern Energy Shareholders Vote Against the Merger?

by Tom Konrad Ph.D., CFA

This morning, hedge fund Water Island Capital called on Pattern Energy (PEGI) Shareholders to vote against the merger with the Canada Pension Plan Investment Board (CPPIB).

Water Island claims the merger is undervalued compared to the recently surging prices of other Yieldcos, and that PEGI would be trading at over $30 given current valuations. There are not a lot of other Yieldcos left, especially if we eliminate those with their own special circumstances. These are Terraform Power (TERP) which is subject to its own buyout agreement with Brookfield Renewable Energy (BEP), and Clearway (CWEN and CWEN/A) where...

Green swan, Black swan: No matter as long as it reduces stranded spending

by Prashant Vaze, The Climate bonds Initiative

In January, authors from several institutions under the aegis of BiS, published The Green Swan Central banking and financial stability in the age of climate change setting out their take on the epistemological foundations for, and obstacles against, central banks acting to mitigate climate change risk.

The book’s early chapters provide a cogent and up-to-date analysis of climate change’s profound and irreversible impacts on ecosystems and society. The authors are critical of overly simplistic solutions such as relying on just carbon taxes. They also recognize the all-too-evident deficits in global policy to respond to the threat.

In short, they accept the need for central banks to act.

The Two Arguments

The paper makes two powerful arguments setting out the challenges central banks face using their usual mode of working.

Firstly, climate change’s impact on financial systems is an unknowable unknown – a...

The Yieldco Virtuous Cycle

by Tom Konrad, Ph.D., CFA

Readers who followed my coverage of the Yieldco bubble in 2015 know the Yieldco Virtuous Cycle.

A Yieldco’s stock price rises

It issues new shares, and invests the money in renewable energy projects.

Because the stock price is high, it is able to buy more project cash flow by issuing fewer shares than it has in the past.

Cash flow available for distribution (CAFD) per share increases, despite the increasing number of shares outstanding.

Yieldco management sets a target for continued rapid annual distribution growth, which can be met either by further share issuance (if...

Eneti and Brookfield Renewable Earnings

By Tom Konrad, Ph.D. CFA

Here are a couple earnings notes I shared last week with my Patreon followers.

Eneti, Inc. (NETI) - formerly Scorpio Bulkers (SALT)

Eneti completed its name and ticker change on February 8th. New ticker is NETI (formerly Scorpio Bulkers (SALT), which I recently wrote about here.

Highlights from February 2nd earnings report:

37 of the 47 vessels owned at the 3rd quarter have been sold or have completed sale agreements.

Net asset value is $23.94/share. Since most assets are cash or vessels held for sale, this number is basically accurate.

The stock is still a good buy...