Alternative energy and clean energy mutual funds are open-ended funds that invest primarily (at least 50% of the portfolio) in the securities of clean energy and alternative energy companies. Closed-end funds are included in the list of alternative energy and clean energy ETFs.

This list was last updated on 2/20/2021.

Calvert Global Energy Solutions Fund Class A (CGAEX); Class C (CGACX)

Calvert Green Bond Fund (CGAFX)

Ecofin Global Renewables Infrastructure Fund (ECOIX)

Erste WWF Stock Environment CZK (AT0000A044X2.VI)

Eventide Multi-Asset Income (ETNMX)

Fidelity Select Environment and Alternative Energy Portfolio (FSLEX)

Firsthand Alternative Energy (ALTEX)

Gabelli ESG Fund Class AAA (SRIGX); class C (SRICX)

Guinness Atkinson Alternative Energy Fund (GAAEX)

New Alternatives FD Inc (NALFX)

Shelton Green Alpha Fund (NEXTX)

Triodos Renewables Europe Fund

If you know of any mutual fund that is not listed here and should be, please let us know by leaving a comment. Also for stocks in the list that you think should be removed.

Saving energy is too important of an issue to not invest in!

I am looking in a fund that will invest in only FUSION ENERGY. It only going to be 10 to 30 years before it’s profected. If you think Tech is big just wait. Solar and wind will be gone, Coal will stay in the ground.

There are no stocks or mutual funds investing in fusion.

Should your list include https://www.greencentury.com/the-green-century-funds/

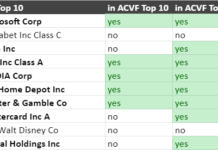

This list focuses on funds that have the majority of their holdings in Clean/Alternative energy focused stocks. Green Century funds include stocks from all sectors, with a focus on environmental leaders in each. For example, here are the top five holdings of the Green Century Balanced fund:

Alphabet, Inc., Class A 2.99%

MasterCard, Inc., Class A 2.11%

Microsoft Corporation 1.95%

Cigna Corporation 1.81%

Apple, Inc. 1.60%

So the fund may be green, but it has little to do with energy, be that energy green, alternative, clean, or otherwise.

What about Swell Investing? Are they cool? https://info.swellinvesting.com/

Have not looked at them yet, but there do seem to be a lot of new investment platforms that promise to be green and have many similarities to mutual funds… I’ve been thinking about a comparison article on all of the ones I can find. Perhaps we need a new category for these sorts of financial platforms.

I did a bit more homework on Swell. It appears they’re a sort of “robo-broker” service, buying and selling stocks for the account-holder in accordance with the decisions of a mutual-fund-style advisor. Reviews say that as that kind of service goes, Swell is very good at the SRI game, but is kind of expensive and offers very little human interaction.

Typically, SRI mutual funds are expensive compared to non SRI funds, so I geuss it’s not surprising that a SRI robo-broker is not expensive compared to other robo brokers. Aspriation (reviewed here) http://www.altenergystocks.com/archives/2019/03/are-aspirations-deposits-really-fossil-fuel-free/ is another variation on the theme, and then you can also use Motif, which allows basket trades like mutual funds and you can seek out green baskets. I put together a couple Motifs in 2016 through 2018 for readers, but have not been maintaining them this year, although I expect to update them again.

Winslow Green Solutions should be removed from the list, as they have gone out of business.

In fact, they did so in 2010, so I’m not sure how they made it onto the list in the first place.

Thanks for the catch. The fund had a lot of AltE holdings when I started looking into clean energy mutual funds in 2008.