How Green are Your Earnings?

What Constitutes an Alternative Energy Company? There's a debate going on in the clean energy investment community about which companies are "green" enough to merit our attention. Before the filming of my WealthTrack appearance, I got into a discussion with Ardour Global Indexes' Joseph LaCorte. The Global Alternative Energy ETF (NYSE: GEX) is based on the index he manages. The format of the show includes a top pick from each of the guests at the end of the show, and Mr. LaCorte was hoping that I'd pick GEX, since I had previously told him that it was...

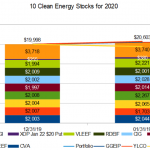

Divestment v Coronavirus: Ten Clean Energy Stocks for 2020 January Update

by Tom Konrad, Ph.D., CFA

January 2020- where do I start? A year of market-shaking news in a month.

The Brink of War

The month started off with a literal bang when Trump decided that a good way to distract the public from his impeachment trial would be to try to start a war with Iran by assassinating one of Iran's top military leaders, Qassem Suleimani. A week later, the world and markets heaved a collective sigh of relief when Iran decided that their honor had been satisfied with two missile strikes on US bases. While Trump reported no casualties, Iran's Foreign...

Seven Green Stocks I Told My Sister to Buy

Tom Konrad CFA I guide my sister through the stock market, she guides me through the mountains. An earlier version of his article was first published on the author's Forbes.com blog, Green Stocks on February 15th. This version has been updated to reflect market action and news since then. Earlier this week, I wrote about how my annual green stock trading advice had worked out for my sister and readers (well) and the two stocks where I thought she...

Questions about DayStar Technologies

I received an e-mail from a reader that had questions about holding DSTI. I had some concerns about DSTI. I was wondering if you still believe investment in this company or alternative energy stocks is worth it. If crude oil drops further (let say mid 50s) do you think it will have negative impact on alternative energy stocks particularly ENER and DSTI. I was very happy with the holding a couple days ago, but the performance of DSTI in last 2 days without any news has got me concerned. Let me answer your question with first a...

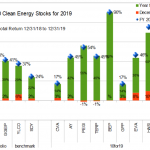

Ten Clean Energy Stocks For 2019: Sell The Peaks

I missed my regular monthly update in early June because of vacation.

In hindsight, early June looks like it was a good buying opportunity. The broad market of dividend stocks (represented by my benchmark SDY) falling six percent in May, only to rebound a similar amount in June. At the time, I would have continued to advise caution: “Sell the peaks” rather than “Buy the dips.”

Particularly volatile stocks like European autoparts supplier Valeo (FR.PA) from this list would have generated even greater short term gains. But it would take more than a six percent market decline to transform this bear...

Ten Clean Energy Stocks for 2010

Tom Konrad, CFA A mini-portfolio of stocks that not only are green, but should outperform the market in an environment of increasing concern about climate change and peak oil. This is the third annual list of green stocks I have published. In 2008, it was a list of ten speculative alternative energy companies (in three parts) that I thought might catch public notice that year. As we all now know, 2008 was a horrible year for speculative stocks, and my stocks were no exception, losing an average of 55% that year, although that still ended up being better than...

December Update: 11 Clean Energy Stocks for 2012

Tom Konrad CFA What the Election Brought to Energy Stocks Obama's reelection did not bring on a new bull market for Clean Energy stocks, as some had hoped. My Clean Energy model portfolio was flat (+0.4%) for the month, while the widely held Powershares Wilderhill Clean Energy ETF (PBW) fell 1.6%. In contrast, the broad market, as measured by the Russell 2000 ETF, (IWM) rose 1.1%. If Obama's re-election had a strong effect on any energy sector, it was coal stocks: the Market Vectors Coal ETF (KOL) was down 8.5% over the same...

Six Weeks, Twelve Clean Energy Stocks

Tom Konrad CFA It's been a busy six weeks since I last updated readers on the news events driving my Ten Clean Energy Stocks for 2013 and six alternative picks. I looked into the performance of the portfolio as a whole at the start of the month, along with some comments about the four renewable energy developers. I thought at the time we might be seeing a bottom for these beleaguered stocks, but if I was right, we have yet to see the upturn. Nevertheless, the...

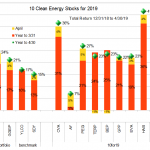

Ten Clean Energy Stocks For 2019: April Ascent

In April, my 10 clean energy stocks model portfolio continued to power ahead, despite the concerns about market valuation I expressed last month. As I said at the time "me being nervous about the market is not much of an indicator that stocks are going to fall" at least in the short term. So I continue to trim winning positions and increase my allocation to cash as stocks advance.

Both the model portfolio and the Green Global Equity Income Portfolio (GGEIP) were up 4.5% and 3.6% respectively in April. This was solidly ahead of their clean energy income benchmark YLCO...

Ten Clean Energy Stocks For 2017: Earnings Season

Tom Konrad Ph.D., CFA Earnings season began in earnest in February. My Ten Clean Energy Stocks model portfolio gave back a little of its large January gains because a mix of good and bad earnings mostly offset each other. One pick (Seaspan Preferred) gave back its large January gains. Neither the original gain nor the loss were driven by news. Instead, they seemed driven by investors changing expectations for global trade in an uncertain political environment. For the year to March 17th, the portfolio and...

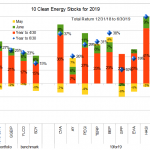

2020 Hindsight: Ten Clean Energy Stocks For 2019

by Tom Konrad Ph.D., CFA

Sometimes it's good to be wrong.

When I published the Ten Clean Energy Stocks For 2019 model portfolio on New Year's Day 2019, I thought we were likely in the beginning of a bear market. With 20/20 hindsight, that was obviously wrong.

I made the following predictions and observations:

"he clean energy income stocks which are my focus should outperform riskier growth stocks."

"eep value investors will put a floor under the stock prices of these ten stocks."

"I could also be wrong about the future course of this market."

"I have a history...

Shares of Capstone Rising

Shares of Capstone Turbine Corp (CPTC) are rising sharply this morning with high volume and gapped up with a gain of over 35% this morning. There is currently no news to cause this increase today and I will be digging deeper to find out what is going on. This is good news for the stock and also the portfolio. My holdings are now up over 50% in about 10 days. If you were thinking of buying the stock now, you should wait till some news confirms this move. Update at 12:15 EST: The only news I can...

Portfolio For A GHG-Regulated World

Investment opportunities connected to climate change and greenhouse gas (GHG) regulation are a popular topic of discussion on this blog. Most of the time, however, the companies we discuss are relatively small, often unknown to most investors and overall pretty speculative. Yesterday, I came across an interesting article on Seeking Alpha entitled "Investing In a Greenhouse Gas-Regulated World" - the title says it all. The article looks at the question of investing in a GHG-constrained world from a conventional portfolio management perspective, and therefore argues for a low weighting in pure-play cleantech or carbon finance stocks, and...

Alternative Energy Stocks Portfolio Update

It's been six weeks since I last provided readers with an update on the Paper Portfolio. According to the guidelines I laid out there, stocks are added to the portfolio when Chares or I mention them positively for the first time (leaving out ones for which Yahoo! finance does not have historical data, which are mostly pink sheet stocks.) Here are the ones we've added since then. Stock Article Date Added Price Price 9/5/07 DOW Investing in energy Efficient Homes 7/24/07 $47.20 $42.20 OC Investing in energy Efficient Homes 7/24/07 $33.00 $24.26 ...

Ten Clean Energy Stocks for 2010: Third Quarter Update

Tom Konrad CFA I like to think that one of the things that distinguishes me from the mass of investment bloggers and newsletter writers is that I write about my mistakes, as well as my great calls. This is not just a service to readers, but a service to myself. Overconfidence and why I write about my mistakes One of the most pernicious cognitive errors common among stock market investors arises from our wish to see ourselves as great investors. One of the ways we accomplish that goal is to selectively and unconsciously self-edit our...

Shares in Capstone Purchased

This morning I purchased shares of Capstone Turbine Corp (CPTC) in both my personal portfolio and the mutual fund. I have been waiting for the stock to show some strength after its recent declines. The stock appears to have some nice support at the $2.25 level as a bottom. They will be announcing quarterly earnings on November 10th. Capstone Turbine developments and manufactures microturbine generators. The company’s microturbines can also be used as generators for hybrid electric vehicle applications. It also offers Model C60 integrated combined heat and power systems (CHP). A one third stake have been purchased...