Tag: CAFD

List of Solar Farm Owner and Developer Stocks

Solar farm owner and developer stocks are publicly traded companies who develop or manufacture equipment that converts sunlight into other types of useful energy. Includes manufacturers and developers of both solar photovoltaic and solar thermal equipment, as well as their supply chain.

This list was last updated on 3/21/2022.

See also the list of Solar Manufacturing Stocks, the list of Residential Solar Stocks, and solar and wind inverter stocks.

7C Solarparken AG (HRPK.DE)

Abengoa SA (ABG.MC, ABGOY, ABGOF)

Acciona, S.A. (ANA.MC, ACXIF)

Adani Green Energy (ADANIGREEN.NSE)

Algonquin Power and Utilities (AQN, AQN.TO)

Atlantica Yield PLC (AY)

Azure Power Global Ltd. (AZRE)

Bluefield Solar Income Fund (BSIF.L)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Energy...

One Week, Three YieldCo Deals. Are More Buyouts on the Horizon?

by Tom Konrad, Ph.D., CFA

It's been a busy several days in the YieldCo space.

On February 5, 8point3 Energy Partners (NASD:CAFD) announced an agreement to be acquired by an infrastructure investment fund managed by Capital Dynamics. While I was still writing an article on why the sale price was at a virtually unheard of discount relative to the stock market price, two more YieldCo deals were announced: NRG Energy (NYSE:NRG) agreed to sell its sponsorship stake in NRG Yield (NYSE:NYLD and NYSE:NYLD/A) to Global Infrastructure Partners, and YieldCo TerraForm Power (NASD:TERP) made an offer to buy out Spanish YieldCo Saeta Yield (Madrid:SAY) at a 20 percent...

First Solar and SunPower Lobby Shareholders to Sell 8point3 YieldCo

by Tom Konrad Ph.D., CFA

Will shareholders accept the deal?

On Monday, 8point3 Energy Partners, the joint YieldCo from First Solar and SunPower, entered into a definitive agreement to be acquired by Capital Dynamics.

When public companies are sold, it's almost always at a premium to the market price. It's that price premium that persuades shareholders to sell. So why would 8point3 (NASD: CAFD) shareholders accept a deal that offers them only $12.35, or 15 to 20 percent below the roughly $15 price CAFD has been trading around for the past three months?

To answer this question, we need a little history.

Jan Schalkwijk, founder...

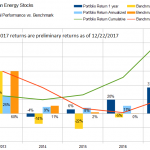

Ten Clean Energy Stocks For 2017: Taking Profits

By Tom Konrad Ph.D., CFA

2017 is turning into a second banner year in a row for my “Ten Clean Energy Stocks” model portfolio. I expected at best to make high single digit returns after the impressive 20% (while my benchmark fell 4%). Instead, the portfolio produced a 36.8% total return while its benchmark is up 19.5% with only four trading days left in the year.

Such returns are obviously cause for celebration, and also for profit taking. I plan to replace at least five of this year's list with new stocks in the 2018 (tenth annual) “Clean Energy Stocks” model...

Power REIT: No News Is Good News

Tom Konrad Ph.D., CFA I first wrote about Power REIT (NYSE MKT:PW) in 2012, when the tiny real estate investment trust unveiled its plans to become what would have been the first Yieldco by investing in the land underlying solar and wind farms... before the term 'Yieldco' had even been invented. In the years since, the company made some progress buying land under solar farms. According to the most recent shareholder presentation, they now own land under seven solar farms totaling 601 acres and 108 MW, in addition to their legacy railroad asset. These assets produce...

Quick Take: What Sunpower Project Sales to 3rd Party Mean for 8.3 Energy Partners

This morning, SunPower (SPWR) announced that it had sold a majority interest in two solar projects totaling 123MW. Owners of stock in SunPower's jointly sponsored Yieldco 8point3 Energy Partners (CAFD) might be wondering, "Hey, shouldn't SunPower be selling these projects to CAFD?" The Yieldco model has Yieldcos using inexpensive capital from income investors to fund the purchase of projects from their developer sponsors, which have more expensive capital because developing solar projects is riskier than owning already-developed ones. In fact, one of the two projects in question can be found in 8point3's "Right of First Offer" or ROFO...

Yieldcos: Calling The Bottom

by Tom Konrad Ph.D., CFA On a podcast recorded on September 14th, I said I thought that Yieldco stocks had bottomed at the end of September. Two weeks later, that call still looks like a good one (see chart.) I'm starting to hear optimistic noises from other Yieldco observers, although the general tone remains quite bearish. Why do I think September 29th was the likely bottom? End of quarter. Some institutional investors such as mutual funds reshuffle their portfolios at the end of the quarter so that they don't have...