by Tom Konrad, Ph.D., CFA

It’s been a busy several days in the YieldCo space.

On February 5, 8point3 Energy Partners (NASD:CAFD) announced an agreement to be acquired by an infrastructure investment fund managed by Capital Dynamics. While I was still writing an article on why the sale price was at a virtually unheard of discount relative to the stock market price, two more YieldCo deals were announced: NRG Energy (NYSE:NRG) agreed to sell its sponsorship stake in NRG Yield (NYSE:NYLD and NYSE:NYLD/A) to Global Infrastructure Partners, and YieldCo TerraForm Power (NASD:TERP) made an offer to buy out Spanish YieldCo Saeta Yield (Madrid:SAY) at a 20 percent premium. In an interesting twist, Global Infrastructure Partners owns 24 percent of Saeta Yield.

Last week’s flurry of activity caps a very active five months of YieldCo buyouts. Brookfield Asset Management (NYSE:BAM) completed the acquisition of SunEdison’s stake and half of the public shares in TerraForm Power on October 17, 2017. And it acquired all of TerraForm Global on December 29. In both cases, public shareholders received a premium over the share price before the deal was announced. On November 1, Algonquin Power & Utilities (NYSE:AQN) announced the purchase of Abengoa’s sponsorship stake in Atlantica Yield (NYSE:AY.)

All of these deals are an outgrowth of the bursting the 2015 YieldCo bubble. YieldCos 8point3, Terraform Global and Saeta Yield were formed in the final months before the bubble burst, and so never had time to grow to a sustainable size while stock market money was still cheap. Now they’re being bought by larger YieldCos that had more time to grow, and are seeking greater scale to better manage the cost of being public companies.

More buyouts on the horizon?

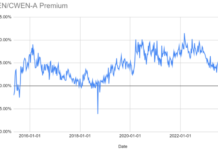

The reason public YieldCos exist in the first place is to finance clean energy projects with cheap stock market capital sourced from a wide pool of investors. Historically, stock market capital has been significantly cheaper than the private capital deployed by infrastructure funds like Capital Dynamics and Global Infrastructure Partners. With the notable exception of NextEra Energy Partners (NEP), YieldCos’ stock prices have been so low (and the capital they raise consequently so expensive) that they have had trouble bidding against private infrastructure funds to buy solar and wind farms.

This problem for YieldCos is not solely the result of the hangover from the YieldCo bubble. Infrastructure funds are experiencing a boom, if not a bubble of their own. While bubbles in private markets are even harder to detect than stock market bubbles, there are signs that can be indicative of such an occurrence. For one, private infrastructure funds currently have access to larger amounts of lower-cost capital than they have had in the past. There is also the flurry of acquisition activity by such funds.

If the infrastructure fund boom continues, we can expect that they will continue looking at the remaining YieldCos as possible acquisition targets. There are two likely candidates: Pattern Energy Group (NASD:PEGI) and TransAlta Renewables (TSX:RNW and OTC:TRSWF).

Pattern is currently paying out nearly all its cash available for distribution (CAFD) to shareholders in its $1.69 dividend. While the company hopes to reduce the payout ratio to 80 percent over the next few years, this will be difficult to do given rising interest rates and its falling stock price. But at Friday’s closing price of $18.41, its yield is 9.2 percent.

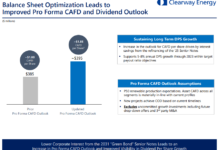

8point3 versus NRG Yield

8point3’s guidance for first-quarter cash available for distribution is $14.5 million to $16.5 million, after $3 million of expenses related to its sale. The midpoint of $18.5 million presale CAFD is down from $22.1 million the previous year. This aligns with my 2017 analysis, which showed that 2017 CAFD was unsustainable. At the time, I estimated 8point3’s sustainable CAFD at $54 million to $60 million, or $0.68 to $0.76 per share.

Using the $12.35 per share purchase price and my high-end CAFD per share estimate, we see that Capital Dynamics was willing to pay $16.25 for each dollar of sustainable CAFD. The buyout of NRG’s sponsorship stake in NRG Yield is difficult to value on a per-share basis, because the price includes other parts of the sponsor’s renewables business.

Some of Pattern’s CAFD may also be unsustainable given rising interest rates, but PEGI is much more conservative in its CAFD estimates than 8point3. If we assume a similar valuation to 8point3, and sustainable CAFD of $1.50 per share, an infrastructure fund could pay over $24 a share for PEGI — a 32 percent premium to the current share price.

A similar calculation for TransAlta Renewables puts sustainable CAFD at $1.00 CAD to $1.10 CAD per share, and a possible buyout valuation at $17 per share. The $17 CAD is a 44 percent premium over the current market price of $11.78 CAD. While neither of these YieldCos is actively looking for a buyer, the same was true for Saeta Yield.

YieldCos are growing up

The recent flurry of YieldCo buyouts highlights a continuing trend of renewable asset developers selling their YieldCo stakes to companies and funds whose primary business is the ownership and operation of energy infrastructure. Some of these buyers are public companies (Algonquin, Brookfield, TerraForm Power), while others are private (Capital Dynamics and Global Infrastructure Partners).

This seems to be a sign that the YieldCo space is maturing, with companies specializing in either clean energy asset ownership or development. When development and asset ownership are combined in a single company, the industry is moving toward a model where a large and stable asset ownership business supports a smaller development arm. We see the beginnings of this model in Pattern Energy’s purchase of a small stake in Pattern Development 2.0, as well as in Algonquin and Brookfield Renewable Energy (NYSE:BEP), where this has been the model all along.

Finally, there are signs of a boom (or even a bubble) in infrastructure funds. As long as this continues, we are likely to see more acquisitions of independent YieldCos. Given their recent stock-price declines, TransAlta Renewables and Pattern appear to be attractive targets.

This article was first published on GreenTech Media

Disclosure: Long PEGI, NYLD/A, AY, TERP, BEP, AQN, RNW. Short NEP Puts (a net long position) and Short CAFD calls (net short).