Tag: CVA

Ten Clean Energy Stocks For 2018: Third Quarter Earnings

Tom Konrad Ph.D., CFA

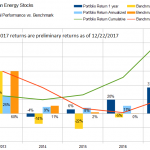

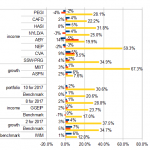

After a fairly brutal September and October my Ten Clean Energy Stocks model portfolio is barely hanging on to positive territory for the year (up 2.4%) as is the private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP, up 0.8%). Yet I can take comfort in superior relative performance, since my broad dividend income benchmark SDY is now down 0.1% for the year, and the clean energy income benchmark YLCO has fallen 5.8%. All returns are total return after fees and dividends.

The strong relative performance in a weak market is most likely due to...

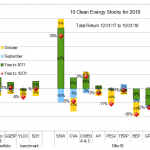

Ten Clean Energy Stocks For 2018: September Quick Update

As you can see from the chart, September was a tough month for my model portfolio of Ten Clean Energy Stocks for 2018. Seaspan (SSW) fell back on trade war fears and Green Plains Partners (GPP) fell on ethanol market weakness caused by retaliatory ethanol tariffs and the Trump EPA's continued undermining of the Renewable Fuel Standard. I'm less sure why Covanta (CVA) is down, but Clearway Energy's (CWEN and CWEN-A formerly NRG Yield) small decline is due to a recent secondary offering.

Two of these (CVA and GPP) were my top picks last month, while the third was Terraform Power (TERP). ...

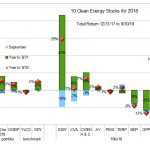

Ten Clean Energy Stocks For 2018: Second Quarter Earnings

Tom Konrad Ph.D., CFA

July and August saw some mild recovery for the stock market after a difficult first half of 2018. Clean energy income stocks continue to lag the broader market, but my Ten Clean Energy Stocks model portfolio has managed to maintain its lead over its broad market benchmark.

Through August 31st, the model portfolio is up 7.5%, compared to its broad dividend income benchmark SDY, which is up 5.3%. Its clean energy income benchmark YLCO is down 1.2, even after dividend income. The private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP), is slightly behind the...

Covanta Accelerating Zero-Waste-to-Landfill

Last week Covanta (CVA: NYSE) opened a new materials processing facility in Indianapolis, increasing waste handling capacity by 500%. The waste handler has been in operation in the community for three decades, collecting and processing over 2,100 tons of solid waste every day to steam energy in a waste-to-energy incinerator. Citizen Thermal Energy buys the steam to heat the buildings of its commercial customers.

The new materials processing facility increases Covanta’s waste handling capacity. The company is targeting manufacturers in the Indianapolis area that are still sending wastes to landfills. Covanta wants to collect more waste as well as attract waste types unique to manufacturers that need...

List of High Yield Alternative Energy Stocks

This is a list of renewable and alternative energy stocks with dividend or distribution yields above 4%. The list includes most Yieldcos (high distribution companies that own renewable energy operations), but is not limited to Yieldcos. Some Yieldcos may be excluded if their yield is below 4%.

Atlantica Yield plc (AY)

Algonquin Power & Utilities Corp. (AQN, AQN.TO)

Bluefield Solar Income Fund Ltd. (BSIF.L)

Brookfield Renewable Partners L.P. (BEP)

Clearway Energy, Inc. (CWEN,CWEN-A)

Companhia Energética de Minas Gerais (CIG)

Covanta Holding Corporation (CVA)

Crius Energy Trust (KWH-UN.TO, CRIUF)

Enviva Partners, LP (EVA)

Foresight Solar Fund plc (FSFL.L)

GATX Corporation Series A (GMTA)

Global X YieldCo ETF (YLCO)

Greencoat UK Wind PLC (UKW.L)

Green...

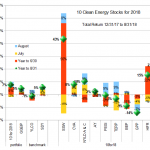

Ten Clean Energy Stocks For 2018: First Half Update

The first half of 2018 has been difficult for most investors, including clean energy investors and dividend income investors. Through June, my broad dividend income benchmark SDY lost 0.6%, while my clean energy income benchmark YLCO lost 4.7%, including dividend income.

My picks were also down for most of the year, finally struggling back into positive territory at the end of May. They finished the first half up a solid 5.9%. The real money strategy I manage, the Green Global Equity Income Portfolio (GGEIP), also squeaked in to positive territory by 1.2% at the end of June.

Details of then stocks'...

List of Waste-to-Energy Stocks

Waste-to-energy stocks are publicly traded companies whose business involves using municipal or other waste as a feedstock to create fuel or electricity. Organic matter and plastics in a waste stream can be converted to fuel and/or electricity chemically, by means of pyrolysis, biologically such as in anaerobic digestion, or by incineration. Alternatively, energy from waste can be captured from natural processes, such as in the collection of methane gas from landfills.

This list was last updated on 6/23/2021

Active Energy Group PLC (AEG.L)

Attis Industries, Inc. (ATIS)

Babcock & Wilcox Enterprises, Inc. (BW)

BioHiTech Global, Inc. (BHTG)

Blue Sphere (BLSP)

Capstone Microturbine (CPST)

China Recycling Energy Corp....

Ten Clean Energy Stocks Back In Positive Territory Year To Date

Stay tuned for a full update next month, but it's nice to be back in the black... especially with the benchmarks still struggling. Thanks to Enviva (EVA), Covanta (CVA), and Seaspan (SSW). Until then, here's the May update, where I said EVA and CVA were two of my 3 top short term picks , and I commented that "I still think Seaspan has significant room to the upside."

AY (at $18.91) and TERP (at $10.83) are my top short term picks right now.

Disclosure: Long EVA, HIFR, GPP, BEP, TERP, PEGI, AY, NYLD, NYLD/A, CVA, SSW.

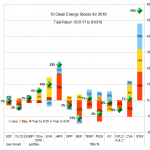

Ten Clean Energy Stocks For 2018: Oddballs Spring Back

After a stormy winter for the broad market and clean energy stocks, including my picks, March and April brought relative calm. Better yet, my model portfolio has rebounded from its February lows, although its benchmarks (SDY for the broad market of income stocks and YLCO for clean energy income stocks) have mostly been treading water.

The gains were led by two of my less conventional clean energy picks, Seaspan (SSW) and InfraREIT (HIFR). Seaspan owns (mostly very efficient) container-ships, which most people would not associate with clean energy, but which I include because they they are much less energy intensive...

Ten Clean Energy Stocks For 2018: Stormy Winter

Tom Konrad Ph.D., CFA

While the broad market has been turbulent for the start of 2018, clean energy stocks have fared worse than most. The Trump administration's anti-environmental efforts had little effect on clean energy stocks in 2017 (it was a banner year for this model portfolio). So far, this year has been quite different. Last year, investors seemed unfazed by the chaos in Washington, but with the single "win" of the Republican tax give-away to corporations, investors now seem to think that Trump may indeed be able to deliver on his polluter-funded agenda.

Income-oriented stocks have also been taking a...

Fiberight: A Deep-Dive Into Trash To Find Cash

by Jim Lane. Biofuels Digest

This week Fiberight secured $70 million for a municipal solid waste center that should be in operation by this May. The high-tech facility will convert 180,000 tons of trash each year from more than 100 Maine towns into biofuel at a 144,000-square-foot steel frame facility that began construction last July.

We visually profile the technology and company in our Multi-Slide Guide here.

The underlying facility is what’s known as a Dirty MRF, or materials recovery facility. That’s where the receiving happens and the sortation begins — and the process of recovering value back from the waste stream begins.

The bottom line...

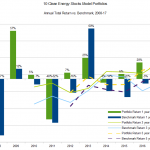

Ten Clean Energy Stocks For 2018

Tom Konrad Ph.D., CFA

Ten Years of "10 Clean Energy Stocks." A 38% total return in 2017 is the one to beat.

I started blogging about investing in clean energy stocks in 2005. At the time, I had just started an independent investment advisory practice, and thought blogging was a good way to impress people with my knowledge of clean energy. I don't know how many people I impressed, but the clients were hardly pounding down the door.

What I did learn, however, was that I loved writing about clean energy from the perspective of a stock investor. Because I was...

Ten Clean Energy Stocks For 2017: Taking Profits

By Tom Konrad Ph.D., CFA

2017 is turning into a second banner year in a row for my “Ten Clean Energy Stocks” model portfolio. I expected at best to make high single digit returns after the impressive 20% (while my benchmark fell 4%). Instead, the portfolio produced a 36.8% total return while its benchmark is up 19.5% with only four trading days left in the year.

Such returns are obviously cause for celebration, and also for profit taking. I plan to replace at least five of this year's list with new stocks in the 2018 (tenth annual) “Clean Energy Stocks” model...

Ten Clean Energy Stocks For 2017: Fall Forward

Tom Konrad Ph.D., CFA

Yieldco Buyouts

A Canadian Yieldco Invasion sent clean energy stocks running up in October and November. My Ten Clean Energy Stocks model portfolio benefited from the purchase of 25% of Yieldco Atlantica Yield (NASD:ABY) by Canadian utility and renewable power generation conglomerate Algonquin Power and Utilities (TSX:AQN or OTC AQUNF), which was one of my Ten Clean Energy Stocks for 2009.

Rumors had circulated that the Atlantica stake would be purchased by Brookfield (NYSE:BAM) and its Yieldco Brookfield Renewable (NYSE:BEP). If there were discussions, Brookfield must have decided that it had enough on its plate with the recently...

Solid Play in Solid Waste

by Debra Fiakas CFA The last article “Advanced Disposal Services: Hauling a Heavy Load” on July 18th inspired a closer look at the solid waste management sector in which it competes. The solid waste industry is growing at a good pace between 1.6% and 2.0% per year, largely on population growth and the human penchant for consumption and waste. In the U.S. solid waste collection is still populated by many localized, family-owned businesses, despite the emergence of several large consolidators that now command as much as 55% of the revenue in waste handling and disposal. Fragmentation creates...

The X Factor in Covanta’s Capital Budget

Debra Fiakas, CFA The Waste Hierarchy, with energy from waste highlighted In the last post “Covanta on a Mission to Up-cycle Municipal Waste," I noted that even a group of experts advising Covanta Holding (CVA: NYSE), has some concerns about the wisdom of channeling municipal waste through mass burn facilities like those of Covanta. Recycling and reuse are considered even higher uses for municipal waste that result in net lower toxic emissions and net higher energy savings or energy generation. For example, a report published by...