Once the electric and plug-in hybrid vehicle frenzy fizzles out, as cleantech frenzies typically do when reality comes knocking (i.e. corn ethanol and solar PV), the next hot thing to hit the world of alternative energy investing could very well be rare earths, or the lack thereof. Rare earth metals are used in a number of technologies, most importantly for alt energy investors in NiMH HEV batteries and in permanent magnets for wind turbine generators and electric motors (made with the element neodymium). This article, as its name indicates, will focus on the wind sector.

Consider the following two quotes on the significance of rare earths to the wind power industry (I got them from articles I found on the Climateer Investing blog, which has been keeping on top of this issue for the past few months. Click on the link above to access a number of articles on that topic):

“To make the most efficient, lightest weight, lowest service wind turbine generator of electricity takes one ton of the rare earth metal, neodymium, per megawatt of generating capacity.” (Jack Lifton, 5/07/09)

“Let’s take a look at wind turbines. In certain applications, two tons of rare earth magnets are required in the permanent magnet generator that goes on top of the turbine. If the permanent magnet is two tons, then 28% of that, or 560 lbs, is neodymium.” (Mineweb, 5/13/09)

Why does this matter? Because China, which accounts for around 95% of global output, is purportedly planing on severely curtailing the export of rare earth minerals. Naturally, this has some people worried. Given the total tonnage of neodymium that goes into each utility-scale wind farm, some may wonder whether this trade ban will throw a spoke in the wheel of wind power development; a wheel, as industry observers know, that has been spinning incredibly fast over the past five years.

Understanding Wind Energy Costs

Perhaps the single most important metric in power generation is the levelized cost of the energy produced. The levelized cost includes all of the costs over the lifetime of the facility (capital and operating) plus a pre-determined return on capital. All of these costs (capital costs, operating costs and cost of capital) are then expressed in present value terms and amortized over the facility’s total lifetime production (generally expressed in $ per kWh or MWh).

When assessing the cost competitiveness of electricity generation fuels, the levelized cost approach yields a true apples-to-apples comparison. Thus, when trying to gauge the impact of various events (e.g. higher natural gas prices, higher cement prices, a trade ban on neodymium) on the relative cost positions of different generation technologies, the impact on the levelized energy cost provides the best measure.

Last Friday, I read a recently-published study by Maria Isabel Blanco, former Policy Director at the European Wind Energy Association (EWEA) and now an academic in Spain, on the economics of wind power. In a nutshell, the study examines, based on survey of EWEA members (EWEA’s membership accounts for around 80% of global wind turbine manufacturing) and a review of the literature, the generation costs of wind energy in Europe.

Because there are no fuel expenditures for wind, capital costs make up the vast majority of the levelized cost of wind energy. According to the study, capital costs make up around 80% of the total cost of wind energy over the lifetime of a typical onshore facility (offshore wind is not addressed in this article). The wind turbine ex works – meaning the machine itself plus the tower, transportation to the site and installation – makes up around 70% of capital costs, or 56% of the total lifetime cost. Balance of plant costs include grid connection and site preparation (e.g. roads and other civil engineering work), among others.

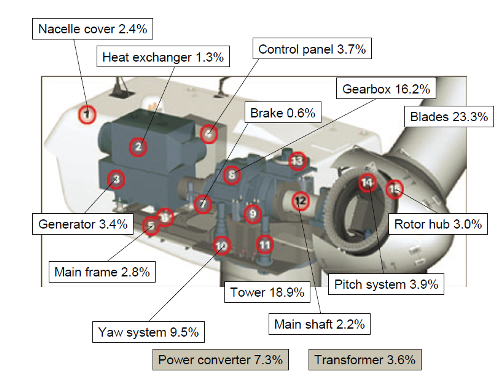

The first figure below comes from an article on the wind power supply chain by BTM Consult published in the January/February 2007 edition of Wind Directions (see pages 5 and 6 for the full-size image). The second figure comes from a September 2007 report written by Garrad Hassan for the Canadian government on wind turbine manufacturing (see page 33 for the original figure).

Both figures show the approximate contribution of each core component to the final cost of a wind turbine. There is, of course, variation around the percentages shown here based on the turbine model, the manufacturer, the location of the turbine assembly plant relative to where components and sub-components are manufactured, etc. However, taken together, these two figures yield a good ballpark estimate of how the cost of a wind turbine is broken down between its main parts.

Both sources agree that the generator, the component that requires significant amounts of neodymium, represents around 3.4% of the total cost of a turbine. The generator thus accounts for around 2.4% of the total capital cost of a typical wind project.

The table below looks at the impact of generator costs on the installed cost (i.e. capital cost) of a fictional wind project. The data comes from EERE’s 2008 Wind Technologies Market Report, where capacity-weighted average installed wind costs in the US are reported at around $1,915/kW, and capacity-weighted average turbine costs ex works are reported at around $1,360/kW, or approximately 71% of installed costs (in line with the European numbers above). The calculations assume that all other costs remain constant.

| Original Generator Cost @ 3.4% of Turbine Cost ($/kW) | % Increase In Generator Cost | New Generator Cost ($/kW) | Installed Cost Following The Increase In Generator Cost ($/kW) |

% Increase In Installed Cost |

| 46 | 50% | 69 | 1938 | 1.2% |

| 46 | 100% | 92 | 1961 | 2.4% |

| 46 | 150% | 116 | 1984 | 3.6% |

| 46 | 200% | 139 | 2007 | 4.8% |

| 46 | 250% | 162 | 2031 | 6.0% |

| 46 | 300% | 185 | 2054 | 7.2% |

| 46 | 350% | 208 | 2077 | 8.5% |

| 46 | 400% | 231 | 2100 | 9.7% |

| 46 | 450% | 254 | 2123 | 10.9% |

| 46 | 500% | 277 | 2146 | 12.1% |

The Levelized Cost of Wind Energy

Using a model she built, the author of the European study discussed above calculated the levelized cost of wind energy in Europe, based on actual capital, operating and financing costs and ignoring all incentives and taxes – she therefore computed the “true” cost of wind power.

She found that the single most critical variable impacting the levelized cost of wind energy was full load hours, or the average annual production divided by the facility’s nameplate capacity (the more often cited capacity factor is equal to full load hours divided by total hours over the measurement period). Capital costs came in second.

A drop of 10% in full load hours, according to the author’s model, leads to a cost increase of 8.5%. In comparison, a 10% increase in capital costs, all else equal, triggers a 7.7% increase in total lifetime costs. As can be noted in the table above, generator costs would have to increase by over 400% to trigger a 7.7% increase in levelized energy costs – while 7.7% is not a trivial number, especially if the increase is sudden, it probably does not constitute a project killer in most cases.

Of course, the costs and calculations presented here are rough estimates and will differ across installations and regions. Nevertheless, they provide a good approximation of the potential impact of higher generator costs on the cost of wind energy.

The Market For Wind Generators

Over the past three years, the supply of many core components for wind turbines has been incredibly tight, leading to a reversal of the long-term trend toward lower levelized wind energy costs (for a recent analysis this reversal in the US, see the EERE’s 2008 Wind Technologies Market Report). Generators, however, were not one of those rare components. Bearings and gearboxes are the two parts for which the most severe shortages exist (or did, pre-crisis), while the market for generators is relatively well supplied by the likes of Siemens (SI) and ABB (ABB).

Even though increases in copper prices have put upward pressure on generator costs in the past few years, it is fair to say that generators have not been a problem component in the wind supply chain.

Conclusion

It is too early to tell what impact Chinese restrictions on rare earth exports will have on the price of wind generators and, ultimately, on the levelized cost of wind energy. However, as shown above, the wind industry is an position to bear substantial cost increases in this one component before the overall economics of wind projects are affected.

More generally, I believe it’s premature to conclude that limits on the export of rare earths mean that China will also limit the export of value-added manufactured goods such as permanent magnets. The main idea here is, most likely, to bolster the country’s manufacturing sector – the very same manufacturing sector that acts as a giant job creation machine and prevents China from experiencing widespread social unrest. As recently pointed out by The Economist, all of emerging Asia’s consumers consume about 40% of what Americans do and, although this is gradually changing, it wouldn’t be in China’s interest to strain that trade relationship by depriving the West of a whole host of technologies that consumers here have gotten used to.

While rarer rare earths may materially impact certain sectors of the economy, the wind industry, by-and-large, should do just fine.

DISCLOSURE: The author is long ABB

A nicely reasoned analysis.

And, it is appropriate that you targeted this issue at the wind energy industry. It is somewhat less sensitive to incremental cost than others. Also, in a “worst case”, other generator designs may be considered. Although such alternatives are much less desirable due to weight, size, efficiency, etc., they would allow the wind turbines to continue to be built.

In contrast, permanent magnet DC motors are appropriate for use on vehicles. REE availability limitations here could be more significant. It should also be noted that constraints on REE availability will also affect other aspects of electric vehicles. For example, Lanthanum is used in NiMH batteries like those in the Prius.

While it appears increasingly likely that China will absorb all or most of its REE production sometime within the next few years, a not insubstantial portion of that will be used to produce higher value products for export, e.g. generators for wind turbines.

One should also note that REEs are not really all that rare. However they are rare in presently economical deposits. Thus, the real implications for these developments are that the price of electricity (as with other energy) will likely continue to escalate for at least the next few decades.

Mike:

Exactly – from what little I know about rare earths, trade restrictions could have significant impacts for certain applications, but not for wind.

The idea behind this post came after I read a number of articles that implicitly – or explicitly – suggested that rare earth minerals could sink the “alternative energy industry.” (as if that were a homogeneous category) Wind and HEVs were thrown in the mix together because the numbers sound impressive (see the two quotes at the outset of this post). In reality, while this may be a big deal for HEVs (although the same argument applies here in terms of the export of value-added products continuing), this really is not a material factor for wind.

As you point out, this action by the Chinese government will trigger a race for new sources of REEs and, although it may be a few years before new supplies come on line, they eventually will.

Nice article.