Tom Konrad CFA

|

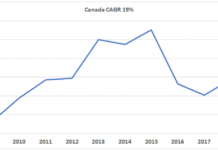

| Inverter for a solar array. (Photo credit: Wikipedia) |

Solar inverter stocks are looking cheap, but until the weaker players are forced out, they are likely to get cheaper.

The major publicly traded solar inverter companies are Power-One (NASD:PWER), Satcon (NASD:SATC), SMA Solar (OTC:SMTGF), Siemens (NYSE:SI), Advanced Energy Industries (NASD:AEIS), Schneider Electric (OTC:SBGSF) and upstart Enphase Energy (NASD:ENPH). Over the last year the industry has faced eroding margins and an increasingly competitive environment. This parallels the problems of solar manufacturers: the industry has too much capacity for a market that is not growing as fast as many expected.

Power-One and SMA currently look quite cheap in terms of Price to Earnings ratios (5.9 and 4.9, respectively), so I asked my panel of green money managers for their thoughts on the industry. Is the industry near bottom?

I received responses from Rafael Coven, Managing Director at the Cleantech Group, and manager of the Cleantech index (^CTIUS) which underlies the Powershares Cleantech ETF (NYSE:PZD), and from Garvin Jabush, the Cofounder and CIO of Green Alpha Advisors and manager of the Sierra Club Green Alpha Portfolio. Here are their thoughts:

Coven on the Competitive Landscape

Solar Inverter industry economics have deteriorated with the decline in overall solar market and diminishing government budgets for solar incentives. Given the difficult demand picture and insufficient product differentiation the market is becoming commoditized and increasingly price-driven.

Jabusch on How it Will Be Resolved

[T]he problem, as with panels and wafers, is narrowing margins. The solution, as with panels and wafers, will be to make up for that with increasing scale…. [We] believe the scale of renewables will continue to expand, although timing their turnaround is proving challenging.

Which Companies Will Survive

Both agree that diversification and a strong balance sheet will be key to company survival.

Coven:

Just as in Solar PV, the shakeout will weed out the weaker (undercapitalized) players (thankfully there are far fewer players than in solar PV). There are better emerging inverter technologies, but I’m don’t know their time to commercial launch, nor how good the product pipelines of the current solar inverter players are vis-à-vis coming entrants. I doubt that the undercapitalized inverter players will have the resources either survive new low-cost entrants from Asia nor be able to buy or license some of the better emerging technologies. Companies such as Siemens or Schneider can afford to buy whatever looks like the winning technology. In this business, having diversification is critical.

Jabush:

[T]he respective sector leaders with the strongest financial and market positions will weather the downturn the best, and we feel like Power-One is one of these.

Two Buyers and Three Probable Survivors

As Coven says, Siemens and Schneider are diversified giants, and so will not feel pressure as much as more focused industry players. Power-One and SMA are also well capitalized with negligible debt and current profits. Power-One is more diversified than SMA, with a large electronics business selling power supply products to computer and storage industries. I expect all four will survive the shake-out. Solar is only a sideline for Advanced Energy Industries, so it, too should be able to weather the decreasing margins in the industry.

Probable Loser

Satcon looks unlikely to survive the shake-out. The company is losing money, has shrinking sales, and a horrible operating margin of -46%. Even rapid growth would not help the company’s economics, unless it were accompanied by increased pricing, which seems unlikely. I expect Satcon to declare bankruptcy, with its rivals buying any valuable pieces from Satcon’s creditors after.

Wildcard

Like Satcon, Enphase has a weak balance sheet and is losing money rapidly. Unlike Satcon, Enphase has one of the “emerging technologies” Coven spoke about, selling microinverters which are integrated with the individual panels. Microinverters have the advantage that they simplify installation by removing the need to work with direct current, and they are also better at optimizing system output. Because of this, Enphase is growing rapidly, while Satcon is shrinking.

Given Enphase’s weak balance sheet, the stock is likely to continue to decline despite the strong revenue growth. Either Enphase will be acquired by a stronger player, or existing shareholders will suffer significant dilution as the company is forced to return to the markets for additional operating capital.

China Takeover

An acquirer might not just be one of the stronger industry players Coven pointed to. Jabusch speculates that one of the stronger diversified Chinese solar companies might look to acquire a newly cheap power conversion player. He thinks it “makes sense for a larger solar firm to want to add power control devices such as inverters, storage and distribution to their verticals,” while emphasizing that this is only speculation. ”But,” he says, “ the pieces fit, so it can’t be ruled out.”

Conclusion

Given the consensus that the shake-out is far from over, it is too early to buy into the solar inverter industry. Even likely industry survivors will continue to see deteriorating margins until the weaker players exit. Possible buy-out targets may receive a price bump on buy-out news, but any acquirer (even one from China) will probably wait for weakening industry economics to allow them to pick up their target our of bankruptcy, or at least a better price than is available today.

Disclosure: No positions.

This article was first published on the author’s Forbes.com blog, Green Stocks.

DISCLAIMER: Past performance is not a guarantee or a

reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.