by Tom Konrad Ph.D., CFA

Investing in the past is a good way to lose money. Just ask anyone who has been investing in coal stocks since Obama we re-elected.

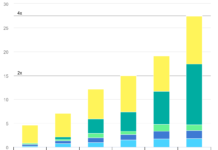

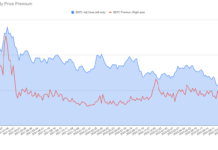

A glance at the chart above shows that the VanEck Vectors Coal ETF (KOL) is down about 50% over the last four years, even while the broad market (as represented by the SPDR S&P 500 ETF (SPY)) has gained almost 50%. But even if we knew this was going to happen, should investors have rushed into the energy sectors most loved by liberals: That is, Wind, Solar, or Clean Energy Stocks in general?

Hindsight says “Yes, No, and No,” which is hardly a comforting response to a an investor looking to understand what might happen over the next four years. Wind stocks were up 90%, as shown by the First Trust ISE Global Wind Energy ETF (FAN). Solar stocks were volatile, and ended basically flat, significantly lagging the market as a whole, as embodied in The Guggenheim Solar ETF (TAN). Finally, the PowerShares Clean Energy (PBW), a widely held basket of clean energy stocks.

What Obama Did

Shortly after the election in 2012, a reporter with USA Today called to ask me why wind and solar stocks had not taken off. As you can read in his article, I told him that essentially, one presidential election would not transform the economy. I predicted legislation promoting alternative energy or attacking coal was off the table- an easy prediction to make, given Republican control of Congress. I also predicted that Obama would continue doing “Pretty much what he [had] been doing for the” previous three years: doing what he can through rule-making. Which is what he did.

What many may find surprising is that Obama’s rule-making was only a minor factor in the recent decline of coal stocks. His administration’s most important energy policy, the Clean Power Plan remains tied up at the Supreme Court. True, coal advocates like the Institute for Energy Research (IER) will point at two other regulations, the Mercury and Air Toxics Standards (MATS) and the Cross State Air Pollution Rule (CSAPR.)

What Obama Didn’t Do

The coal industry’s problems with MATS and CSAPR hint at the underlying cause of the industry’s troubles. The industry is like a coddled child sent out into the world: It’s not flexible or tough enough for a real-world job, it’s bankrupt from credit card debt, and it still has not learned to clean up its room.

Take these points in reverse order. MATS, CSAPR, and even the Clean Power Plan are regulations telling coal plants to be a little less dirty than they are, but not nearly as clean as any of their power generation siblings: natural gas, nuclear, wind and solar. Like any wayward child, coal promised to clean up its room… remember “Clean Coal?”

Fantasies like Clean Coal and hiring a professional housekeeper to keep a child’s room tidy might have been affordable before technology innovation in natural gas drilling, solar, and wind started cutting into the price of power.

But even without affordable clean coal, MATS is not causing the wholesale closure of coal plants, according to the nonpartisan Energy Information Administration.

Technology has recently been sending the price of power in the opposite direction: down. Ten years ago, coal power could legitimately call itself a source of cheap (if not clean) power. Now, technology innovation have left coal choking on its own fumes, while clean coal (a.k.a. IGCC) and nuclear as simply too expensive to compete without subsidies, as shown by in this 2015 analysis by financial advisory firm Lazard.

Lazard found that, without subsidies, the cheapest sources of power were:

- Energy efficiency, at $0 to $50 per MWh

- Wind, at $32 to $77 $ per MWh

- Utility scale solar, at $43 to $70 per MWh and

- Combined Cycle Gas, at $52 to $78 per MWh

Coal was far behind, with the cheapest coal costing almost as much as the most expensive wind, solar, and combined cycle gas at $65 per MWh. The cheapest nuclear and clean coal (IGCC) were far behind, at $97 and $96.

Keep in mind that these are unsubsidized numbers. If the Obama Administration declared a war on coal, it’s the invisible hand of economics that won all the battles. And that is why new capacity additions are overwhelmingly wind, solar, and natural gas:

|

| Source: GTM Research / SEIA U.S. Solar Market Insight, Q2 2016 |

Adding to the poor economics of coal power, the coal mining industry racked up debt like an irresponsible teenager with a credit card at the worst possible time. Arch Coal borrowed heavily to fund acquisitions in 2011, Peabody borrowed to fund acquisitions in Australia. And these are just two in a string of bankruptcies that have left nearly every big coal firm in bankruptcy or emerging from it. They also play back into the theme of coal not cleaning up its own room: Coal producer bankruptcies are shifting the costs of cleaning up mines to the states.

Baseload: An Unwanted Suitor

Coal advocates like to point out that “the sun does not always shine and the wind does not always blow.” They then go on to call solar and wind power “unreliable” and claim that the grid cannot operate without backup power always at the ready. Coal and nuclear power plants are what is called “baseload” power: they run at a near constant level. That’s not the same as being reliable: Reliable people

show up when they say and do what they say they are going to do.

A person who is always there, never goes away even when you want a little privacy, and is always doing things for you even when you don’t want anything is more likely to be called an unwanted suitor than “reliable.”

We’re actually pretty good at predicting the weather, especially over large areas and a few days or hours in advance. While wind and solar power on the electric grid does vary over time, it’s usually there in approximately the quantity we expect. It would be a great complement to say that a large coal or nuclear power plant was “as reliable as the sun coming up in the morning.” The “Equivalent Forced Outage Rate- Demand” (EFORd), a measure of how often a power plant is out when it’s needed, is about 4% for nuclear, 7.5% for coal, and 10% for gas plants [pdf, 2008-2012 data]. So coal power is there most the time (even producing power at 3am when everyone is asleep and it may not be needed.) Yet even this unwanted suitor fails to show up about one time in 13 when he’s really needed.

Solar arrays and wind turbines also go down unexpectedly, but the small size (relative to coal) of solar arrays and individual wind turbines means that they don’t all go out at once. A single 250 MW coal plant produces approximately the same amount of energy as 400 typical 1.5MW wind turbines, or 100,000 to 200,000 home solar arrays. Some of these will be down at any time, but they won’t all go down at once, especially if they are scattered over a wide area.

In this sense, solar and wind are far more reliable than coal. It’s true that solar and wind need to be supplemented with more flexible generation, energy storage, or flexible demand response in order to match the patterns of electricity demand. But baseload power also needs flexible power resources to match the normal fluctuations of demand, and to stand by at the ready for that one time in 13 when you’re hoping it will be there, but it isn’t.

What The Next President Can’t Do

The heated rhetoric from fossil fuel advocates and environmentalists alike served to hide the very real economic problems coal power has had in adapting to the new reality of falling technology costs for solar and wind and falling fuel prices for natural gas generation.

The continued decline in the cost of wind and solar generation guarantee that these technologies will continue to be the leading forms of new power on the electric grid. In turn, their variability will make it more expensive to run baseload power stations such as coal and nuclear, making them even less economic than they already are.

The free market is much more powerful than any president.

Donald Trump has repeatedly promised to ‘save’ the coal industry. If elected, he is certain to be even less effective at reviving coal than Obama was at killing it. The free market is much more powerful than any president, and coal simply cannot compete in a free market.

If Hillary Clinton is elected, she will almost certainly be accused of putting more coal miners out of work as she tries to promote renewable energy, but she will not deserve the blame or the credit any more than Trump or Obama.

The true blame and credit for the changes in the way we produce and use electricity fall squarely on technological progress and market economics.

How Investors Can Survive and Even Thrive in the Future of Energy

Investors who observed the gridlock in Washington, D.C.four years ago, and rightly concluded that Obama would be ineffective at reigning in fossil fuels were correct. Nevertheless, they have lost most of the money.

Would they have done better if they had plowed their money into solar and wind? Not if they bought a solar ETF like TAN or a clean energy ETF like PBW.

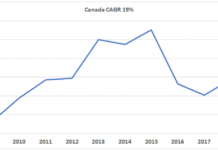

Conservative investors (in the financial sense of the word: risk-averse) investors had an additional problem. The future of energy may lie in solar, wind, and other energy technology, but technology companies are not conservative investments. The technological innovation driving the rapid price declines for wind and solar is a problem for incumbent companies as well. Today’s leading solar manufacturer is tomorrow’s has-been, a fact I pointed out in 2009. In the same article, I also said my top pick at the time was a company that few people would think of as “green:” a Toronto-listed bus manufacturer called New Flyer (NFYEF.) At the time, New Flyer was trading at C$9 and paid a C$0.62 (7%) annual dividend. Today, seven years later, the stock trades at C$43, the dividend has been maintained and recently increased, and my readers and I still own it.

In 2012, I could not give the USA Today reporter a similar conservative income pick in what I told him was my favorite energy sector at the time, energy efficiency: Such stocks did not exist. That changed in early 2013 with the IPO of Hannon Armstrong Sustainable Infrastructure (HASI.) After interviewing the CEO of Hannon Armstrong, I said, “I can’t help but be enthusiastic about the company,” which was then trading at $11.75, slightly below the IPO price. HASI was about to start paying an annual dividend which I estimated would exceed 15 cents a quarter (5%). The company quickly increased its dividend to $0.22 a quarter that December, than to $0.26 in 2014, and $0.30 last year. I expect it to increase the quarterly dividend to at least 34 cents this year, or 5.9% at the current price. Did I mention the stock price has doubled?

How do I find conservative income stocks that double or quintuple in a handful of years, while solar and coal investors are losing their shirts? Not just by understanding the technology. Anyone who understood solar technology in 2009 would have rightly predicted the enormous growth of the industry – from 2% of new generation capacity in 2010, to 64% in the first quarter of 2016. But if they had taken that prediction, ignored my warning and bought the Guggenheim Solar ETF (TAN), they would have lost 77% of their money, despite Obama’s attepts to promote the solar industry. Even coal investors would have done better with the VanEck Vectors Coal ETF (KOL): It “only” fell 64% over the same period.

It takes knowledge of economics, technology, and the whole energy system to successfully navigate the Future of Energy. Knowing who is going to win the election in November might help on the margin, but neither Trump nor Clinton can roll back the progress of technology nor battle with Adam Smith’s Invisible Hand of the market.

Disclosure: Long NFYEF, HASI

Tom Konrad Ph.D., CFA is a freelance writer and portfolio manager specializing in income stocks positioned to benefit from ongoing changes in the energy economy.

This makes me think you should do a review of your top 5 or 10 successes/gains & top 5 or 10 failures/losses for the past 12+ years of altenergystocks

Some ideas…

+

NFI and HASI

RNW, PEGI

AXY, PFB, WM

ZOLT, WFI, CSE

–

WND, FVR, MXWL, PW, AMRC

NGP and RPG too

noticed that others started altenergystocks in 2004 (the days of hydrogen and hybrids) until ~2007 so i guess you haven’t been running this thing for 10 years yet

I started writing about clean energy investing at tomkonrad.wordpress.com in July 2006 (https://cleanenergywonk.com/2006/07/)

I wrote my first article for AES in March 2007.

http://www.altenergystocks.com/archives/2007/03/

I became editor in 2008 or 2009.

Re the top winners and losers, the big winners have all been income stocks, the big losers have all been technology or “value” stocks, with just a couple of exceptions.

That’s why I focus so much on income stocks now. It’s what I’m good at.