Hybrid Technologies and the California Highway Patrol ‘CHP’ to Showcase Hybrid’s Lithium Powered Chopper...

Hybrid Technologies Inc. (HYBT) is proud to announce that the historic CHP memorial chopper powered by the Hybrid Technologies Lithium system will be presented to media and the public in a ceremonial CHP ride across California. The initial press conference will be held in Los Angeles, California and is part of a CHP and CAHP weeklong event surrounding graduation and memorial services for the legendary California Highway Patrol.

What’s Up with UQM?

As part of a general portfolio cleanup, I recently considered selling my stake in UQM Technologies, Inc. (AMEX:UQM), a manufacturer of electric motors for hybrid and electric vehicles. I chose to keep the stock because they seem to have sufficient cash on hand to fund several years' operations. I'm glad I did, because the stock is up 76% since Monday, with no recent news. But there's a rumor that Chrysler will be using a UQM product in one of its planned electric cars. If that rumor is true, the stock's rise is probably justified. I like the company either...

Behavioural Transit

Investors act in irrational, but predictably irrational, ways. That is the basic tenet of Behavioral Economics. (Looking for references, I came across an interesting book by that title, by the Alfred P. Sloan Professor of Behavioral Economics at MIT’s Sloan School of Management.) For me, these predictable irrationalities provide ways to profit from the mistakes of others in the market, so long as I do not fall into the same (or other) cognitive traps which cause the market opportunities in the first place. I describe one such technique in this article. Applications to Policy Design In addition to those...

War With Iran? Buy Alternative Energy Stocks.

September is starting out as the month of speculation about a massive three day air strike on Iran. Is Bush ready to attack Iran while our troops are still trying to stabilize both Afghanistan and Iraq? In February, administration officials were denying it. The preparations now going on could simply be the stick part of a negotiating strategy; the bad cop to Russia's good cop. But Bush's chances of successful cooperation with Putin could be better. What if? If Bush does launch a massive three day air strike on Iran, what will that mean for alternative energy stocks? I...

Enova News Updates

Enova Systems Inc (ENOV) announced that it has entered into a joint School Bus program with a major North American Truck Manufacturer. The School Bus project will feature Enova's post transmission 80 kW Hybrid Drive System and has the potential to lead to future production in 2006 and beyond. They have also recently announced a partnership with First Auto Works (FAW) of China to supply their 80kW Parallel Hybrid Drive system for "Hybrid City Bus." FAW is the largest automobile manufacturer in China and with its expertise in not only buses, but also automobiles and trucks,...

Plug-in and Hybrid Locomotives; Another Sweet Spot for Axion Power

John Petersen I'm a cynic and a heretic when it comes to plug-in vehicle schemes because most defy the laws of economic gravity and violate a cardinal rule that Ford engineers developed for the EcoStar light delivery vehicle program in the early '90s: – The unloaded weight of a plug-in vehicle should never exceed 70% of its loaded weight. Investors who pay attention to this simple rule can easily distinguish between pipe-dream vehicle electrification schemes that are nothing more than feel-good eco-bling and realistic vehicle electrification projects that make economic sense. For the last...

List of Electric Vehicle and Plug-In Hybrid Electric Vehicle Stocks

Electric Vehicle (EV) and Plug-in Electric Vehicle (PHEV) stocks are publicly traded companies which produce EVs or PHEVs, their components, or charging infrastructure.

This list was last updated on 6/3/22.

AeroVironment, Inc. (AVAV)

Blink Charging Co. (BLNK)

BYD Company, Ltd. (BYDDY)

Enova Systems, Inc. (ENVS)

EEStor Corporation (ZNNMF)

Electrameccanica Vehicles Corp. (SOLO)

Envision Solar International (EVSI)

EVgo, Inc. (EVGO)

Fisker (FSR)

GreenPower Motor Co. (GPV.V)

iShares Self-Driving EV and Tech ETF (IDRV)

Kandi Technologies Corp. (KNDI)

KraneShares Electric Vehicles and Future Mobility Index ETF (KARS)

Leo Motors (LEOM)

Lordstown Motors Corp. (RIDE)

Navitas Semiconductor Corporation (NVTS)

Nio Inc. (NIO)

Nikola Corporation (NKLA)

Proterra Inc. (PTRA)

Tesla Motors, Inc. (TSLA)

UQM Technologies (UQM)

Valeo SA (FR.PA, VLEEF, VLEEY)

Vision Marine Technologies Inc. (VMAR)

VMoto Limited...

Battery Investing for Beginners: Index

John Petersen wrote a series of popular articles last week to introduce new investors to the battery sector, following the A123 IPO. We've had a couple requests from readers who missed one part or another, so here is a quick index to the articles. Part I - Battery industry overview. Parrt II - Comparison of energy storage technologies and companies. Part III - Benchmarking Performance of battery stocks Part IV - Debunking misconceptions about electric vehicles and battery technology.

The Race For Silicon Anodes

Graphite is the most widely used material for battery anodes. The anode is the positively charged electron collector in a battery. It collects and accelerates the electronics emitted by the battery’s cathode. Graphite gets the anode job because it is has excellent electric conductivity and resists heat and corrosion. Plus it is light weight, soft and malleable.

As satisfied as manufacturers might be with graphite anodes, none would balk at an alternative material that boosts battery performance or reduces cost. Scientists believe battery capacity can be increased as much as ten times by using silicon for anodes. It requires six atoms of carbon to bind one...

Alternative Energy Technologies and the Origin of Specious

John Petersen Thanks to a recent comment from JLBR, I've found a new hero in Dr. Peter Z. Grossman, an economics professor from Butler University who cogently argues that government attempts to force alternative energy technologies into an R&D model that was created for the Manhattan Project and refined for the Space Program will always result in commercial disaster because "the goal of the Apollo Program was the demonstration of engineering prowess while any alternative energy technology must succeed in the marketplace." In a recent article titled "The Apollo Fallacy and its Effect on U.S. Energy Policy" Dr....

Plug-in Vehicles, Unconscionable Waste and Pollution Masquerading as Conservation

John Petersen For eighteen months I've been blogging about the energy storage sector and discussing the current and potential markets for batteries and other manufactured energy storage devices. A recurring theme that I've discussed many times is the unrecognized but undeniable truth that while plug-in vehicles masquerade as conservation measures at an individual level, they're incredibly wasteful at a societal level. The conclusion is counter-intuitive and my articles on the subject invariably draw heated criticism from self-anointed defenders of the faith. Their arguments, however, do not change the inescapable truth that plug-in vehicles are one of the most...

China’s First Auto Works Chooses Enova for Hybrid Drive Systems

Enova Systems Inc (ENVA)announced today that it has entered into a development and sales agreement with China's First Auto Works (FAW) for parallel hybrid drive systems for their hybrid buses. FAW signed a two-phase development agreement with Enova for hybrid-electric motors and power controllers for its newest hybrid buses. Enova is working with both FAW and the Southwest Research Institute (SwRI) of Texas to integrate and validate the new Enova parallel hybrid drive system for these buses.

Vehicle electrification – sticker shocks, delays and manufacturing capacity forecasts

John Petersen Today we have a bit of a hodge-podge as I consider sticker shocks, delays and manufacturing capacity forecasts in the vehicle electrification and energy storage sector. Since the sticker shock and delay discussions involve recent news, I'll touch on them first before getting into the fuzzier aspects of manufacturing capacity forecasts. I'd like to begin with a note of thanks to one of my Seeking Alpha followers, MRTTF, for sending me links to both news stories. For readers who don't delve into the comment streams, MRTTF is a PhD chemist who works in R&D...

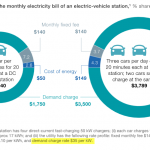

EV Fast Charging Disincentives

by Daryl Roberts

DC Fast Chargers (DCFCs) and Tesla superchargers are a key element in electric vehicle (EV) charging infrastructure that could facilitate wider adoption of EVs by enabling recharging that comes to resemble the time currently taken for gas station stops, and thereby reducing “range anxiety” for drivers.

However, the pricing structure for electrical costs incurred at commercial DC fast chargers is currently prohibitive, because it includes a special fee called a “demand charge”. Rate design in a number of states includes this additional charge, based on the “peak rate” on electric power consumed in kW. In New York,...

Axion Power – A Battery Manufacturer Charging Forward

John Petersen Last week Debra Fiakas of Crystal Equity Research published an article titled "No Battery Producer Left Behind" that was based on old information about the relationship between Exide Technologies (XIDE) and Axion Power International (AXPW) and reached several erroneous conclusions. Since I'm a former Axion director, the stock is my biggest holding and I follow the company like a hawk, Tom Konrad asked me to clarify the record and present a high level overview of Axion's business history, stock market dynamics and technical accomplishments over the last four years. Since Tom's request is a...

Stop-Start Idle Elimination – Slashing Fuel Consumption By Up To 17%

John Petersen I've written several articles over the last year that explain why idle elimination is a crucial first step in the global effort to increase fuel efficiency and curb CO2 emissions. For readers who are new to my blog, or confused by a torrent of news stories and analysts reports that wax poetic on the expected benefits, costs and challenges of gee-whiz vehicles that are "coming soon to a showroom near you," altenergymag.com describes stop-start systems, or micro-hybrids, as follows: "These are conventional vehicles powered either by gasoline or diesel engines in which the 12-volt starter...