GlyEco Expands Antifreeze Recycling Footprint

by Debra Fiakas CFA Glyeco recycles waste glycol into reusable antifreeze, windshield wiper fluid and air conditioning coolants for the automotive and industrial markets. The used coolant and antifreeze liquids are frequently contaminated with water, dirt, metals and oils. The company uses a proprietary technology at the foundation of its recycling system to eliminate contaminants. The company focuses mainly on ethylene glycol in its six processing plants. Last month chemical recycler GlyEco, Inc. (GLYE: OTC/QB) acquired Brian’s On-Site Recycling, a provider of antifreeze and air conditioning coolant disposal services in the Tampa, Florida area. The deal extends...

Environmental Markets: The Next Frontier in Environmental Investing?

The term environmental markets remains foreign to most investors (and environmentalists!), even though these markets represent, in my view, a very compelling investment story. Although we've discussed trading in carbon emissions in the past, I thought I would expand a bit and talk about environmental markets in general, and about good ways to play them. What's An Environmental Market? Environmental markets exist at the confluence of two movements: (a) A growing desire on the part of national and regional governments in several countries to both limit environmentally-damaging behavior and to promote the growth of alternative...

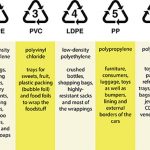

Plastic Recyclers Chasing Arrows

According to Plastics Europe Research Group, over 35 million tons of plastic material was produced globally in 2016, the last year for which full-year data is available. That brought total plastic production to 9 billion tons since 1950. All of those plastic materials remain in existence somewhere - still in use, landfills, junk yards, blowing around the countryside, waterways, oceans, fish stomachs. The post “Plastic Contagion’ on April 13th outline the dangers presented by plastic waste, ranging from respiratory failure from toxic emissions to reproductive interference in aquatic animals.

The building burgeoning volume of plastic waste has sent environmentalists scrambling for solutions to the plastic waste...

Some Emissions Trading News

A lot has happened in the world of carbon finance and emissions trading since we last wrote about this topic, so I felt this might be good time to provide a quick update. (A) The World Bank Carbon Finance Unit recently released its State and Trends of the Carbon Market 2007 (PDF document), a periodic assessment of the scale and characteristics of the global market for carbon dioxide emissions. The Bank found a large increase in the volumes traded (131%) and dollar value (177%) of the global carbon market in 2006 over 2005. Unsurprisingly, the EU ETS...

Hedging Your Climate Risks

Whether you agree it's because of human activity or not (and, for the record, I do), there's no doubt that the weather has been a little wacky over the past few years, driving a range of events that have had very real repercussions on businesses and the economy. Hurricane Katrina is one obvious example, but there have also been other, more subtle cases. Many ski resort operators in North America, for instance, were beginning to believe that winter would never arrive on the eastern side of the continent. In the west, we're now being told that cold weather...

Ten Insights into Carbon Policy and Its Implications

On November 27, I attended the National Renewable Energy Laboratory's (NREL) Fifth Energy Analysis Forum, hosted by NREL's Strategic Energy Analysis & Applications Center. The forum focused on carbon policy design, the implications for Renewable Energy and Energy Efficiency. As a stock analyst focused on that sector, I am extremely lucky to have NREL as a local resource: the quality and the level of the experts at NREL and the ones they bring in is probably not matched anywhere in the country, and conferences like these provide priceless insights into what these Energy Analysts are thinking. Why should investors...

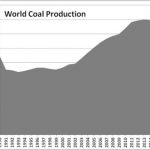

Fossil Fuel Industry: Killing the Customer

by Debra Fiakas, CFA

Published by the Climate Accountability Institute, the Carbon Majors Reportlays bare the truth about which companies are responsible for industrial greenhouse gas emissions. One hundred fossil fuel producers are linked to 71% of global industrial greenhouse gases emitted since 1988. Something like a line in the sand for climate scientists, 1988 is the year human-induced climate change was official recognized by the Intergovernmental Panel on Climate Change.

Fossil fuels in the form of coal, crude oil and gas are by far and large the culprits. Rolling forward three decades later, we can observe in the charts below that fossil fuel production...

Is Energy Sourcing the Gateway Drug to Energy Efficiency?

Tom Konrad CFA I recently interviewed Richard Domaleski, CEO of World Energy Solutions (NASD:XWES). World Energy is a comprehensive energy management services firm whose core offering is extremely price competitive energy sourcing (that is, finding an energy provider to supply all of a client's energy needs at the lowest possible cost.) They achieve competitive sourcing using an electronic energy exchange designed to achieve much better price discovery in what is traditionally a very opaque market. According to Domaleski, a recent KEMA study showed that only 7% of large commercial, industrial, and government customers are sourcing their...

Some Tidbits From The World Of Emissions Trading

To be sure, the near-term prospects for carbon emissions trading are bleak. Continued decline in industrial production across the world's major manufacturing economies will inevitably lower carbon emissions. The clearest indicator of this, short of directly measuring emissions, is a sharp decline in the price of various fossil energy commodities (i.e. oil, natural gas and coal) on the back of falling demand. Another important factor for carbon emissions trading is that the commodity in play - the regulatory right to emit a unit of carbon dioxide equivalent (CO2e) - derives its legitimacy entirely from a regulatory scheme...

Climate Legislation: Who wins? Who loses?

Most Americans now agree that something needs to be done to reduce our greenhouse gas emissions. Hopefully most Americans now appreciate that this is not a small, but even more so, not a simple problem. I am a big believer that the playing field for our low carbon future should start level, and the market should be structured to allow our major power and energy companies a chance to lead the way, instead of simply dishing out punishment for our combined historical choices. Carrots and sticks work well together, but sticks alone are not going to solve our...

US Presidential Election & Carbon Markets: Is The Climate Exchange Story Overdone?

An interesting piece yesterday in POLITICO on how carbon prices on the Chicago Climate Exchange (CCX) have been trending up in recent months, mostly since it's become clear that all three remaining presidential hopefuls will likely regulate CO2 emissions at the federal level. In fact, as per the chart above, prices for the right to emit a metric ton of CO2 have been on a tear, recovering from a pretty significant slump in the preceding months. Last week, the World Bank Carbon Finance Unit released its annual update on the state of global carbon market (PDF...

NYMEX To Get Involved In Emissions Trading

A senior NYMEX official told reporters Wednesday that the exchange was considering getting into the business of carbon emissions trading. Given the actual, but especially the potential, size of this market, it makes sense that established bourses would take a good hard look at it. This will probably not be seen as very good news by the folks at Climate Exchange plc . Of course, until NYMEX actually unveils anything substantial, this will remain nothing but chatter.

List of Environmental Markets Stocks

This post was last updated on 4/27/2022.

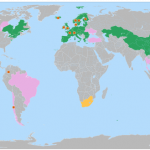

Environmental market stocks are publicly traded companies whose business involves the trading of commodities designed to represent an environmental attribute, such as renewable electricity, the environmental benefits of renewable energy (Renewable Energy Credits ), Carbon Offsets and other types of environmental offsets.

Carbon emission trading implemented

Carbon emission trading scheduled

Carbon tax implemented

Carbon tax scheduled

Carbon emission trading or carbon tax under consideration

By Tbap , via Wikimedia Commons

Crius Energy Trust (KWH-UN.TO, CRIUF)

GlyEco, Inc. (GLYE)

Hannon Armstrong Sustainable Infrastructure (HASI)

Just Energy Group Inc. (JE)

KraneShares Global Carbon ETF (KRBN)

Trading Emissions PLC (TRE.L)

If you know of...

Carbon ETFs/ETNs: Playing Copenhagen

Charles Morand At $126 billion transacted in 2008, up from $11 billion in 2005, the global carbon market is the fastest growing commodities market in the world and, provided that an agreement is reached at the COP15 conference in Copenhagen and that the US adopts a cap-and-trade program, this growth could go on for several more years. Yet this is a market that remains comparatively unknown for a number of reasons, not the least of which is the fact that the rules surrounding it are very complex. Unlike other commodities, to successfully invest directly in...

Biochar’s Likely Market Impacts

Biochar is still mostly a research and cottage industry, yet it has the potential to impact returns for a broad range of investors. Tom Konrad, Ph.D., CFA Biochar, or amending soil with biomass-derived carbon, shows great potential to improve the productivity of soils, as well as to increase the utilization of fertilizers by plants, while sequestering carbon to reduce the drivers of climate change. On August 10, I went to the 2009 North American Biochar Conference to look at the potential for investors. Before I went, I took a look at the publicly traded companies...

US Exchanges And Environmental Investing

An interesting bit of follow-up on my article last week about exchanges and environmental markets. Both the NYMEX and the Chicago Climate Exchange (CCX) have partnered up, in the past 2 weeks, with specialty cleantech and alt energy index makers to launch derivatives products. On March 14, Chicago Climate Futures Exchange (CCFE), a wholly owned subsidiary of the CCX, and WilderShares LLC, announced (PDF document) a licensing agreement to launch a futures market based on the WilderHill Clean Energy Index . The ECO is also the underlying index for the Powershares WilderHill Clean Energy Portfolio ETF...