Fossil Fuel Industry: Killing the Customer

by Debra Fiakas, CFA

Published by the Climate Accountability Institute, the Carbon Majors Reportlays bare the truth about which companies are responsible for industrial greenhouse gas emissions. One hundred fossil fuel producers are linked to 71% of global industrial greenhouse gases emitted since 1988. Something like a line in the sand for climate scientists, 1988 is the year human-induced climate change was official recognized by the Intergovernmental Panel on Climate Change.

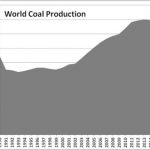

Fossil fuels in the form of coal, crude oil and gas are by far and large the culprits. Rolling forward three decades later, we can observe in the charts below that fossil fuel production...

Hedging Your Climate Risks

Whether you agree it's because of human activity or not (and, for the record, I do), there's no doubt that the weather has been a little wacky over the past few years, driving a range of events that have had very real repercussions on businesses and the economy. Hurricane Katrina is one obvious example, but there have also been other, more subtle cases. Many ski resort operators in North America, for instance, were beginning to believe that winter would never arrive on the eastern side of the continent. In the west, we're now being told that cold weather...

Competition In Environmental Markets Heats Up

Close followers of the environmental finance space have known it for a while; Climate Exchange (CXCHF.PK or CLE.L) is sitting on a potential gold mine. The market for environmental commodities, but especially carbon emissions, is slated to grow significantly over the next 5 to 7 years. It was therefore only a matter of time before competition sprung up, both from small players trying to leverage their technological platforms and from the big guys. The big guys came out swinging this week, with NYMEX announcing a partnership with JP Morgan and Morgan Stanley, among others, to set up a...

Wall Street And Climate Change Get Cosier And Cosier…

A couple of interesting news from Wall Street this week in the realm of carbon finance. Firstly, on Tuesday, JP Morgan announced the launch of what is, as far as I can tell, the first ever bond index with a special climate change risk overlay. In the interest of disclosure, I was tangentially involved with this project. While this overlay probably won't have much of an impact in the very near term, it will be interesting to see what happens once constituent firms are all subjected to some form of greenhouse gas regulation. Second, on Thursday, Lehman...

Investing in Climate Change

This post was supposed to be about coal-to-liquids (CTL), but I came across interesting info yesterday after opening a former colleague’s mail that I thought would make for a more interesting post. The CTL piece will thus have to wait a bit. What was in the package was a hard copy of the January/February 2007 edition of CNBC European Business. This edition is dedicated to climate change, but, more importantly, to how some firms are positioning themselves to benefit from the markets that will be created as a result of regulatory and other actions to tackle greenhouse gas...

Carbon ETFs/ETNs: Playing Copenhagen

Charles Morand At $126 billion transacted in 2008, up from $11 billion in 2005, the global carbon market is the fastest growing commodities market in the world and, provided that an agreement is reached at the COP15 conference in Copenhagen and that the US adopts a cap-and-trade program, this growth could go on for several more years. Yet this is a market that remains comparatively unknown for a number of reasons, not the least of which is the fact that the rules surrounding it are very complex. Unlike other commodities, to successfully invest directly in...

Carbon Offsets Work – Will the Mainstream Media Ever Get It?

The carbon markets are an area of keen interest for me personally and professionally, so it is always frustrating that the mainstream media largely refuses to learn the details. In general, layman and media who don’t understand the details of the carbon markets attack carbon offsets in two areas, first, questioning whether the credits are for a project that would have occurred anyway (a concept known in carbon as “additionality”), and second questioning whether there are checks and balances to ensure the environmental standards are adhered to and the abatement actually happens (in carbon known as the validation...

Beware The Vagaries Of Government

I just came across this article on potential problems with the emerging trade in carbon credits. The piece is not technical and I wouldn't say that it is particularly well-researched, but it does raise a key point - as the market for carbon emissions grows, the need for standardization and collaboration between governments and regulators will become ever more pressing. This could create problems. The carbon market is unique in that the commodity traded derives its value primarily from its ability to meet the requirements set by an environmental regulator. There is also a market for voluntary...

Linking Emissions Trading Systems

For those interested in the topic of emissions trading, a new piece was just published by the International Emissions Trading Association on the topic of 'linking' different emissions trading regimes (PDF document). Linking entails allowing emission credits from one scheme to be rendered tradable in another. For example, European credits would be valid and tradable in California, and vice-versa. Beyond allowing the carbon market to become more efficient and liquid, linking could also present a range of arbitrage opportunities. For all of you environmental markets fiends out there, I would definitely recommend this paper. It's short (13...

Avoiding a Carbon-Price Backlash

by Tom Konrad, Ph.D. Economics and Greenery, a Belated Rapprochement It is truly a triumph of economic ways of thinking that many of environmental activists are championing market-based approaches to tackling climate change. Those people who are not for cap-and-trade on global warming gas emissions promote the even more economically rigorous carbon tax. The most common defense against criticisms of subsidies for renewable energy is to retort that the fossil fuel industry benefits from much large subsidies. Not only do fossil fuels get generous subsidies in direct and indirect payments, but they seldom pay anything like the indirect costs...

List of Environmental Markets Stocks

This post was last updated on 4/27/2022.

Environmental market stocks are publicly traded companies whose business involves the trading of commodities designed to represent an environmental attribute, such as renewable electricity, the environmental benefits of renewable energy (Renewable Energy Credits ), Carbon Offsets and other types of environmental offsets.

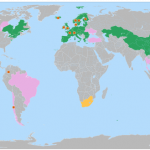

Carbon emission trading implemented

Carbon emission trading scheduled

Carbon tax implemented

Carbon tax scheduled

Carbon emission trading or carbon tax under consideration

By Tbap , via Wikimedia Commons

Crius Energy Trust (KWH-UN.TO, CRIUF)

GlyEco, Inc. (GLYE)

Hannon Armstrong Sustainable Infrastructure (HASI)

Just Energy Group Inc. (JE)

KraneShares Global Carbon ETF (KRBN)

Trading Emissions PLC (TRE.L)

If you know of...

Climate change, carbon trading and America…it’s only a matter of time

Just a quick follow-up on my carbon trading post a few days ago. Thanks to GreenBiz.com for the heads up on the results of a survey that were released during MIT's seventh annual Carbon Sequestration Initiative Forum. The results show that climate change now tops the list of environmental concerns for Americans. I don't want to reveal too much here since this is a GreenBiz.com story, but it suffices to say that this provides yet more ammunition to the political backers of a framework to reduce greenhouses gases in America. Momentum is building and there will definitely be some...

Some Emissions Trading News

A lot has happened in the world of carbon finance and emissions trading since we last wrote about this topic, so I felt this might be good time to provide a quick update. (A) The World Bank Carbon Finance Unit recently released its State and Trends of the Carbon Market 2007 (PDF document), a periodic assessment of the scale and characteristics of the global market for carbon dioxide emissions. The Bank found a large increase in the volumes traded (131%) and dollar value (177%) of the global carbon market in 2006 over 2005. Unsurprisingly, the EU ETS...

A New Player In The North American Emissions Trading Sector

Over the past two weeks, a couple of announcements were made that went mostly unnoticed despite their importance to the North American carbon marketplace. Firstly, on May 30, the Montreal Exchange, a derivatives exchange, announced that it was launching an emissions trading market for CO2. The Montreal Exchange is now a unit of the TSX Group (TSXPF.PK or X.TO), the firm that runs all of Canada's exchanges. The second announcement came last week, when the premiers of Quebec and Ontario, Canada's two largest provinces and the heart of its industrial base, announced that they were moving ahead...

US Presidential Election & Carbon Markets: Is The Climate Exchange Story Overdone?

An interesting piece yesterday in POLITICO on how carbon prices on the Chicago Climate Exchange (CCX) have been trending up in recent months, mostly since it's become clear that all three remaining presidential hopefuls will likely regulate CO2 emissions at the federal level. In fact, as per the chart above, prices for the right to emit a metric ton of CO2 have been on a tear, recovering from a pretty significant slump in the preceding months. Last week, the World Bank Carbon Finance Unit released its annual update on the state of global carbon market (PDF...

How Energy Deregulation Affects States and Stocks

by Elaine Thompson

Bloomberg New Energy Finance, in an executive summary of its New Energy Outlook 2017 report, predicts renewable energy sources will represent almost three-quarters of the $10.2 trillion the world will invest in new power-generating technology.

Analysts outline several reasons for this increase in spending, such as the decreasing costs of wind and solar and consumers’ increasing interest in solar panels. Competition between power sources also continues to grow, with products like utility-scale batteries upsetting coal and natural gas’s roles in the marketplace.

But more importantly, state-driven renewable portfolio standards pave the way for additional ventures in renewable energy technologies, particularly...