Power REIT’s Preferred Stock Offering: A Hedge That Pays 7.75%

Power REIT's preferred stock offerning (NYSE:PW-PRA) is an excellent hedge for the legal risks borne by the holders of its common stock (NYSE:PW.)

Should Pattern Energy Shareholders Vote Against the Merger?

by Tom Konrad Ph.D., CFA

This morning, hedge fund Water Island Capital called on Pattern Energy (PEGI) Shareholders to vote against the merger with the Canada Pension Plan Investment Board (CPPIB).

Water Island claims the merger is undervalued compared to the recently surging prices of other Yieldcos, and that PEGI would be trading at over $30 given current valuations. There are not a lot of other Yieldcos left, especially if we eliminate those with their own special circumstances. These are Terraform Power (TERP) which is subject to its own buyout agreement with Brookfield Renewable Energy (BEP), and Clearway (CWEN and CWEN/A) where...

Climate Bonds Mid-Year Roundup

by the Climate Bonds Team

Halfway in 2016: Issuance Up on 2015: New Underwriters from China: And Where Will Green Bonds Land by Dec 31st?

The Headline Figures:

At the end of Q2, issuance for 2016 stood at USD 34.6bn – bringing it close to the total issuance for 2015 with 6 months of the year to go.

In the first two weeks since the end of Q2 - total issuance surpassed the 2015 total. We expect even more in the second half of the year.

USD 18.6bn issued in Q2 alone making it the highest single quarter of green bond...

Yieldco Valuations Look Attractive

By Tom Konrad Ph.D., CFA

Despite a run-up in the fourth quarter of 2023, it has been a long time since valuations of clean energy stocks have been this cheap. Perhaps it is worries about hostility towards clean energy under a new Trump administration, or disappointment at the slow implementation of the Inflation Reduction Act. Whatever the cause, prices are low, and many clean energy stocks are likely to produce good returns even if the political climate turns further against them.

This is especially true for companies that are less dependent on favorable policy or subsidies. For instance, Yieldcos, high...

Green Bonds: 2015 Year End Review

by the Climate Bonds Team Another successful year for the green bond market with 2015 issuance hitting $41.8bn making it the biggest year ever for green bonds. Achieving scale hasn’t been the only reason to celebrate the green bond market at the year-end; the real success is the geographical spread of green bonds across the world. Green bond markets are popping up all across the world, in Brazil, China, Estonia, Mexico and India… just to name a few! Green bond market momentum continues to build after a successful COP in Paris. ...

Fossil Fuel Companies Should Be Issuing Green Bonds

by the Climate Bonds Team ‘Fossil fuel companies should not be issuing green bonds because they are not green businesses.’ Varying versions of this statement crops up often at green bond conferences and in articles. We disagree, and here is why: It’s use of proceeds that matter Green bonds are about use of proceeds. What matters is the green characteristics and features of the projects that are being invested in, the ‘use of proceeds’, not the balance sheet backing the bond. This is an accepted concept in the green bond market...

Capstone Infrastructure: Green Income At A Cardinal Discount

Tom Konrad CFA Capstone Infrastructure Corp.'s Gas Cogeneration facility in Cardinal, Ontario. Capstone Infrastructure Corporation (TSX:CSE, OTC:MCQPF. Disclosure: I own this stock) is an international operator and developer of green infrastructure assets and utilities which is currently selling at a significant discount to most comparable firms. I recently ran a comparison of six similar Canada-listed firms, and Capstone seemed much cheaper on several measures. The Discount The following chart compares five renewable energy and green infrastructure firms with most of their operations in Canada: Capstone, Algonquin Power and Utilities (TSX:AQN, OTC:AQUNF), Brookfield Renewable Energy Partners (NYSE:BEP),...

Five Pioneers Mining the Sun for Income

by Jared Wiedmeyer For the past few years, solar industry stakeholders have imagined a future where the general public has the ability to invest in pure-play renewable energy real estate investment trusts (REITs) that finance and construct both utility-scale and distributed photovoltaic (PV) projects in the United States. While these stakeholders wait for this reality to come to fruition, existing REITs already have several options to own or develop solar projects that still allow them to comply with the IRS's asset and income tests. This past May, Chadbourne & Park's Kelly Kogan and Scott Bank moderated a roundtable with...

Enviva: Wood Pellets Into Dividends

by Debra Fiakas CFA Last week Enviva Partners, LP (EVA: NYSE) reported financial performance for its wood pellets business in its quarter ending September 2015. Sales totaled a whopping $116.6 million, representing a 53% increase compared to $40.5 million in the same quarter last year. The big jump in revenue resulted from higher volumes to larger customers. Distributable cash flow totaled $12.6 million compared to $8.2 million in the year ago period. Quarter performance made possible a declared cash distribution of $0.44 per common unit, which is 7% higher than the minimum quarterly distribution. At its...

Green Asset-Backed Bond From Hannon Armstrong Has Measured GHG Savings

by the Climate Bonds Team Hannon Armstrong’s (HASI) second green ABS, $118.6m, will save 0.39 tons of GHG annually per $1,000! ($100.5m, 4.28%, 19 yr, A and $18.1m, 5.00%, 19 yr, BBB) Hannon Armstrong (NYSE:HASI) closed its second green ABS bond (Sustainable Yield Bond) following its inaugural issuance in December 2013. The ABS was a private placement split into two tranches with different credit ratings (from Kroll Bond Credit Rating Agency): $100.5m with a rating of A and 4.28% interest rate, and $18.1m with a rating of BBB and 5.00% interest rate. Both tranches have a 19-year tenor....

Second Largest Quarter For Green Bonds Ever

Third quarter reflects strong growth and new market entrants

Overview

The green bond market has kept its strong pace in Quarter 3 2017, reaching a total of USD27.7bn from July to September.

On September 28th, the total amount of green bonds issued in 2017 ytd (USD83.2bn) overtook last year’s total issuance of USD81.6bn.

We covered the big moment in our Blog Post here.

Lots of new issuers

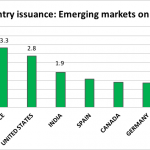

The top sources of issuance were:

Mexico - USD4bn

China - USD3.9bn

France - USD3.3bn

U.S. - USD2.8bn

India - USD1.9bn

Mexico was a surprising addition to the number one spot, after issuing no green bonds in Q1 or Q2 this year.

Big...

Roundtable Greenlights Effort on Renewable Energy Covered Bonds

by Sean Kidney “There is more liquidity than ever being put into the system, but funds are still not being allocated to renewable energy projects” “The bottleneck for renewable energy is not in construction financing but a year or two after construction .” “ is not an asset class where risk changes over time – it changes between pre-completion to post-completion stages… it is incorrect to think that offloading an asset post-completion dumps risk onto others because the riskier part of the project is past.” “Alignment of interest with investors is strong as the issuing bank...

Green swan, Black swan: No matter as long as it reduces stranded spending

by Prashant Vaze, The Climate bonds Initiative

In January, authors from several institutions under the aegis of BiS, published The Green Swan Central banking and financial stability in the age of climate change setting out their take on the epistemological foundations for, and obstacles against, central banks acting to mitigate climate change risk.

The book’s early chapters provide a cogent and up-to-date analysis of climate change’s profound and irreversible impacts on ecosystems and society. The authors are critical of overly simplistic solutions such as relying on just carbon taxes. They also recognize the all-too-evident deficits in global policy to respond to the threat.

In short, they accept the need for central banks to act.

The Two Arguments

The paper makes two powerful arguments setting out the challenges central banks face using their usual mode of working.

Firstly, climate change’s impact on financial systems is an unknowable unknown – a...

Green Bonds Mid-Year Summary 2017

by the Climate Bonds Team

Climate Bonds looks at the last six months numbers, the trends and our tips for the rest of 2017

Green Bonds Mid-Year Summary 2017

Headline figures for the Half Year (H1)

2017 issuance to H1: USD55.8bn

Records broken: Quarter 2 (Q2) is the largest quarter of issuance on record at almost USD30bn

82 green bond deals issued in the quarter from 74 issuers

Over 50% of issuers were first time issuers

Green Bond transactions accounted for 3% of global bond market transactions in Q2 2017

Top 5 largest issuers of H1:

Republic of France (USD7.6bn),

EIB (USD2.8bn),

...

$37B 2014 Green Bond Issuance Triples Market

by Tess Olsen-Rong Following a landmark green bond growth year in 2013, the labelled green bond market has once again experienced a year of incredible growth in 2014: by year-end there had been $36.6bn of green bonds issued by 73 different issuers – that’s more than a tripling of the market! The final figure was boosted by a late flurry of green municipal bonds. This exponential growth takes the total amount of green bonds outstanding to $53.2bn by the end of 2014. So, what happened to cause this tripling of issuance? Well, corporate and municipal bond...

Four Clean Green Dividends

by Debra Fiakas CFA The recent pullback in stock prices in the U.S. equity market has opened the door to some interesting dividend yields. Investors with a taste for environmentally-friendly businesses have some particularly interesting alternatives that can pump up the purse as well as protect Mother Earth. AES Corporation (AES: NYSE) is a world-class power generator from mixed portfolio of conventional and renewable power sources. About 28% of its 29,352 megawatts of generation capacity is from renewable fuel sources, including hydro, biomass, solar and wind, and another 33% from plants using natural gas. The balance of...