One Week, Three YieldCo Deals. Are More Buyouts on the Horizon?

by Tom Konrad, Ph.D., CFA

It's been a busy several days in the YieldCo space.

On February 5, 8point3 Energy Partners (NASD:CAFD) announced an agreement to be acquired by an infrastructure investment fund managed by Capital Dynamics. While I was still writing an article on why the sale price was at a virtually unheard of discount relative to the stock market price, two more YieldCo deals were announced: NRG Energy (NYSE:NRG) agreed to sell its sponsorship stake in NRG Yield (NYSE:NYLD and NYSE:NYLD/A) to Global Infrastructure Partners, and YieldCo TerraForm Power (NASD:TERP) made an offer to buy out Spanish YieldCo Saeta Yield (Madrid:SAY) at a 20 percent...

The Greenium: Growing Evidence of a Green Bond Premium

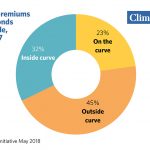

Highlights from the latest Q4 2017 Green Bond Report from the Climate Bonds Initiative: Two years of data observations examining green bond behavior in primary markets

Climate Bonds Initiative has released the fourth “Green Bond Pricing in the Primary Market” report analysing the performance of green bonds issued in the period October-December 2017. This is the last quarterly report; future publications will be produced semi-annually allowing a more longtitudinal analysis as the market expands.

The Q4 2017 report covers USD15.1bn or almost 40% of the face value of labelled green bonds issued in Q4. 15 EUR and 8 USD labelled green bonds are...

Will Investors Flock to SunEdison’s Emerging-Market YieldCo?

by Tom Konrad CFA SunEdison is proposing something entirely new: a YieldCo with a focus on projects in Africa and Asia, but it's a long way between an S-1 filing with the SEC and and IPO. The June launch of SunEdison's (SUNE) first YieldCo, TerraForm Power (NASD:TERP), transformed the parent company's prospects. Now it wants to repeat the performance with a first-of-its kind YieldCo that will focus on investment in Africa and Asia. A YieldCo is a publicly traded company that is formed to own operating clean energy assets that produce a steady cash flow,...

Capstone Infrastructure: How Bad Is The Worst Case?

Tom Konrad CFA Disclosure: I have long positions in MCQPF and AQUNF. Capstone Infrastructure Corporation (TSX:CSE, OTC:MCQPF) has been trading at a significant discount to its peers because of a power supply agreement which expires at the end of 2014. Capstone is seeking a new agreement with the Ontario Power Authority for its Cardinal gas cogeneration facility, a process which has taken much longer than management expected. The cardinal Cardinal plant currently accounts for about a third of Capstone’s revenue and a quarter of earnings before interest, taxes, and depreciation (EBITDA), but two-thirds of distributible income. The high fraction...

Massachusetts: Green Bond Auction Hot, Other Bonds Tepid

by Sean Kidney The Massachusetts AA+ green bond I mentioned last week got a lot of coverage on release this week – even the WSJ ran the story. But there was a twist: it seems the State had to scale back the total $1.1bn GO offering to $670m on tepid demand, but the green bond bit was 30% oversubscribed. For all you prospective issuers out there: the green bonds also lured as many as 9 new institutional investors for Massachusetts bonds. One buyer went so far as to say “We think more municipalities should do the same." So perhaps...

Five Green REITs

by Tom Konrad Ph.D., CFA

Why Green Buildings are Profitable Buildings

Buildings are responsible for approximately a third of greenhouse gas emissions, so making buildings more efficient and switching them to renewable sources of energy is an essential part in addressing climate change.

Fortunately, new technologies such as cold climate heat pumps, heat pump water heaters, induction stoves, as well as the ever falling cost of renewable electricity and improvements to insulation and building envelopes often provide opportunities to improve buildings while achieving extremely attractive investment returns from the energy and maintenance savings alone.

Because of the great financial returns, building owners who...

Buffet Bet Comes Out for Solar

by Sean Kidney Warren Buffet is a famous proponent of value investing and he surely received a sign of the value in solar investments over fossil fuels last week. The MidAmerican Energy $850m Topaz solar project bond we mentioned a couple of weeks ago was so successful that a second tranche is expected to cover the remaining debt of the project. The offer was oversubscribed by $400m which would have mopped up the total $1.2bn of debt in the project; Buffet's Berkshire Hathaway (BRK-A) controls MidAmerican. In contrast, Buffet’s investment in $2bn of bonds from gas company...

Yieldco Valuations Look Attractive

By Tom Konrad Ph.D., CFA

Despite a run-up in the fourth quarter of 2023, it has been a long time since valuations of clean energy stocks have been this cheap. Perhaps it is worries about hostility towards clean energy under a new Trump administration, or disappointment at the slow implementation of the Inflation Reduction Act. Whatever the cause, prices are low, and many clean energy stocks are likely to produce good returns even if the political climate turns further against them.

This is especially true for companies that are less dependent on favorable policy or subsidies. For instance, Yieldcos, high...

Green Bonds From Terraform Global, SolarCity, and Hannon Armstrong

by the Climate Bonds Team Yieldco TerraForm Global (GLBL) issues a whopping $810m green bond (7 years, 9.75%, B2/B+) TerraForm Global Operating has issued an $810m green bond, with 7-year tenor, 9.75% coupon and ratings of B2 and B+ from Moodys and S&P respectively. TerraForm Global is a recent yieldco spin off (IPO last month) of SunEdison (SUNE) group (have a look here if the yieldco concept is new to you). Terraform Global owns and operates renewable energy assets - solar, wind and hydro - in emerging markets, in the following locations: Solar: China, India, South Africa,...

Sunny Climate For Solar Income Up North

Tom Konrad CFA Disclosure: I am long PW and HASI. In a rational world, the sunniest places would have the warmest reception for solar technology and investment. While solar is having its day in the sun in Hawaii, state incentives make the economics of photovolatics equally attractive in Vermont, a state not known for its sunny skies. And while California is famous for its rapid deployment of solar, the economics are at least as good in Washington state, New York, New Hampshire, and chilly Maine. It’s not only the economics of solar which can counter-intuitively get better...

Green Dividend Yield Portfolio

By Harris Roen There is a new and growing interest in the world of alternative energy investing, the search for high-quality dividend yield among green investments. To this end, the Roen Financial Report has created a Green Dividend Yield Portfolio, a select group of high-yield alternative energy stocks. Together, this selection of companies can produce a steady stream of income for the alternative energy investor. A New Source for Dividend Yield The Green Dividend Yield Portfolio is a collection of high-yield stocks that are in the alternative energy business. Companies that fall...

Solar Rooftop Lease Securitization A Ground-Breaking Success

Sean Kidney Last week we blogged that SolarCity (SCTY) and Credit Suisse were about to issue a new $54.4 million, climate bond – a rooftop solar lease securitization. It’s out: BBB+, 4.8%, 13 years. The long tenor is interesting – and great. And S&P’s BBB+ rating suggest those credit analysts may be beginning to understand solar. This bond has been long-awaited by the green finance sector, who are hoping it’s the harbinger of things to come. I did get the chance to look at the S&P opinion. Their rating reflected, as they put it, their views on over-collateralization (62%...

Green Bond Update: Wind Company Bonds

by Corporate Bonder Market Overview Data compiled by the Bank for International Settlements indicate that the total size of the global debt securities market (domestic and international) was $98.7 trillion as at September 2011, of which $89.9 trillion were notes and bonds. Governments accounted for $44.6 trillion of outstanding debt securities, financial organizations $41.9 trillion, corporations $11.2 trillion and international organizations $1.0 trillion. The focus of this report is on corporate borrowers. US corporations are the largest debt issuers, accounting for 46% of corporate debt globally, followed by the Eurozone with 20%, Japan 9%, China 6%, and...

Fifteen Clean Energy Yield Cos: Where’s The Yield?

Tom Konrad CFA In the first article of this survey of yield cos, I noted that many of the recent yield co IPOs have risen so far as to "lend the very term "yield co" a hint of irony" because rising stock prices are accompanied by falling annual dividend yields. Yield Co Worries Because yield cos invest in clean energy infrastructure such as wind farms and solar facilities, conservative income investors may worry about the durability of the technology. Will solar panels still be producing power twenty...

Second Largest Quarter For Green Bonds Ever

Third quarter reflects strong growth and new market entrants

Overview

The green bond market has kept its strong pace in Quarter 3 2017, reaching a total of USD27.7bn from July to September.

On September 28th, the total amount of green bonds issued in 2017 ytd (USD83.2bn) overtook last year’s total issuance of USD81.6bn.

We covered the big moment in our Blog Post here.

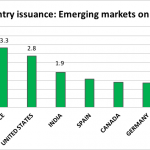

Lots of new issuers

The top sources of issuance were:

Mexico - USD4bn

China - USD3.9bn

France - USD3.3bn

U.S. - USD2.8bn

India - USD1.9bn

Mexico was a surprising addition to the number one spot, after issuing no green bonds in Q1 or Q2 this year.

Big...

Climate Bonds 2016 Highlights

by the Climate Bonds Team

A record year with green bond issuance of USD 81bn, up 92% on 2015 figures

The Trends

A maturing of the green bonds market, diversification across issuers, products and use of proceeds are the main trends identified in our Green Bonds Highlights 2016 summary.

The Big Numbers

92% – growth on 2015 making 2016 the most prolific year to date

USD 11.8bn – November issuance, the largest month on record

24 – number of countries with green bond issuers

27% – proportion of Chinese issuers

241 – number of labelled green bonds issued (median size USD133.7m)

>90 – number of new issuers

>50 – number...