BioNitrogen: Valuable Technology, Management Questions

by Debra Fiakas CFA My last post outlined how Bion Environmental Technologies, Inc. (BNET: OTC/QB) is transforming livestock waste into organic fertilizer. Bion is not the only aspiring fertilizer producer. BioNitrogen Holdings Corp. (BION: OTC/PK) was recently patent protection for a process to produce urea from stranded natural gas. Instead of burning off the unwanted gases, oil and gas operators can turn it into an economically viable by-product. There is more than just cash flow at stake for oil and gas producers. Burning off stranded gas increases harmful emission that can lead to penalties in the...

Plasma Arcs For Pig Waste

This week MagneGas (MNGA: NASDAQ) announced new work completed toward plans to enter the commercial pork sector with a proprietary manure processing and disposal solution. Management held a meeting with the North Carolina Department of Environmental Quality and the U.S. Army Corps of Engineers to discuss MagneGas technology to treat agriculture waste and the state’s required environmental permit protocols. MagneGas aims to sell to pig farmers equipment based on its innovations.

The company wants to help pig farmers address environmental problems cause by manure accumulation with its proprietary waste sterilization process. Handling pig waste using conventional methods can be costly, but failure to...

Boiler Maker in Need of a Shot

by Debra Fiakas, CFA

A reserve split is in the works to keep shares of Babcock & Wilcox Enterprises(B&W) listed under the symbol BW on the NYSE. The stock price of this storied environmental engineering had slipped below the Exchange’s minimum price requirements. Ten shares will be melded into one beginning July 23, 2019.

Reverse merger math alone will not solve B&W’s problems. One hundred and fifty two years in business, B&W has been providing environmental technologies and services for energy and industrial customers since the company’s first boiler was sold right after the American Civil War. The company boasts that Thomas Edison was one of...

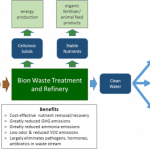

Bion: Waste To Dollars

Earlier this week Bion Environmental Technologies (BNET) received approval of a patent for its proprietary ammonia recovery process. Bion’s technology converts livestock wastes into ammonium bicarbonate. Patent protection in the U.S. paves the way for Bion to deliver an environmentally friendly chemical to the market at attractive profit margins.

Ammonium bicarbonate is used for a variety of purposes from leavening to crop additives. It is the fertilizer market that has caught Bion’s attention. The company intends to ‘close the loop’ for the agricultural sector by helping livestock producers economically dispose of waste and then delivering a fertilizer for food crops that qualifies as organic.

It is an attractive...

A Coal Stock…Almost

This morning, I read an article in this week's Economist that summarized well what I've been hearing over the past few weeks: coal is back in fashion with power utilities. As pointed out in the article, on a BTU basis, coal remains the cheapest fuel for thermal generation, an the prospect of high carbon prices is not deterring even European power generators from investing in coal-fired assets. A few months ago, Tom discussed his peak coal portfolio. The long-term perspective is of course critical to keep in mind, and that piece helps putting recent news around...

Praxair’s Long Road to Capturing Carbon

by Debra Fiakas CFA In 2007, industrial gas supplier Praxair (PX: NYSE) teamed up with power plant equipment dealer Foster Wheeler (FSLT: Nadaq) to work on demonstration projects for cleaning up coal-fired electric generating plants. At first the duo planned to pursue clean coal technologies and oxygenated coal combustion systems. The joint press release at the time indicated Praxair’s “oxy-coal’ technology would be applied to Foster Wheeler’s ‘circulating fluidized-bed steam generators.’ The oxycombustion process is one of several proposed methods to capture carbon dioxide from coal-fired power plants. In a retrofit situation, pure oxygen would replace air...

Capturing CO2 for Environmental Remediation

by Debra Fiakas CFA In 2009, the Department of Energy (DOE) awarded $17.4 million in funding to a gaggle of companies pursuing practical uses for carbon dioxide. The recipients were asked to kick in a total of $7.7 million. A year later in 2010, the DOE picked six projects to a second round of support totaling $82.6 million. Industrial giant Alcoa, Inc. (AA: NYSE) leads one of the winning groups, including partners U.S. Nels, CO2 Solutions (CST: V or COSLF: OTC/BB) and Strategic Solutions. The DOE gave the Alcoa team $13.5 million to complete a pilot...

Plastics from Carbon Dioxide

by Debra Fiakas CFA In the last post, I promised to close out this series on carbon dioxide capture with a note on a third example of Department of Energy funding for innovations in turning carbon dioxide (CO2) into a valuable raw material. Besides changing the chemistry of inorganic compounds and feedstock for biofuel production, CO2 has some potential for plastics. In 2010, the DOE placed a bet of $18.4 million on Novomer, Inc., which is a self-described sustainable chemicals developer. The bet appears to be paying off as Novomer and its partners go into production...

List of Pollution Control Stocks

Pollution control stocks are publicly traded companies whose business involves technologies for removing or reducing the emissions of harmful pollutants, contaminants, and/or waste from human activity, or removing these pollutants from the environment or water.

This article was last updated on 6/25/2020.

Advanced Emissions Solutions, Inc. (ADES)

Advanced Disposal Services (ADSW)

Babcock & Wilcox Enterprises, Inc. (BW)

Bion Environmental Technologies (BNET)

Biorem Inc. (BRM.V, BIRMF)

Casella Waste Systems (CWST)

CECO Environmental Corp. (CECE)

CDTi Advanced Materials, Inc. (CDTI)

Clearsign Combustion Corp. (CLIR)

CO2 Solutions, Inc. (CST.V, COSLF)

Donaldson Company, Inc. (DCI)

Ecolab, Inc. (ECL)

EcoSphere Technologies, Inc. (ESPH)

Euro Tech Holdings (CLWT)

Fuel Tech (FTEK)

iPath Global Carbon ETN (GRN)

OriginClear (OCLN)

Pacific Green Technologies Inc. (PGTK)

Republic Services,...

OriginClear Gambles on Marketing Program

by Debra Fiakas, CFA

Last week waste water treatment developer OriginClear (OCLN: OTC/QB) announced pilot projects for rental of its commercial water systems for pool cleaning. The company has several patents to its credit, protecting its innovations. OriginClear has developed a proprietary catalytic process to clean up solids from waste water as well as an oxidation technology to eliminate microtoxins in water. Unfortunately, the company has struggled to extract value from its efforts. OriginClear has yet to report profits. Indeed in the most recently reported fiscal year ending December 2019, revenue of $3.588 million only barely covered cost of goods of $3.217 million, let alone operating expenses that...

A Concrete Proposal

The Economist recently had a story on how the cement industry is beginning to confront the fact that the industry produces 5% of the world's emissions of greenhouse gasses. Carbon dioxide is emitted not only by the fossil fuels used to create the heat used in the creation of cement, and by the chemical reaction in that process. Unfortunately for us, cement is a remarkably useful building material, not least as a structural material which can also serve as thermal mass in passive solar buildings. All the large cement firms: Lafarge, Holcim, and Cemex (NYSE:CX) have joined a voluntary...

Water Out Of Thin Air

It is an irony that surrounded by the flood waters of Hurricanes Harvey and Irma, a drink of fresh, clean water may be hard to come by. Of course, the all three levels of government make plans for stockpiling and deploying emergency bottled water well ahead of natural disasters. Yet in the hours and days following the worst of both the recent storms, the media was filled with stories of people who lacked water.

What if water could be made manufactured? If such a technology existed, what a boon it might be to thirsty storm victims.

Ambient Water Corporation (AWGI: OTC/PK) has...

Air Products Goes Operational with Carbon Capture

by Debra Fiakas CFA In October 2009, the U.S. Department of Energy selected a dozen projects aimed at bringing relief to a planet suffocating in a cloud of toxic carbon dioxide emissions. The DOE called the program it’s Large-Scale Industrial Carbon Capture Storage Projects and wrote checks for $575 million out of American Recovery and Reconstruction (ARRA) funds. A little more than a year later the DOE weeded out all but three projects for the second phase of the program. Besides Leucadia Energy (subsidiary of Leucadia National, LUK: NYSE) and Archer Daniels Midland...

What Shouldn’t Be in a Green Energy Portfolio

The London Accord took a look at what portfolio theory would suggest as the most effective ways to address Climate Change. Knowing which technologies don't make the cut is at least as useful as knowing which technologies do. Tom Konrad, Ph.D., CFA I recently looked at a paper from the London Accord which used portfolio theory to recommend the best mixes of technologies to deliver different levels of carbon abatement. The most useful technologies to achieve the needed levels of carbon abatement were Forestry, Hydropower, Biofuels, Wind, Efficiency, and Geothermal. I suggested stocks that investors might consider to invest in...

FuelTech: Pushing on a String of New Orders

by Debra Fiakas CFA Earlier this month Fuel Tech, Inc. (FTEK: Nasdaq) announced the receipt of order for air pollution control systems totaling $2.0 million. The customers are strung out across the U.S., Europe and China, but they all have dirty combustion systems and need to reduce toxic nitrogen oxide (NOx) and carbon dioxide (CO2) emissions or risk running afoul of government clean air standards. These shipments are just the most recent in a string of orders Fuel Tech has won in recent months. In late August 2015, the company received similar air pollution contracts from...

Three Water Recycling Stocks

by Debra Fiakas CFA The water series continues as we attempt to get arms around the very large market to package, deliver, purify, treat, and recycle water. As the need for water increases with population and economic activity, the use of waste waters has become an imperative. In this post we look at three companies helping to clean up, reclaim and otherwise recycle waste water. Ecosphere Technologies, Inc. (ESPH: PK) has introduced several water solutions that can be used in agriculture, mining, industry, or municipal applications. The company’s flagship Ozonix Technology is a chemical-free system to recycle...