2023: Looking Up Like the 2009 Disney Movie

There is no shortage of things to worry about as we start 2023. The Federal Reserve is (rightly, in our opinion) worried about inflation becoming entrenched, and so is likely to continue hiking interest rates for much of 2023. Putin looks unlikely to concede defeat in Ukraine, and his desperation may lead to escalation, potentially even of the nuclear variety. California seems to be washing away while remaining in a drought.

China has loosened the zero-Covid policies that helped the country continue functioning during the first stage of the pandemic, while much of the rest of the world shut down. ...

When Market Calls are Wrong

Tom Konrad, Ph.D., CFA. My recent market call now looks premature. What lessons can we learn? When we make market predictions, we will inevitably be wrong some of the time. I stuck my neck out at the start of June, saying "We're near the peak." I later gave some numbers to allow readers to objectively judge if that call was right or wrong. I said that we should consider it an accurate call if the S&P 500 fell 20% (to 756) before it rose 5% (to 992.) The S&P 500 has not yet come near 756, but it closed...

This Isn’t What Green Money Management Looks Like

Tom Konrad, Ph.D., CFA

I don’t spend much time reading investment company ESG reports, but a friend asked me to take a look at a copy of the TIAA’s 2021 Climate Report. I was deeply unimpressed. Here are a few things in the report that triggered my greenwashing radar:

TIAA wants to work with companies to improve their behavior. They call this company engagement. “e do not expect to account for the majority of our emissions reduction — we are primarily focused on company engagements” page 9.

Much of TIAA’s emphasis is on reducing emissions from their own operations,...

Buying Foreign Stocks: To ADR or Not To ADR

by Tom Konrad, Ph.D., CFA

Since my 10 Clean Energy Stocks for 2021 list contains 5 foreign stocks this year, a reader asked about the relative merits of buying a foreign stock compared to a US ADR. Here is a summary of the relative merits (for US investors) of buying a foreign stock directly compared to buying the American Depository Receipt (ADR).

First, let’s look at the tickers for the five foreign stocks in the list. There are four types of ticker in the list this year:

The stock on its home exchange in the local currency. These have the form...

Twelve Green Investment Themes From Putin’s War on Ukraine

By Tom Konrad, Ph.D., CFA

Horrific, Tragic, Unprovoked, Heartbreaking. There is no lack of adjectives to describe Putin’s war on Ukraine. And while there probably can’t be too much coverage of the tragedies and war crimes, many others can write those far better than I.

As an economic and stock market commentator, the adjective I will focus on is world-changing. There is no doubt that the first land war in Europe since World War II, piled on top of a global pandemic, is already reshaping the economy in dramatic ways.

Some of those changes, like Europe switching away from Russian gas and...

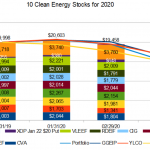

Ten Clean Energy Stocks for 2020: Trades

by Tom Konrad Ph.D., CFA

Four weeks ago, I predicted that the 12% market correction we had seen would turn into a true bear market. Bear markets are often defined as a decline of more than 20% for the major market indexes, but I find it more useful to focus on long term changes in investor sentiment.

What I did not predict was just how severe the effect of the coronovirus shutdown would be on the economy. I thought we would need the combined of the effect of the shutdown and investors re-assessing their risk tolerance to bring us into full...

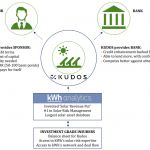

How Weather Risk Transfer Can Help Wind & Solar Development

by Daryl Roberts

The Need To Accelerate Renewables Adoption

Renewables are growing rapidly as a percentage of new electric generation, but are still being assimilated too slowly and still constitute too small of a fraction of total generation, to be able to transition quickly enough to scale into a low carbon economy in time to mitigate climate change.

The issue of providing public support, with subsidies and other reallocation methods, is a politically charged subject. High carbon advocates, for example American Petroleum Institute, argues that support for renewables distorts the market. On the other hand, it has been argued, for example by...

Step By Step Fossil Fuel Divesting With Mutual Funds

by Tom Konrad Ph.D., CFA

A large and growing number of individual investors are showing an interest in divesting from fossil fuels. Where in the past I have been asked to give a talk on divestment once every year or two, I’ve spoken on the subject three times so far in 2020. (Here is a recording of a presentation I did for my college alumni association.)

The response to these talks has been overwhelmingly positive, but I’m left with the impression that a lot of the less financially sophisticated attendees are still not sure where to start. For most of these...

Pop Goes the Clean Energy Stock Bubble

by Tom Konrad, Ph.D., CFA

2020 ended with a massive spike in clean energy stock prices. From the end of October, election euphoria drove Invesco WilderHill Clean Energy ETF (PBW) from $63.32 to $136 at the close on February 9th, a 114% gain in 100 days.

Joe Biden is as strong a supporter of clean energy as Donald Trump was a supporter of big fossil fuel companies, but even with control of the presidency and both chambers of congress, there is a limit to what a president can do in a short time. This is especially true when their top priority...

Green Energy Investing For Beginners, Part II: How Much To Invest

Tom Konrad, CFA In Green Energy Investing for Beginners, Part I, gave information to guide the choice of green investment vehicles (mutual funds, ETFs, or stocks.) This article is intended to help investors decide how much of their money to put into those vehicles. An informed decision of how much to invest in green energy is at least as important as how you make the investment. The choice between green Exhange Traded Funds (ETFs) and green Mutual funds rests on a difference of about one percent per year, caused by differences in fees. Yet in the first three quarters...

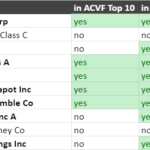

Are ESG Funds All That Different?

by Jan Schalkwijk, CFA

ESG investing is all the rage these days. That is, investing that includes the non-traditional environmental, social, and governance factors in the investment process. Its appeal to the broader investment industry is twofold:

1) The writing is on the wall: as wealth is passed down to younger generations who in the aggregate care more about values alignment, the asset management industry does not want to lose the assets and the fees they generate.

2) Thematic investing is popular and ESG is one of the hottest themes. Wall Street is not going to miss out. Much like crypto...

Green Energy Investing For Beginners, Part IV: Model Portfolio

Tom Konrad, CFA My target sector allocation for Green Energy Sectors: How much to put in Solar, Wind, Geothermal, Biomass, Biofuels, Energy Efficiency, Alternative Transport, and enabling technologies such as Smart Grid and Transmission. In Part I of this series on green energy investing (see also Part II and Part III), I suggested readers "structure your portfolio to reflect the technologies which are actually going to make a difference." This is not the same as investing in a market portfolio, because the market tends to overemphasize the most exciting or familiar (as opposed to the most useful) technologies. This...

Trading Options and Foreign Stocks: When Low Trading Volume Is Not Illiquid

Tom Konrad, Ph.D., CFA

As usual, I am putting together my Ten Clean Energy Stocks for 2020 model portfolio for publication on January 1st or 2nd next year. As I wrote in November, expensive valuations for the US clean energy income stocks I specialize in mean that the 2020 model portfolio will contain more than the usual number of foreign stocks, and I am also planning on including a little hedging with options.

Why option strategies are now affordable

I have never included options in the model portfolio before because the commission structure did not make it cost effective for small investors...

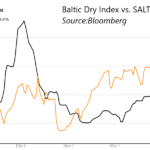

SALT: Buying the Balitc Dry Dips

by Tom Konrad, Ph.D. CFA

The Baltic Dry Index (BDI) is a shipping and trade index created by the London-based Baltic Exchange. It measures changes in the cost of transporting various raw materials, such as coal and steel.

Since the BDI is a measure of the income which firms that own dry bulk cargo ships can earn, changes in the BDI tend to drive changes in the stock prices of such companies.

Stock Price Correlation

Until recently, one such company was Scorpio Bulkers (SALT), one of my Ten Clean Energy Stocks for 2021 picks. The chart below shows the last 5 years, with...

Voting and GameStop

Only a couple weeks ago, I quoted the market aphorism, “In the short-run, the market is a voting machine, but in the long-run, it is a weighing machine.”

It comes to mind again now that Robinhood types are short squeezing hedge funds with GameStop (GME) and other nostalgia stocks.

It's another example that any strategy that relies on valuation affecting prices in the short run (like stonks betting that GME would go down because it lacks a viable business) is incredibly risky. It's also incredibly risky to bet that any trend driven by popularity will last. Eventually, there are going...

Correction, or Bear Market?

by Tom Konrad, Ph.D., CFA

On February 21st, I was helping an investment advisor I consult with pick stocks for a new client's portfolio. He lamented that there were not enough stocks at good valuations. This is one of the hardest parts of being an investment advisor: a client expects the advisor to build a portfolio of stocks which should do well, but sometimes, especially in late stage bull markets, most stocks are overvalued. I reminded him, "The Constitution does not guarantee anyone the right to good stock picks." He agreed, but he still had to tell his client that...