Eneti: The New Offshore Wind Installation Leader

By Tom Konrad, Ph.D., CFA

With its purchase of Seajacks, Eneti (NYSE:NETI) has become the world’s largest owner of offshore wind installation vessels. The two articles were shared with my followers on Patreon as the news came out.

Valuing the Eneti/Seajacks Combination (First published August 5th)

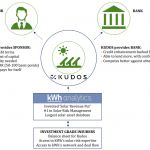

Eneti (NETI) just announced it is buying offshore wind turbine installation firm Seajacks. The purchase will be with a combination of shares, cash, and assumed debt: 8.13 million shares, $299 million of assumed net debt, $74 million of newly-issued redeemable notes, and $12 million of cash. Current Eneti shareholders will own 58% of the combined firm.

After...

Wind Turbine Art

My sister, who is a linocut artist, just finished some wind turbine prints for me. One is below, you can check out the others at facebook.com/SarahKonradArt

Wind and Heat Pumps: A Winning Combination

This article has been cross-posted on The Oil Drum. Last month, I brought you some nice maps showing when and where good wind resources are found in the US. Now I've found something better: a visual comparison of electrical load with wind farm production, published by the Western Area Power Administration in 2006. The study compared electricity production from five wind farms in Northern Colorado, Southwestern Nebraska, and Central Wyoming in 2004, 2005, and the start of 2006, compared with electricity consumption in the same area over the same time period. Comparison of Wind Production to...

List of Wind Farm Owner and Developer Stocks

Wind farm owner and developer stocks are publicly traded companies that site, permit, develop, construct, own, or operate wind farms for producing electricity.

This list was last updated on 3/22/2022

Acciona, S.A. (ANA.MC, ACXIF)

Adani Green Energy (ADANIGREEN.NSE)

Algonquin Power and Utilities (AQN, AQN.TO)

Atlantica Yield PLC (AY)

Atlantic Power Corporation (AT)

Avangrid, Inc. (AGR)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Energy Partners (BEP)

China Longyuan Power Group Corporation Limited (0916.HK, CLPXF)

China Ruifeng Renewable Energy Holdings Limited (0527.HK)

Orsted (ORSTED.CO, formerly DENERG.CO)

E.ON AG (EONGY)

Enel SpA (ENEL.MI, ESOCF)

Greencoat UK Wind (UKW.L)

Infigen Energy Limited (IFN.AX, IFGNF)

Innergex Renewable Energy Inc. (INE.TO, INGXF)

Neoen S.A (NEOEN.PA)

NextEra Energy Partners, LP (NEP)

NextEra Energy, Inc. (NEE)

Nordex AG (NRDXF, NDX1.DE)

Northland Power Inc....

List of Offshore Wind Stocks

Offshore wind stocks are publicly traded companies whose business is involved in the construction or ownership of offshore wind farms and turbines.

General Electric (GE)

Equinor ASA (EQNR)

NaiKun Wind Energy Group Inc. (NKW.V, NKWFF)

Northland Power Inc. (NPI.TO, NPIFF)

Orsted (ORSTED.CO, formerly DENERG.CO)

Siemens Gamesa Renewable Energy (GCTAF, SGRE.MC)

Sif Holding NV (SIFG.AS)

Vestas (VWS.CO, VWSYF, VWDRY)

If you know of any nuclear energy stock that is not listed here, but which should be, please let us know in the comments. Also for stocks in the list that you think should be removed.

List of Wind Power Manufacturing Stocks

Wind power manufacturing stocks are publicly traded companies whose business is involved in the development or manufacture of wind power equipment.

AB SKF (SKF-B.ST, SKFRY)

Broadwind Energy (BWEN)

China High Speed Transmission Equipment Group Co., Ltd. (0658.HK, CHSTF)

General Electric (GE)

Helix Wind, Corp. (HLXW)

Inox Wind Limited (INOXWIND.BO)

Nordex AG (NRDXF, NDX1.DE)

Sauer Energy, Inc. (SENY)

Siemens Gamesa Renewable Energy (GCTAF, SGRE.MC)

Sif Holding NV (SIFG.AS)

Suzlon Energy Limited (SUZLON.BO)

Toray Industries, Inc (TRYIF, 3402.T)

TPI Composites, Inc. (TPIC)

Trinity Industries (TRN)

Vestas (VWS.CO, VWSYF, VWDRY)

Xinjiang Goldwind Science & Technology Co., Ltd. (2208.HK)

If you know of any wind power manufacturing stock that is not listed here, but which should be, please let us...

How Weather Risk Transfer Can Help Wind & Solar Development

by Daryl Roberts

The Need To Accelerate Renewables Adoption

Renewables are growing rapidly as a percentage of new electric generation, but are still being assimilated too slowly and still constitute too small of a fraction of total generation, to be able to transition quickly enough to scale into a low carbon economy in time to mitigate climate change.

The issue of providing public support, with subsidies and other reallocation methods, is a politically charged subject. High carbon advocates, for example American Petroleum Institute, argues that support for renewables distorts the market. On the other hand, it has been argued, for example by...

Eneti and the Jones Act

By Tom Konrad, Ph.D., CFA

About a month ago, an astute reader asked me if Eneti's (NETI) contracted Wind Turbine Installation Vessel (WTIV) would be able to operate in US waters since it will not be compliant with the Jones Act. For those not familiar, the Jones Act requires that all transport of goods between US ports must be done by vessels built in the US, and owned and operated by US citizens.

I looked into it, and concluded that it probably could, since installing wind turbines is not transport, but rather lifting (jack-up, in the parlance), an exemption which is...

Ten Alternative Energy Speculations for 2008: Geothermal, Wind and Wave, and Thin Film Hype

This article is a continuation of my Ten Alternative Energy Speculations for 2008, with picks #8, 9, and10 published last Thursday. If you haven't already, please read the introduction to that article before buying any of the stock picks that follow. These companies are likely to be highly volatile, and large positions are not appropriate for many investors. My least risky picks are part of that same article linked to above; the moderately risky picks are here. This article contains the most speculative three picks. #3 Nevada Geothermal Power (OTCBB:NGLPF or Toronto:NGP.V) US$1.29 or CAD$1.26 Geothermal first started catching...

Eneti and Brookfield Renewable Earnings

By Tom Konrad, Ph.D. CFA

Here are a couple earnings notes I shared last week with my Patreon followers.

Eneti, Inc. (NETI) - formerly Scorpio Bulkers (SALT)

Eneti completed its name and ticker change on February 8th. New ticker is NETI (formerly Scorpio Bulkers (SALT), which I recently wrote about here.

Highlights from February 2nd earnings report:

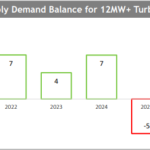

37 of the 47 vessels owned at the 3rd quarter have been sold or have completed sale agreements.

Net asset value is $23.94/share. Since most assets are cash or vessels held for sale, this number is basically accurate.

The stock is still a good buy...

SALT: Buying the Balitc Dry Dips

by Tom Konrad, Ph.D. CFA

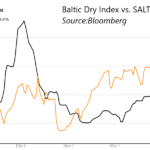

The Baltic Dry Index (BDI) is a shipping and trade index created by the London-based Baltic Exchange. It measures changes in the cost of transporting various raw materials, such as coal and steel.

Since the BDI is a measure of the income which firms that own dry bulk cargo ships can earn, changes in the BDI tend to drive changes in the stock prices of such companies.

Stock Price Correlation

Until recently, one such company was Scorpio Bulkers (SALT), one of my Ten Clean Energy Stocks for 2021 picks. The chart below shows the last 5 years, with...

Buying Innergex – Texas Was Bad, But Not That Bad

By Tom Konrad, Ph.D., CFA

Last week, I published this call to buy Innergex (INGXF, INE.TO) because investors had been overreacting to the losses from the February cold snap in Texas. The stock is up since then, but still seems a decent value.

Canadian Yieldco Innergex Renewable Energy (INGXF, INE.TO) took a big financial hit from the power disruptions in Texas in March.

It's complex, but their financial hedges on power prices for three of its wind farms ended up creating enormous liabilities - more, in fact, than two of their wind farms are worth. Two of their facilities also had benefits...

Investing in in Prairie Winds

Last week NextEra Energy, Inc. (NEE: NYSE) broke ground on its newest wind power project. The company plans to build 71 wind towers in Wayne County, northeastern Nebraska, outfitting each with General Electric (GE: NYSE)turbines. Called the Sholes Wind Energy Center, the wind farm will have a collective generating capacity near 160 megawatts and require $200 million in to build. Construction is expected to begin in March 2019, to meet a December 2019 planned operational start.

The Omaha Public Power District (OPPD) has already signed a twenty-year power purchase agreement with NextEra, making return on the Sholes project close to guaranteed. OPPD is the twelfth largest public power utility in the...

Warm Wind For Vestas

by Debra Fiakas, CFA

A stream of impressive news has been delivered by wind turbine producer Vesta Wind Systems AS (Copenhagen: VWS.CO, US OTC: VWSYF, US ADR: VWDRY) over the last few weeks. Over the last two months the company has received orders for wind power turbines totaling 3,781 megawatts. Customers in the U.S. appear to be quite shy, withholding their names and the final destination of the power projects. Nonetheless, the more transparent European, Chinese and Brazilian customers provide a good view on how well regarded Vestas has become.

Business has been so good Vestas is opening a new nacelle and hub assembly factory in...

Offshore Wind Blows Into The US: Seven Stocks To Catch The Breeze

Tom Konrad CFA The Growth of Offshore Wind Offshore wind has finally gotten a toe hold in the United States. The United States' first offshore wind farm, the 30 megawatt (MW) Block Island Wind Farm, is under construction. A new project, the South Fork Wind Farm will be three times the size of Block Island (90 MW), is set to be approved by the Long Island Power Authority. This project will be located 30 miles East of Montauk, NY and Southeast of Block Island in a wind energy area designated by the federal Bureau of Ocean Energy...

What A Portfolio Approach To Climate Policy Means for Your Stock Portfolio

Portfolio theory can lend insights into which carbon abatement strategies policymakers should pursue. If policymakers listen, what will it mean for green investors? Tom Konrad, Ph.D., CFA Good Info, Not Enough Analysis I've now read most of my review copy of Investment Opportunities for a Low Carbon World. The quality of the information is generally excellent, as Charles has described in his reviews of the Wind and Solar and Efficiency and Geothermal chapters. As a resource on the state of Cleantech industries, it's generally excellent. As an investing resource, however, it leaves something to be desired. Each chapter is written...