25 years on from Chernobyl: Nuclear’s unclear future, and the on-going renaissance for alternative energy stocks

Karl L. Mitchell, Ph.D.

Summary

On April 26th, 1986, the world’s worst nuclear accident occurred at the Chernobyl nuclear power station in northern Ukraine. The blast spewed a cloud of radioactive fallout over much of Europe, causing many hundreds of thousands to flee from their homes in Ukraine, Belarus and western Russia. 25 years later we are facing the only other level 7 event on the International Nuclear Event Scale; at Fukushima, Japan. Although less immediately catastrophic, it has resulted in the evacuation of hundreds of thousands of people, and the human and economic impact in such a densely populated country will be profound. More broadly, the impact on government energy policies amidst a climate of rising energy costs and concerns about the impact of fossil fuels on the environment is likely to be significant, with major shifts in public opinion resulting in reductions to many nuclear programmes. Setting aside the environmental and safety concerns, it seems that the scene is set for a radical shift towards alternative energies based on an integrated distribution of energy sources and grid upgrades. The technology required already exists and is implemented, and alternative energy industries have been investing massively in order to sustain already high rates of growth. The challenge is to maintain this expansion, which is good news for alternative energy investors.

Chernobyl and its effects

The consequences of the Chernobyl nuclear disaster were massive. Dealing with this incident has cost an estimated 18 billion rubles, and contributed to the crippling of the Soviet economy in the late 1980s and collapse of the government. Death estimates range wildly, from 4000 (the World Heath Organisation, WHO [1]) to 200,000 (Greenpeace [2]) and even 985,000 (a Russian publication [3]). These differences may be explained in part to different methods; Reports with higher figures looked more at unexplained anomalies in deaths and diseases, whereas the WHO figures were focusing more on deaths where the causal relationship – either directly during the disaster, or later as a result of cancers – could be defined. Bias may also play a role. Greenpeace certainly have an agenda. However, despite being a well-regarded UN-affiliated organization, the WHO, who throughout most of the 1950s were clearly against nuclear power, have an agreement with the International Atomic Energy Agency dating from 1959 that grants the IAEA the right of prior approval over any research it might undertake or report on to the IAEA; In short, giving veto to an agency whose goals include to “seek to accelerate and enlarge the contribution of atomic energy to peace, health and prosperity through the world”. In any case, whether the figures are four thousand, one million, or somewhere in between, the human and economic consequences of this nuclear incident were massive, and it seems appropriate to remember those lost on the 25th anniversary and consider the relevance of those events today.

The Chernobyl event is one of only two considered to be a level 7 event on the International Nuclear Event Scale. The other is the on-going Fukushima incident which, although it is less serious in many ways as it does not appear to have caused any deaths directly, will have comparable and profound long-term effects. As with Chernobyl, it has resulted in the evacuation of hundreds of thousands of people, and the economic consequences on as small and densely populated a nation as Japan will be great. But is incident an anomaly? Perhaps it’s the last great nuclear incident? Certainly the context, a magnitude 9 earthquake, is very rare. For many years now, nuclear proponents have been saying that nuclear power is “safe”, and more that it is an economic necessity in the face of rising fuel prices and shrinking fossil fuel reserves. These same people argue that it couldn’t happen in America, despite Three Mile Island’s partial meltdown and numerous smaller incidents since [4].

Since 2007, the number of active nuclear reactors in the world has actually shrunk. In 2010 the world had ~440 reactors, accounting for ~14% of the world’s electricity demand (~2628 TWh); of these, 104 are in the United States, providing 19.6% of the supply (807 TWh) [5]. This compares with about 30% in the European Union. A look to the future suggests that, in order to accommodate the expansion of demand for electricity and replace fossil fuel power stations, the world would need to a few thousand new power stations, several hundred of which would be in the United States; and so even if nuclear power stations were an order of magnitude safer, level 7 nuclear events are still going to happen. So, how safe would they need to be, from natural disaster, from terrorism and from human fallibility? Can we really protect against every possibility, no matter how refined the power plant design? Do you really want one in your backyard? For the vast majority of people, the answer to the last of these questions is “no”, and this has only been exacerbated by Fukushima.

What are our options?

But, for a moment, let’s set aside the very real safety concerns and consider the main argument espoused by nuclear protagonists, that it is simply an economic and environmental necessity; CO2 production rates need to be reduced for the good of our environment, peak oil is near if not already passed, coal and natural gas reserves are going to shrink in the future, and alternative energies are simply not financially viable. But is all of this true? Certainly fossil fuel supplies will eventually dwindle and, despite a small number of detractors, anthropogenic climate change appears to be a very real phenomenon supported by almost all scientists that are not funded by the oil industry. But when it comes to viability in the free market we have to look at simple economics.

A recent report of the U.S. Energy Information Administration sought to estimate the unsubsidized costs of energy production for 2016 in the United States from different sources, including capital costs, operation, maintenance and transmission, based on current prices and trends [6]. It found that, of those methods available, “Advanced Nuclear” would likely cost around $113.9/MWh. This is more than most many of the alternatives, including coal. Note that these are production costs, and do not take into account health and environmental costs, which may be significantly greater for some sources [7]. Of alternative energy sources, geothermal, which is viable around the Pacific Rim, comes in at $101.7/MWh, hydroelectric at $86.4/MWh, wind at $97.0/MWh, and biomass at $112.5; all of these are cost-competitive with nuclear today. Solar energy, which is the most abundant source on Earth, came in at $210.7/MWh (photovoltaic) and $311.8/MWh (thermal). However, these figures are coming down more rapidly than any other form of energy production.&nb

sp; The cheapest available energy source is Advanced Combined Cycle Natural Gas at $63.1/MWh, at a whopping 45% cheaper than nuclear.

Of course, all of these figures have their uncertainties. Nuclear power costs are almost impossible to predict due to uncertainties in requirements for long-term storage of waste and the costs of incidents. The estimate for entombing the Fukushima power plant alone is $12bn, which is comparable to the entire Price-Anderson fund [10], the effective indemnity cap for major nuclear incidents in the United States. If the U.S. were to experience a single level 7 incident directly, the costs would not be met, and hence current nuclear policy artificially lowers the costs of nuclear. Fossil fuel industries have high environmental and health costs [7], which are difficult to account for. This is not to state that alternative energies are problem free, and there are cost-increasing factors. Wind is a highly variable form of energy production [8,9], requiring both a wide distribution of turbines [9] and development of pumped storage plants (a technique that is already in use worldwide) to smooth out supply. Solar is also variable, especially from night to day, and is not well suited to higher latitude, cooler regions. Geothermal only works near volcanic zones and can cause local subsidence and minor earth tremors. Taken on their own, none of the clean alternatives are an ideal solution to world energy problems, but our energy needs could easily be accommodated using a combination of solar (both power plants and rooftop installations), wind farms (widely distributed) and geothermal (near volcanic zones), together with smart grid solutions and large scale pumped storage facilities to smooth out supply. All of these technologies exist already, and just need to be implemented on a broader scale.

Furthermore, in the context of Fukushima, the highly regulated nuclear industry is almost certainly going to be under greater scrutiny, increasing safety demands and insurance costs, and a “Not In My Back Yard” mentality. This will inevitably result in a rise in costs at a time when alternative energy production costs, some of which are already cheaper, are generally decreasing.

It is true that nuclear power stations are fast to implement and bring online. However, alternative energy installations do not have to be massive power plants with a huge up-front capital costs; In fact, many can be established by individuals and local communities. In southern states such as California, an increasing trend is to lease solar panels for your roof at rates that undercut local grid prices; In fact, in many places its even possible to generate an excess, selling it back to the grid for a profit. In Texas, a local cotton farmer, Cliff Etheredge, led his community to establish the Roscoe Wind Farm, currently the largest wind farm in the United States. By spanning the 627 wind turbines across the edges of farmers’ fields over four counties and 100,000 acres, 400 land owners share in royalties of 781 MW of electricity production, equivalent of a modest sized nuclear power station, bringing in a needed boost to the local economy. If this project were to be extended across farmlands throughout the United States (over 2 billion acres), a simply extrapolation shows that it could provide more than the nation’s electricity needs (over 17 TW rated capacity).

Some large-scale investment will be necessary, however. The national grid system of the United States needs a major overhaul, to reduce the considerable transmission losses and to balance the loads from more supply-variable solar and wind energy generation. The Tres Amigas project [11], to link the three primary interconnections, shows great potential here, and seems to be a no-brainer. Also, the 21.5 GW of pumped storage capacity also needs to be increased by at least an order of magnitude, in order to smooth out the remaining supply. Such broad scale projects may need to involve the government, as national infrastructure costs are difficult to implement in the fragmented energy industry.

While alternative energy costs continue to decrease compared with fossil fuels, existing power stations will remain in service, and potentially more natural gas power stations will be built; They are cheap running, produce far less CO2 than coal or oil and, if shale reserves can be tapped safely, which is unclear at present, may end up providing the backbone of energy production for the next few decades.

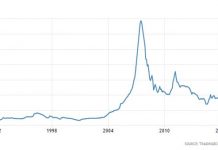

At the moment, many wind and solar stocks in particular are undervalued relative to P/E ratios and anticipated growth, largely due to market volatility and uncertainties in the near future; Recent decisions regarding subsidies in Italy and Germany hit solar stocks particularly hard. Chinese solar [e.g. LDK, JKS, JASO, SOL, TSL, DQ, HSOL, CSUN] and wind [MY] stocks typically have P/E below 10, and PEGs below 0.5, and many U.S. stocks in the same areas remain competitive [e.g. SPWRA, SOLR, PWER, SATC, AMSC]. Even the powerhouse of the solar world, First Solar [FSLR], has a quarterly earnings growth in excess of 10% and a PEG of 0.63. Compared with almost any other industry these are impressive figures. Geothermal Energy stocks [ORA, CPN, HTM, NGLPF.OB] also show great potential [12], despite the relatively long implementation timescales.

Critics of alternative energy solutions point out that these industries rely on government subsidies and tax breaks in order to fuel their growth, but the same argument applies to nuclear power in the United States [13], and also to oil [14]. Given the falling costs [15] and rate of growth [16] of alternative energies, in the face of rising energy prices, such subsidies should become less relevant over the next few years, and in many cases are simply not required to match grid parity. Their purpose for the time being is to act as a stimulus for faster growth in the light of growing demands for clean and independent energy, rather than a means of facilitation. So, as far as alternative energy stocks are concerned, I’m in it for the long haul. It will undoubtedly be a bumpy ride, as changing government policies, such as we’ve seen coming from Italy and Germany, will result in volatility, but their growth in the mid-to-long term seems assured, and the current low valuations seem to provide a very attractive entry point.

Disclaimers:

All opinions contained within this article are the author’s own, and in no way reflect the policy or opinions of his employers. This article was written and researched in the author’s own time.

Disclosure:

Long: LDK, SOL, PWER, COMV, CPST, ENOC, HTM, BWEN, AMSC.

Short: with anyone who argues in favour of building a nuclear power plant on an Earthquake zone.

[1] Cardis, E. et al. ,“Cancer consequences of the Chernobyl accident:

20 years on”, J. Radiol. Prot. 26 127

doi:10.1088/0952-4746/26/2/001. For a summary of findings, see http://www.who.int/mediacentre/factsheets/fs303/en/index.html.

[2] “The Chernobyl Catastrophe: Consequences on Human Health”,

Greenpeace, 2005. http://www.greenpeace.org/international/Global/international/planet-2/report/2006/4/chernobylhealthreport.pdf

[3] Yablokov, V. et al., “Chernobyl: Consequences of the Catastrophe

for People and the Environment”. Annals of the New York Academy

of Sciences. 2009. (a translation of a 2007 Russian publication).

[4] “Nuclear reactor accidents in the United States”. Source:

http://en.wikipedia.org/wiki/Nuclear_accidents_in_the_United_States.

[5] “Resources & Stats: U.S. Nuclear Energy Plants”, Nuclear Energy

Institute, 2011. Source: http://www.nei.org/resourcesandstats/nuclear_statistics/usnuclearpowerplants/.

[6] “Annual Energy Outlook”, U.S. Energy Information Administration,

2011. Source: http://www.eia.doe.gov/oiaf/aeo/pdf/2016levelized_costs_aeo2011.pdf

[7] Epstein, P. R. et al., “Full costs accounting for the lifecycle of

coal”,

http://onlinelibrary.wiley.com/doi/10.1111/j.1749-6632.2010.05890.x/pdf,

Ann. N. Y. Acad. Sci. 1219, 73-98, 2011.

[8] Peterson, J., “Gone With The Wind – Debunking Geographic Diversity”,

http://www.altenergystocks.com/archives/2011/04/gone_with_the_wind_debunking_geographic_diversity_1.html,

April 21st, 2011.

[9] Konrad, T., “Petersen’s Wind Power Paradigm Paralysis”, http://www.altenergystocks.com/archives/2011/04/petersens_wind_power_paradigm_paralysis_1.html,

April 24th, 2011.

[10] “Price-Anderson Nuclear Industries Indemnity Act”, Wikipedia

article. Source: http://en.wikipedia.org/wiki/Price–Anderson_Nuclear_Industries_Indemnity_Act

[11] Murray, J. “U.S. unveils plans for giant renewable energy hub”.

Source:

http://www.businessgreen.com/bg/news/1804299/us-unveils-plans-giant-renewable-energy-hub,

19th October, 2009. Also see http://tresamigasllc.com/

and Giberson, M., “Tres Amigas Proposes Three-way Transmission Link”, http://www.altenergystocks.com/archives/2009/11/tres_amigas_proposes_threeway_transmission_link.html,

November 11, 2009.

[12] Konrad, T., “Geothermal stocks overview”. Source: http://www.altenergystocks.com/archives/2010/10/geothermal_stocks.html

[13] Koplow, D. et al., “Review of selected nuclear tax subsidies in

the American Power Act”, Memorandum, http://www.earthtrack.net/files/uploaded_files/Nuclear%20Tax%20Subsidies%20in%20APA_June%202010.pdf,

17th June, 2010.

[14] Kocieniewski, D., “As Oil Industry Fights a Tax, It Reaps

Subsidies”, New York Times, http://www.nytimes.com/2010/07/04/business/04bptax.html,

July 3rd, 2010.

[15] Groom, N., “Solar module price could drop 20 percent in 2011”, http://www.reuters.com/article/2011/04/20/us-sharp-idUSTRE73J6C720110420,

April 20th, 2011.

[16] “Who’s Winning the Clean Energy Race? Growth, Competition and

Opportunity in the World’s Largest Economies”, The Pew Charitable

Trusts, http://www.pewtrusts.org/uploadedFiles/wwwpewtrustsorg/Reports/Global_warming/G-20%20Report.pdf,

2010.