John Petersen

One of the most seductive and dangerous stock market myths is the immensely popular but demonstrably false notion that the rapid cost reductions and performance gains we enjoyed during the information and communications technology revolution will be repeated in the age of cleantech. The persistence of the mythology is astonishing when you consider that the entire history of alternative energy proves that cost reductions and performance gains are extraordinary events, rather than common occurrences. Investors who buy into economies of scale mythology without carefully considering the fundamental differences are in for a world of disillusionment and pain as they watch their portfolio values erode.

Everybody above the age of twelve has heard about economies of scale – they’re the reason products tend to get better and cheaper over time. Most of us, however, don’t take the time to consider the forces that give rise to economies of scale. As a result, we blithely assume that experience in one sector will carry over to another. Unfortunately, it’s not that simple.

Wikipedia identifies the following basic economies of scale:

- Purchasing economies – bulk buying of materials through long-term contracts;

- Managerial economies – increasing the specialization of managers;

- Financial economies – obtaining lower-interest rates and having access to a wider range of financial instruments;

- Marketing economies – spreading the cost of advertising over a greater range of output in media markets;

- Manufacturing economies – taking advantage of larger scale in the manufacturing function; and

- Experience economies – learning by doing.

Each of these factors reduces long run average costs (LRAC) and shifts the cost of production down and to the right.

The ugly truth most investors fail to recognize is that economies of scale occur in specific companies and diminish as a company or product matures. While specific companies can benefit from economies of scale that drive their production costs down, industries frequently suffer from diseconomies of growth and competition that drive production costs up while product prices are falling – a combination that invariably compresses profit margins. The principal diseconomies include:

- Constraints on raw material and component availability;

- Cannibalization of market opportunities by competing firms;

- Duplication of efforts on “secret sauce” differentiation within product classes;

- Ownership of critical technological advances by emerging market participants;

- Economic gravity, which favors cheaper products over more costly alternatives; and

- Human inertia, which favors established products and practices.

When I was young, the best performing battery technology was lead-acid, which had specific energy in the 30-50 watt-hours per kilogram range. The next step was nickel cadmium (NiCd) batteries with specific energy in the 45-80 wh/kg range. Then came nickel metal hydride (NiMH) batteries with specific energy in the 60-120 wh/kg range. Today’s pinnacle of performance is lithium-ion batteries with specific energy in the 90-190 wh/kg range.

My inner optimist considers a four-fold improvement in battery technology and calls it progress. My inner pragmatist compares a four-fold improvement in battery technology to a billion-fold improvement in information technology and knows that something is very different. Our need for better batteries was no less urgent than our need for better electronics. In fact, many of the companies that drove gains in electronics were also active in the battery industry. Where progress in IT was immense, the battery industry was basically stagnant. Even the cast of Sesame Street can look at these facts and say with confidence “One of these things is not like the other.”

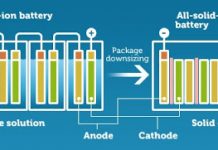

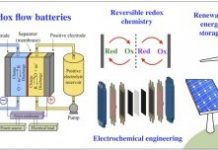

The reasons for the disparity are really quite simple. Where electronics are governed by the laws of physics, energy storage is governed by the laws of chemistry. When you make an electronic device smaller you reduce its material content and improve its performance at the same time. When you make an energy storage device smaller, you get fewer chemical reactions and less storage potential. More importantly, battery manufacturing is a mature industry and we use the same basic processes, equipment and product architecture today that we used 35 years ago. Albert Einstein taught that “doing the same thing over and over again and expecting different results” was insanity. There’s a lesson there for investors.

While it would be an oversimplification to suggest that the only major differences between battery types are changes in the chemistry manufacturers put into their can or pouch, it wouldn’t be gross oversimplification. In many cases energy and power are declining as manufacturers try to optimize safety and cycle life. The major performance gains the world so desperately needs are not going to arise from minor modifications to chemistry in a can. If they arise, they’ll come from entirely new approaches based on fundamentally different chemistries, manufacturing processes and product architectures.

In the lithium-ion space there is precious little substantive differentiation between the various chemistries and form factors. There are differences, but they’re usually fine tuning to optimize energy, power, safety or cycle life. In general, the chemistries with the highest energy and power have the lowest safety and cycle life. Conversely, manufacturers who are willing to dial energy and power down a notch have been able to realize impressive safety and cycle life gains. When it comes to manufacturing costs, however, nobody has a significant advantage over the old line lithium-ion battery producers like Sony, Panasonic-Sanyo and LG Chem who’ve been in business for decades and have already optimized their economies of scale. Any way you look at it, new market entrants like A123 Systems (AONE), Ener1 (HEV), Valence Technologies (VLNC) and Altair Nanotechnologies (ALTI) will be playing catch-up ball for years.

The lead-acid space is a lot like the lithium-ion space when it comes to product differentiation. Leading lead-acid battery manufacturers like Johnson Controls (JCI), Enersys (ENS) and Exide Technologies (XIDE) produce high quality products that are basically fungible commodities. While there are modest differences, there’s nothing that’s truly unique about any of their products.

To the best of my knowledge, Axion Power International (AXPW.OB) is the only publicly held battery technology developer that’s doing something completely different. Where its competitors are fooling around with additives that offer modest improvements in cycle-life and charge acceptance, Axion is replacing traditional lead-based negative electrodes with patented carbon electrode assemblies that boost cycle-life and dynamic charge acceptance by 1000% or more. The chemistry stays the same, but the electrode fabrication methods are completely different and so is the final device – a hybrid that’s half battery and half supercapacitor and can be assembled on any conventional AGM battery production line

.

Axion’s carbon electrode assemblies have never been manufactured on a commercial scale. Its first generation electrode fabrication line produced enough electrode assemblies to support its testing, demonstration and validation projects with automakers, railroads and other potential customers, but the production capacity and quality control were not high enough to meet customer needs. Last month, Axion completed the installation of a second-generation automated electrode fabrication line that promises to significantly improve both. Axion is currently engaged in manufacturing process, quality control and product performance validation with its potential customers. Until that work is completed, a design win or production contract would be premature. Once Axion introduces its first commercial product, it will be at the top left-hand corner of the total cost curve. As near as I can tell, Axion is the only battery manufacturer in the world that has a reasonable opportunity to realize true and significant economies of scale in its future operations.

Disclosure: Author is a former director of Axion Power Internatinal (AXPW.OB) and owns a significant long position in its common stock.

John,

If the DOE does not grant Axion the money it as requested, do you see any alternative funding arrangements that could keep them in Pennsylvania? Or would we be looking at a 6 to 9 month move?

I don’t think a lock, stock and barrel move is likely under any circumstances. The two plants in New Castle are core facilities that were bought at very good prices and are critical to ongoing technology development work. That’s not likely to change.

The real question is if funding is not available for a large electrode fabrication plant in PA, would Axion consider building it in Europe or Asia instead? There I think the answer might well be yes.

Great point. On another point, I’m betting most investors have seen their stomachs turn with the recent downward trend in the stock price. Hopefully the MoU with Norfolk (if still happening in April) will give cheer to investors.

Happy Friday,

Justin

Do you think the request for authorization to issue 75 million more shares of common stock have helped send the price down? I got this info in the proxy statement.

The price slide started in early April and the proxy statement wasn’t filed till the 21st, so I think the two are unrelated. As near as I can tell the price decline is nothing more than a normal retracement after a long and sustained run that doubled the stock price. If you’d like to see a fairly typical chart of a company coming out of the valley of death, the 2 year 6 month chart for ACPW is very instructive. The typical pattern is run up, retrace, run up, retrace.