by Clean Energy Intel

Following the announcement that CIGS solar start-up Solyndra had declared Chapter 11, I published an article suggesting that although this was clearly not good news, the overall solar sector in the US was still in relatively good competitive shape, with a healthy trade surplus with the rest of the world of some $1.9bn. You can read my original article here.

Although competition from China is intense, particularly in low-cost module production, the US remains a strong player across the supply chain as a whole – particularly in polysilicon production and the manufacture of the capital equipment required to make solar products. And China is the key customer in both of these areas.

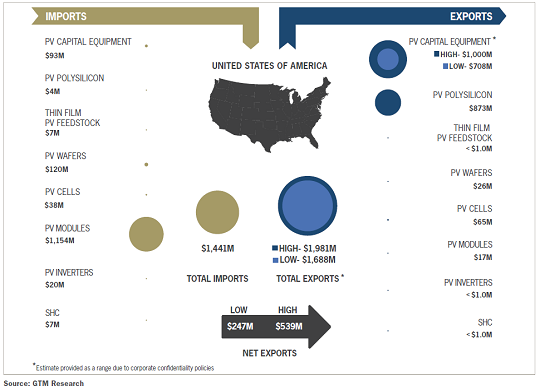

As an update on this, GTM Research has provided a very interesting chart breaking down the components of the bilateral trade balance between the US and China itself – shown below:

All data relate to 2010. As you can see, the net bilateral trade surplus appears to be between $247m and $539m in favor of the US. The most significant flows in favor of the US firstly relate to solar capital equipment, of which the US exports between $708m and $1bn to China. Secondly, exports of polysilicon for solar use come in at around $873m.

Strong US companies like First Solar (FSLR) and SunPower (SPWRA) continue to offer good competition to Chinese players in modules in the rest of the world. And they are of course the leaders in the burgeoning US Utility Scale Solar market. However, as one would expect, actual module sales into China have been tiny – at only $17m.

As I argued in my previous article, mentioned above, the long-term health of the solar sector greatly depends on its ability to get costs down towards grid parity. In a pragmatic sense, a combination of US innovation and low cost Chinese manufacturing may well be the best way to get there. What is important is that during this process of creative destruction, the US maintains a healthy trade surplus in solar.

From an investment perspective, let me simply repeat the conclusion from my last article:

“…..this probably means that in the process ahead towards a very competitive lower cost, higher volume market it’s probably best to stick with the main low-cost Chinese players such as Suntech Power (STP), Trina Solar (TSL), Yingli Green Energy (YGE) and JA Solar (JASO), alongside US players with a strong market position such as First Solar (FSLR) and SunPower (SPWRA). The period ahead could be very difficult for second tier players everywhere.

Having said that, I currently have no positions in either solar or clean energy as a whole and will maintain that position until the macro environment becomes clearer – for more detail see here“.

Disclosure: I have no positions in the stocks discussed.

About the Author: Clean Energy Intel is a free investment advisory service (available at www.cleanenergyintel.com), produced by a retired hedge fund strategist who also manages his own money inside a clean energy investment fund.