This Isn’t What Green Money Management Looks Like

Tom Konrad, Ph.D., CFA

I don’t spend much time reading investment company ESG reports, but a friend asked me to take a look at a copy of the TIAA’s 2021 Climate Report. I was deeply unimpressed. Here are a few things in the report that triggered my greenwashing radar:

TIAA wants to work with companies to improve their behavior. They call this company engagement. “e do not expect to account for the majority of our emissions reduction — we are primarily focused on company engagements” page 9.

Much of TIAA’s emphasis is on reducing emissions from their own operations,...

10 Clean Energy Stocks for 2021: Wrap Up

By Tom Konrad, Ph.D., CFA

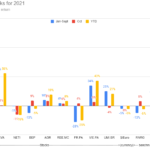

The Ten Clean Energy Stocks for 2021 model portfolio had a decent year. With a 13.2% total return, it handily beat its clean energy income stock benchmark, the Global X Renewable Energy Producers ETF (RNRG, formerly YLCO), which fell 12.1%. It did not, however, compare as well to the wider universe of income stocks, which had an excellent year, with its benchmark SDY up 27.2%.

The poor performance of clean energy stocks in 2021 was largely due to the bursting of a clean energy bubble which formed in the second half of 2020 fueled by speculation...

10 Clean Energy Stocks for 2021: November. Notes on MIXT, GPP, EVA

By Tom Konrad, Ph.D., CFA

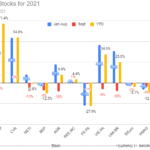

Monthly Performance

Returns for the Ten Clean Energy Stocks for 2021 model portfolio are shown below. It was a good month for clean energy stocks as well as the broader stock market, with the portfolio up 4% for a 20% total return through the end of October. Its clean energy benchmark (RNRG) was up more (8%) but is still down 6% for the year. Its broad market benchmark (SDY) rose 5% and has caught up with the model portfolio at a 20% return year to date.

Earnings

Third quarter earnings season has started. Below are some notes I’ve...

Analyzing Greystone Logistics

by Roel Aerts

Greystone Logistics (GLGI) designs and manufactures plastic pallets for the logistics industry. They use recycled plastic which would otherwise be destined for landfill. They grind and pelletize the plastic in house. Injection molding and proprietary resin blend is used to manufacture the pallets.

Greystone is headquartered in Oklahoma and has its manufacturing plant in Iowa.

Recent results and Financials

· The company had invested heavily in manufacturing equipment several years ago, that loaded them with quite some debt. Over the last years they worked on a massive reduction in debt. In 2 years they reduced it from 21.6M$ to 9.4M$...

Invest-Divest 2021: A Decade of Progress Towards a Just Climate Future

The movement to divest pension funds, universities and colleges, faith organizations and foundations from fossil fuels, and invest in climate solutions, has reached new heights in the fight for meaningful, ambitious climate action.

In the lead up to COP26, join a global coalition of organizations to announce a historic slate of groundbreaking divest/invest commitments, unveil a new “state of the D/I movement” report, including an update of assets under management committed to divestment, and celebrate major victories. Join us on Tuesday October 26th at 11am EST for this monumental event.

RSVP Here to join the Invest-Divest 2021: A Decade of Progress...

Will McConnell Kill The Bull Market?

By Tom Konrad, Ph.D., CFA

The risks of playing politics

The American news media often tries too hard to be “balanced” when talking about politics.

Depending on which news sources you rely on, you may be hearing that “congress” is having trouble passing bills to fund the government and raise the debt ceiling. More partisan sources will be blaming it on the Democrats or the Republicans, depending on their political bent.

I generally consider myself an independent who cares deeply about the environment and competent government. Since the rise of Donald Trump, the Republicans have shifted from being the party of big business...

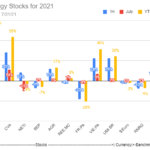

10 Clean Energy Stocks Performance Chart

Here's the performance through August for the 10 Clean Energy Stocks for 2021 model portfolio... The market has turned down a bit since then but the relative performance has not changed significantly. The model portfolio is still well ahead of its benchmarks., both clean energy (RNRG) and broad market (SDY).I don't know if this recent downturn is just a blip, or the start of the possible larger decline I've been worrying about. But I'm prepared if it's the latter.

DISCLOSURE: Long positions all the stocks in the model portfolio.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of...

Wind Turbine Art

My sister, who is a linocut artist, just finished some wind turbine prints for me. One is below, you can check out the others at facebook.com/SarahKonradArt

Polaris Infrastructure: Deleveraged, Derisked

By Tom Konrad, Ph.D., CFA

Geothermal power is a type of renewable electricity that even the most conservative electric utilities find it easy to get behind. Like conventional coal and gas plants, it uses heat to drive a turbine which in turn creates electricity. The main difference is that the heat comes from natural geologic processes, rather than burning fossil fuels, making it renewable and free of greenhouse gas emissions, giving it considerable environmental appeal as well.

Where Geothermal Developers Stumble

The problem lies in the resource. The potential for producing power from solar, wind, and hydropower at any location can be...

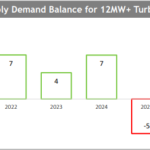

Eneti: The New Offshore Wind Installation Leader

By Tom Konrad, Ph.D., CFA

With its purchase of Seajacks, Eneti (NYSE:NETI) has become the world’s largest owner of offshore wind installation vessels. The two articles were shared with my followers on Patreon as the news came out.

Valuing the Eneti/Seajacks Combination (First published August 5th)

Eneti (NETI) just announced it is buying offshore wind turbine installation firm Seajacks. The purchase will be with a combination of shares, cash, and assumed debt: 8.13 million shares, $299 million of assumed net debt, $74 million of newly-issued redeemable notes, and $12 million of cash. Current Eneti shareholders will own 58% of the combined firm.

After...

10 Clean Energy Stocks Updates: Green Plains Partners Refi; Covanta Buyout

By Tom Konrad, Ph.D., CFA

Second quarter earnings season is in full swing. Below are a couple updates and the monthly performance chart that I recently shared with my Patreon supporters.

Green Plains Partners Earnings and Future Dividend

(published August 2nd)

Ethanol Master Limited Partnership Green Plains Partners (GPP) declared second quarter earnings today. The main news remains the long anticipated debt refinancing and new dividend guidance going forward.

At the end of the first quarter, I predicted that, after debt refinancing, GPP would increase its quarterly dividend to something in the $0.25 to $0.30 range.

The new guidance is for the partnership to target...

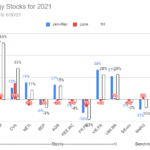

Finding a Bottom and Model Portfolio First Half Returns

By Tom Konrad, Ph.D., CFA

Even as the broad market rose, the start of 2021 was brutal for clean energy stocks. The sector experienced a bubble in late 2020 and January this year as optimism grew that we finally had a President who understands the magnitude of the climate problem and has committed to do something about it. The bubble also grew from the great hope that with the presidency and slim majorities in both houses of congress, he would actually be able to get his agenda through.

That might have happened if the Senate Republicans were interested in governing and...

A Disappointing Supreme Court Biofuel Decision. Why It’s Not Over Yet

By Jim Lane

The case

Last week’s decision stems from a May 2018 challenge brought against EPA in the U.S. Court of Appeals for the Tenth Circuit by the Renewable Fuels Association, the National Corn Growers Association, National Farmers Union, and the American Coalition for Ethanol, working together as the Biofuels Coalition. The petitioners argued that the small refinery exemptions were granted in direct contradiction to the statutory text and purpose of the RFS and challenged three waivers the EPA issued to refineries owned by HollyFrontier Corp. and CVR Energy Inc.’s Wynnewood Refining Co.

The case is HollyFrontier Cheyenne Refining, LLC v....

Eneti and the Jones Act

By Tom Konrad, Ph.D., CFA

About a month ago, an astute reader asked me if Eneti's (NETI) contracted Wind Turbine Installation Vessel (WTIV) would be able to operate in US waters since it will not be compliant with the Jones Act. For those not familiar, the Jones Act requires that all transport of goods between US ports must be done by vessels built in the US, and owned and operated by US citizens.

I looked into it, and concluded that it probably could, since installing wind turbines is not transport, but rather lifting (jack-up, in the parlance), an exemption which is...

Alkaline Electrolyzers – The Future needs a Metamorphosis

by Ishaan Goel

The second article in this series on water electrolyzers focused on polymer electrolyte membrane electrolyzers (PEMEs). PEMEs have increasingly captured the interest of industry over recent years, due to favorable technical characteristics. Despite this, the global electrolyzer market today is dominated by a much older model - alkaline electrolyzers (ALKEs). (For details of how both electrolyzers work, refer to the first article in the series).

The graph above shows the investment costs ($/kW) of ALKEs and PEMEs as the technology has advanced over time. In other words, they show the initial capital cost for every 1 kW of...

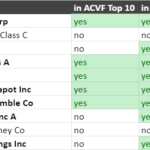

Are ESG Funds All That Different?

by Jan Schalkwijk, CFA

ESG investing is all the rage these days. That is, investing that includes the non-traditional environmental, social, and governance factors in the investment process. Its appeal to the broader investment industry is twofold:

1) The writing is on the wall: as wealth is passed down to younger generations who in the aggregate care more about values alignment, the asset management industry does not want to lose the assets and the fees they generate.

2) Thematic investing is popular and ESG is one of the hottest themes. Wall Street is not going to miss out. Much like crypto...