Buying Innergex – Texas Was Bad, But Not That Bad

By Tom Konrad, Ph.D., CFA

Last week, I published this call to buy Innergex (INGXF, INE.TO) because investors had been overreacting to the losses from the February cold snap in Texas. The stock is up since then, but still seems a decent value.

Canadian Yieldco Innergex Renewable Energy (INGXF, INE.TO) took a big financial hit from the power disruptions in Texas in March.

It's complex, but their financial hedges on power prices for three of its wind farms ended up creating enormous liabilities - more, in fact, than two of their wind farms are worth. Two of their facilities also had benefits...

Atlantica Q1, Buying Hannon Armstrong

By Tom Konrad, Ph.D., CFA

Here are two more updates from last week on Patreon. Also, I realize I neglected to publish the monthly performance chart for my 10 Clean Energy Stocks model portfolio here at the start of the month, so here it is as well:

Atlantica Sustainable Infrastructure Earnings

(published May 11th)

Atlantica Sustainable Infrastructure (AY) released its first quarter earnings announcement and financial statements on May 6th.

Atlantica is one of the higher yielding Yieldcos, 5.3% at the new quarterly dividend rate of $0.43 and a $32.50 stock price. The dividend is safe, since most of Atlantica's debt is fixed rate,...

Earnings Roundup: Metals Prices Boost Covanta and Umicore

By Tom Konrad, Ph.D., CFA

You don’t have to own mining companies to benefit from rising metals prices.

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. Waste to energy operator Covanta and specialty metals recycler Umicore are both benefiting from skyrocketing metals prices.

Just as renewable energy and energy efficiency stocks have long shown that investors don’t have to own fossil fuel companies to benefit from rising prices of fossil fuels, recyclers like Covanta and Umicore are showing that you don’t have to own environmentally damaging mining companies to benefit from rising...

PEM Electrolyzers – Cracking the Chicken and Egg Problem

by Ishaan Goel

The first article in this series introduced two prominent types of water electrolyzers – alkaline electrolyzers (ALKEs) and polymer electrolyte membrane electrolyzers (PEMEs). Electrolyzers are devices that convert water into hydrogen and oxygen using electricity. They enable energy storage through hydrogen when combined with fuel cells, and can decarbonize hydrogen production for industry if supplied with renewable power. Subsequent articles shall focus on various characteristics of these two electrolyzer variants.

The graph above shows the investment costs ($/kW) of PEMEs and ALKEs as the technology has advanced over time. In other words, they show the initial capital cost...

Q1 Earnings Roundup: Yieldcos (AGR, BEP, CWEN, GPP)

By Tom Konrad, Ph.D., CFA

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. If there is any theme, it’s that low interest rates and increased interest in green investments is lowering Yieldcos’ cost of capital to the benefit of stock investors.

Avangrid Earnings

Avangrid's (AGR) Q1 earnings report showed solid progress. Key items of note were:

Increased outlook for full year 2021 Adjusted EPS a little over 5%

Key environmental approval for 800 MW offshore wind farm Vineyard Wind. Expected to begin construction later this year, with expected completion in 2024. Avangrid...

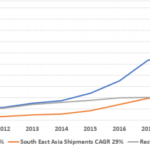

The Solar Industry’s Supply Chain Problems

by Paula Mints

The solar industry has a supply chain problem – no, not just the current polysilicon and glass constraints. Solar wafer, ingot, cell, and module manufacturing are concentrated in China and South East Asia, leaving buyers outside these areas vulnerable to supply chain shocks.

Countries in this region have lower labor costs, lower energy costs, and higher incentives and subsidies for manufacturers. In China, manufacturing is supported (and controlled) by the central government.

Manufacturers in China, who have expanded into South East Asia, can make do with lower

margins than their counterparts in other countries. Manufacturers in South East Asia and China...

Clean Energy Stock Deflation and Biden’s Infrastructure Plan

By Tom Konrad, Ph.D., CFA

Last month saw buying opportunities in some clean energy stocks as the bubble created from the euphoria over Biden’s election vanished as if it never happened.

Clean energy stocks have simply returned to the general upward trendline from the second and third quarter of 2020. Rather than bursting in a market panic, this seems to have been more of a general deflation.

Some clean energy stocks seem reasonably priced, but there are no great values like we often see during the market panics which typically follow bubbles. Without a panic, I’m not ready to buy aggressively. Stocks...

Discom-fort: Barriers to Renewables in India

by Ishaan Goel

Energy is crucial to India’s policy agenda. Millions of households are yet to gain reliable access to electricity, hampering their potential for economic growth. Severe pollution issues create widespread health problems. Renewables are prioritized as viable solutions across the political spectrum, with their low costs and ease of installation in remote regions. The current administration has ambitious plans for renewable energy (RE), targeting an almost 4x increase in installed capacity to 450 GW by 2030 and introducing a spate of tax and investment reforms.

At the heart of the Indian power supply chain lie distribution companies (discoms). The...

Pop Goes the Clean Energy Stock Bubble

by Tom Konrad, Ph.D., CFA

2020 ended with a massive spike in clean energy stock prices. From the end of October, election euphoria drove Invesco WilderHill Clean Energy ETF (PBW) from $63.32 to $136 at the close on February 9th, a 114% gain in 100 days.

Joe Biden is as strong a supporter of clean energy as Donald Trump was a supporter of big fossil fuel companies, but even with control of the presidency and both chambers of congress, there is a limit to what a president can do in a short time. This is especially true when their top priority...

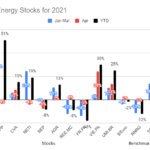

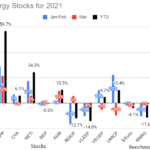

10 Clean Energy Stocks: Returns Through February/ Poll

by Tom Konrad Ph.D., CFA

I'm experimenting with how to display the returns of the 10 Clean Energy Stocks model portfolio. My Patreon supporters seem fairly evenly split between the two options show below, so I'm opening the poll up to my broader readership.

You can see the two most popular options below (with real return data through the end of February) and take the poll here.

Comments are welcome as well.

DISCLOSURE: Long all stocks in the model portfolio.

Covanta and Hannon Armstrong Earnings

by Tom Konrad, Ph.D. CFA

Two more earnings notes I shared with my Patreon followers on February 18th.

Covanta Holdings (CVA)

Leading waste-to-energy firm Covanta Holdings (CVA) announced 2020 earnings today. There will be a conference call tomorrow morning, but here is my high-level impression:

The company managed well through Covid and ended the year within it's original pre-covid guidance. Metals and energy prices, as well as increased maintenance capital expenditures were a drag on results, but prices are improving and capital expenditures will fall in 2021.

The company is conducting a strategic review which will likely result in the sale of some underperforming...

Eneti and Brookfield Renewable Earnings

By Tom Konrad, Ph.D. CFA

Here are a couple earnings notes I shared last week with my Patreon followers.

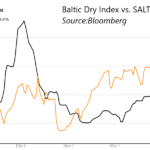

Eneti, Inc. (NETI) - formerly Scorpio Bulkers (SALT)

Eneti completed its name and ticker change on February 8th. New ticker is NETI (formerly Scorpio Bulkers (SALT), which I recently wrote about here.

Highlights from February 2nd earnings report:

37 of the 47 vessels owned at the 3rd quarter have been sold or have completed sale agreements.

Net asset value is $23.94/share. Since most assets are cash or vessels held for sale, this number is basically accurate.

The stock is still a good buy...

SALT: Buying the Balitc Dry Dips

by Tom Konrad, Ph.D. CFA

The Baltic Dry Index (BDI) is a shipping and trade index created by the London-based Baltic Exchange. It measures changes in the cost of transporting various raw materials, such as coal and steel.

Since the BDI is a measure of the income which firms that own dry bulk cargo ships can earn, changes in the BDI tend to drive changes in the stock prices of such companies.

Stock Price Correlation

Until recently, one such company was Scorpio Bulkers (SALT), one of my Ten Clean Energy Stocks for 2021 picks. The chart below shows the last 5 years, with...

January Performance: 10 Clean Energy Stocks for 2021

You can find the original list here. I'll be doing commentary on individual stocks as there is news. The first of these is on MiX Telematics (MIXT) earnings, first published for my Patreon subscribers on January 28th and copied below. A note on Scorpio Bulkers (SALT) from February first will be published here tomorrow.

MiX Earnings

MiX Telematics (MIXT) reported earnings this morning . The numbers showed improvement over the previous quarter, but a decline over the previous year due to the covid crisis which was exacerbated by the strengthening dollar.

The results were pretty much what I expected when I added...

Voting and GameStop

Only a couple weeks ago, I quoted the market aphorism, “In the short-run, the market is a voting machine, but in the long-run, it is a weighing machine.”

It comes to mind again now that Robinhood types are short squeezing hedge funds with GameStop (GME) and other nostalgia stocks.

It's another example that any strategy that relies on valuation affecting prices in the short run (like stonks betting that GME would go down because it lacks a viable business) is incredibly risky. It's also incredibly risky to bet that any trend driven by popularity will last. Eventually, there are going...

Introduction to Electrolyzer Technologies

by Ishaan Goel

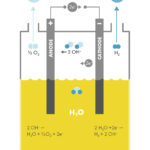

Hydrogen has become increasingly prominent as a potential carbon-free fuel, for both automobiles and providing electricity to buildings. It has direct applications in decarbonizing important industries like steel, and can serve as a storage medium for extra renewable energy over seasonal durations too.

Since hydrogen gas does not occur naturally in our atmosphere, its method of production is an essential component of the hydrogen economy. There are several such methods (discussed in detail here), but the one with least emissions involves using renewable power to run electrolyzers - devices that use electricity to convert water into hydrogen and...