Ten Clean Energy Stocks For 2015: Marching Ahead

Tom Konrad CFA My Ten Clean Energy Stocks for 2015 model portfolio added a second month to its winning streak, with a 6.1% gain for the month and a 5.7% gain for the year, despite a continued drag by the strong dollar. If measured in terms of the companies' local currencies, the portfolio would have been up 7.5% for the month and 10.5% for the quarter or year to date. For comparison, the broad universe of US small cap stocks rose 1.5% for the month and 4.0% for quarter, as measured...

Four Picks and Shovels Stocks

by Tom Konrad, Ph.D., CFA

The last three months of 2020 brought an explosion in clean energy stock prices.

Solar stocks (as measured by the Invesco Solar ETF (TAN), nearly tripled. So did the Invesco Wilderhill Clean Energy ETF (PBW), which includes a broader spectrum of companies. Wind stock rose 61%, and even the relatively sedate Yieldcos were up 32%. The stars of the last half of 2020 was undoubtedly Tesla (TSLA, up 246%) and other electric vehicle stocks.

Money Flows Out of Fossil Fuels and Into Clean Energy

I believe that the cause of the current rise in stock prices is largely...

Ten Clean Energy Stocks For 2014: Patience Rewarded

Tom Konrad CFA For both the stock market and the weather, March was more lion than lamb. My broad market benchmark fell 2.2% to end up 1.5% for the quarter. Volatile clean energy stocks were down 4%, to end the quarter up 15.7%. My annual Ten Clean Energy Stocks model portfolio is designed to avoid much of the sector's notorious volatility, and fell only 0.6%, ending the quarter with a 3.9% total return. In dollar terms, the first six (income oriented) picks returned an average...

Value Trapped: Ten Clean Energy Stocks For 2015, April Update

Tom Konrad CFA My Ten Clean Energy Stocks for 2015 model portfolio held on to first quarter gains in April, despite a 29% fall for one of the stocks. (For details on that decline, see the Power REIT (NYSE:PW) section below.) The portfolio as a whole was rescued by the recovering Canadian Dollar and Euro, as well as mild advances for most of the other stocks across the board. That includes a 4.9% gain for TransAlta Renewables (TSX:RNW, OTC:TRSWF), and a 5.8% gain for FutureFuel (NYSE:FF) which I singled out...

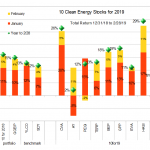

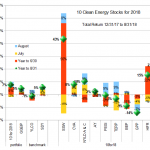

10 Clean Energy Stocks: Returns Through February/ Poll

by Tom Konrad Ph.D., CFA

I'm experimenting with how to display the returns of the 10 Clean Energy Stocks model portfolio. My Patreon supporters seem fairly evenly split between the two options show below, so I'm opening the poll up to my broader readership.

You can see the two most popular options below (with real return data through the end of February) and take the poll here.

Comments are welcome as well.

DISCLOSURE: Long all stocks in the model portfolio.

Alternative Energy and Climate Change Mutual Funds, Part IV

Tom Konrad CFA Cherry picking the holdings of green energy mutual funds. So far in this series I've concentrated on trying to pick the best of the Alternative Energy and Climate Change Mutual Funds. This is a difficult task, because while I found in Part III that most of the funds' performance has been better than comparable index ETFs, these mutual funds' costs are quite high, even by the standards of most mutual funds, as I discussed in Part I. In part II, I tried looking at the sector breakdown of the funds' holdings, to see if...

Ten Green Energy Gambles for 2010: Update I

Tom Konrad, CFA A quick update of last month's list of speculative puts, to reflect the new options symbols. In January, I put together a list of nine puts and one small energy efficiency stock I expect to do well this year. I normally only do updates on these every quarter, but because of the recent change option symbols, I thought I'd revisit my 10 Green Energy Gambles. The links in the original article have stopped working; this new table shows the current list. Here's the list: with updated option symbols. Security Portfolio...

Ten Clean Energy Stocks for 2013: April Update

Tom Konrad CFA While the sun was shining on most clean energy stocks in April, my ten clean energy picks for 2013 (introduced here) got relative showers. The Powershares Wilderhill Clean Energy Index (PBW) was up a sunny 14.1% for April to 19.6% for the year, rising quickly past my picks, which inched up a relatively meager 0.7% to 7.5% for the year so far. Meanwhile, the broad universe of small stocks gained 2.6% for a year to date gain of 15.1%, as measured by my benchmark the iShares...

Ten Clean Energy Stocks For 2015: Riding The Storm

Tom Konrad CFA The first half of 2015 saw a mild advance in the broad market, but concerns about rising interest rates and the ongoing Greek debt drama sent income stocks, clean energy, and most non-US currencies down decisively. My Ten Clean Energy Stocks for 2015 model portfolio has heavy exposure to not only clean energy, but income stocks (6 out of 10) and foreign stocks (4 out of 10.) Despite this the stormy market for all three, the portfolio delivered admirably. The model portfolio ended the second quarter up 9.7%, compared to its broad market...

Ten Clean Energy Stocks For 2014: September Update and Thoughts on the Finavera Deal

Tom Konrad CFA Clean energy stocks and the market in general rebounded strongly in August. My broad market benchmark of small cap stocks, IWM, rose 4.5%, returning to positive territory up 1.7% for the year. My clean energy benchmark PBW also jumped back into the black with an 11.1% gain for the month and 10.8% for the year to date. The less volatile defensive stocks in my 10 Clean Energy Stocks for 2014 model portfolio rose 1.9%. For the year to...

10 Clean Energy Stocks For 2019 – First Two Months Results

It's hard to find anything to complain about in the first two month's performance of my 10 Clean Energy Stocks for 2019 model portfolio. Unfortunately, I'm about to go on vacation and don't have time to do an update on all the earnings reports that have come out over the last two weeks. I will try to get to them individually as I have time.

Strategically, I'd like to say I'm getting very nervous about this market rally, and think that readers should be taking profits opportunistically and increasing your cash positions.

Shares in Altair Nanotechnologies Purchased

I purchased shares in Altair Nanomaterials (ALTI) this morning for both my personal portfolio and also the mutual fund. ALTI is a holding company that specializes in nanomaterials and also contains a life sciences division. The materials company has research in high performance batteries, fuel cells, and photovoltaics. Altair announced earnings today and the stock is up on the morning trading. Revenue Increases 68 Percent for Third Quarter and 230 Percent for Nine-Month Period "An increase in revenue of 230 percent for the first three quarters of 2005 is representative of the significant progress Altair has...

Ten Clean Energy Stocks For 2019

by Tom Konrad Ph.D., CFA

Looking forward to 2019, I'm more optimistic than I have been since the start of 2016, in the wake of the popping of the YieldCo Bubble in late 2015.

The bear market that started in late 2018 seems like it's far from over, but I expect in early 2019 will see it enter a less chaotic phase. After the wild declines and swings of late 2018, I expect investors will begin the new year with an eye to safety more than growth. This means that the clean energy income stocks which are my focus should outperform...

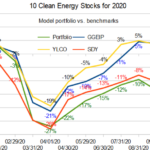

10 Clean Energy Stocks for 2020: Spooked in October, but Trading Anyway

by Tom Konrad, Ph.D., CFA

Two of the cash covered puts in the 10 Clean Energy Stocks for 2020 model portfolio have now expired, and I am left with a difficult decision as to what to replace them with.

As I discussed last month, I feel the market is overvalued given the economic impact of the pandemic and little prospect of fiscal stimulus before January. Yes, the market is not the whole economy, and large tech firms and high income workers and the wealthy are doing great while people on the bottom half of the income ladder are being crushed. With...

Performance Update: Sell and Short Recommendations

Investors are getting bearish these days, which comes as a surprise to me, since I'm used to being in the minority. I was a bear when I first took the leap from mutual funds and started trading stocks in 1999, and am a bear still. I wish I'd turned bullish for a couple of years at what I consider to be the large bear market recovery of 2003-2006, but I didn't. However, since I was (and still am) bullish on commodities since around the same time frame, I can't complain about my returns over the period. This spring, I...

Ten Clean Energy Stocks For 2018: Second Quarter Earnings

Tom Konrad Ph.D., CFA

July and August saw some mild recovery for the stock market after a difficult first half of 2018. Clean energy income stocks continue to lag the broader market, but my Ten Clean Energy Stocks model portfolio has managed to maintain its lead over its broad market benchmark.

Through August 31st, the model portfolio is up 7.5%, compared to its broad dividend income benchmark SDY, which is up 5.3%. Its clean energy income benchmark YLCO is down 1.2, even after dividend income. The private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP), is slightly behind the...