Ten Clean Energy Stocks For 2018: Oddballs Spring Back

After a stormy winter for the broad market and clean energy stocks, including my picks, March and April brought relative calm. Better yet, my model portfolio has rebounded from its February lows, although its benchmarks (SDY for the broad market of income stocks and YLCO for clean energy income stocks) have mostly been treading water.

The gains were led by two of my less conventional clean energy picks, Seaspan (SSW) and InfraREIT (HIFR). Seaspan owns (mostly very efficient) container-ships, which most people would not associate with clean energy, but which I include because they they are much less energy intensive...

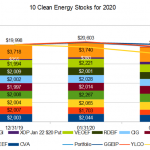

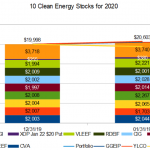

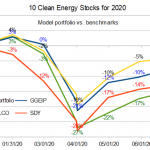

Ten Clean Energy Stocks for 2020: Navigating the Storm

by Tom Konrad, Ph.D., CFA

This monthly update for my Ten Clean Energy Stocks model portfolio is in two parts. I published my thoughts on the current market turmoil on March 2nd. You can find them here. I'm not even going to get into the Fed slashing interest rates like they were a furniture warehouse going out of business on March 3rd except to say that apparently they are more afraid of the effects of covid-19 on the economy than they are of appearing to panic.

You can see overall performance for January and February in the following chart. Not that...

10 Clean Energy Stocks for 2020: Updates on GPP, HASI, CVA

by Tom Konrad, Ph.D., CFA

Market Decline

Last week I warned "The risks in today's stock market outweigh the possibility of future potential gains." Looks like we're seeing those risks manifest in short order. The last couple days' decline have me looking at a few stocks to start adding to my positions again, especially MiX Telematics (MIXT) discussed on June 2nd and Green Plain Partners (GPP), discussed below.

Note that this pullback could easily be very early days of a much larger market decline. We might even see the market fall far enough to test the March lows... any of my buying...

Ten Clean Energy Stocks for 2020: Trades

by Tom Konrad Ph.D., CFA

Four weeks ago, I predicted that the 12% market correction we had seen would turn into a true bear market. Bear markets are often defined as a decline of more than 20% for the major market indexes, but I find it more useful to focus on long term changes in investor sentiment.

What I did not predict was just how severe the effect of the coronovirus shutdown would be on the economy. I thought we would need the combined of the effect of the shutdown and investors re-assessing their risk tolerance to bring us into full...

Divestment v Coronavirus: Ten Clean Energy Stocks for 2020 January Update

by Tom Konrad, Ph.D., CFA

January 2020- where do I start? A year of market-shaking news in a month.

The Brink of War

The month started off with a literal bang when Trump decided that a good way to distract the public from his impeachment trial would be to try to start a war with Iran by assassinating one of Iran's top military leaders, Qassem Suleimani. A week later, the world and markets heaved a collective sigh of relief when Iran decided that their honor had been satisfied with two missile strikes on US bases. While Trump reported no casualties, Iran's Foreign...

10 Clean Energy Stocks for 2020: Rose Colored Covid

by Tom Konrad, Ph.D., CFA

The stock market took off in November, fueled by very positive covid-19 vaccine news, and possibly also the prospect of a little competence and sanity in the White House. While both of these are unambiguously positive for the economy, I think investors are seeing the future through rose colored glasses.

Rose colored covid-19.

What a Biden Victory Means for the Economy

A Biden victory is good news in that we will finally have someone in the White House who will work to reduce the infection rate in the pandemic, rather than vacillating between wishful thinking and actively spurring...

Ten Clean Energy Stocks For 2017: Sunny August Skies

by Tom Konrad Ph.D., CFA

After a strong performance all year, the stock market stumbled in August, along with clean energy stocks in general, although the sector continues to outperform the broad market. My Ten Clean Energy Stocks model portfolio again came out on top, buoyed by two winners (Seaspan Preferred (SSW-PRG) and MiX Telematics (MIXT). Both were catalyzed by strong earnings reports at the start of August, which I summarized last month.

For the month of August, the model portfolio was up 0.9%, for a 26.3% total gain for the year to the end of August. It's clean energy benchmark...

Four Picks and Shovels Stocks

by Tom Konrad, Ph.D., CFA

The last three months of 2020 brought an explosion in clean energy stock prices.

Solar stocks (as measured by the Invesco Solar ETF (TAN), nearly tripled. So did the Invesco Wilderhill Clean Energy ETF (PBW), which includes a broader spectrum of companies. Wind stock rose 61%, and even the relatively sedate Yieldcos were up 32%. The stars of the last half of 2020 was undoubtedly Tesla (TSLA, up 246%) and other electric vehicle stocks.

Money Flows Out of Fossil Fuels and Into Clean Energy

I believe that the cause of the current rise in stock prices is largely...

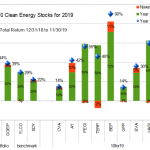

Ten Clean Energy Stocks For 2019: Still Party Time

by Tom Konrad Ph.D., CFA

2019 has become another blockbuster year for the Ten Clean Energy Stocks model portfolio and, to a lesser extent clean energy stocks and the broad stock market as well. I'm frankly surprised to see the party continuing. The continued spiking of the metaphorical punch bowl by the Federal Reserve with interest rate cuts certainly has a lot to do with it. I had expected those cuts to be both fewer and less effective.

Which all goes to show that it's always a good idea to hedge one's bets in the stock market. At least in part...

10 Clean Energy Stocks for 2020: June Update

by Tom Konrad, Ph.D., CFA

The coronavirus pandemic no longer has the United States by its financial center throat, the New York City area, but is instead is now gnawing ravenously at its arms and legs. In June, the stock market seems to be just starting to get a clue that this is also a bad thing, leading to a month of volatility and general consolidation.

Europe, in a display of relative competence, has been much more effective than the US at getting the pandemic beast under control, and so investors looking for safe havens might do well to look there. ...

Finding a Bottom and Model Portfolio First Half Returns

By Tom Konrad, Ph.D., CFA

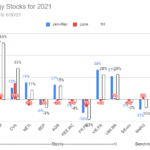

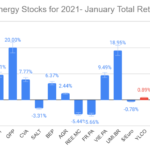

Even as the broad market rose, the start of 2021 was brutal for clean energy stocks. The sector experienced a bubble in late 2020 and January this year as optimism grew that we finally had a President who understands the magnitude of the climate problem and has committed to do something about it. The bubble also grew from the great hope that with the presidency and slim majorities in both houses of congress, he would actually be able to get his agenda through.

That might have happened if the Senate Republicans were interested in governing and...

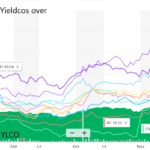

The Yieldco Virtuous Cycle

by Tom Konrad, Ph.D., CFA

Readers who followed my coverage of the Yieldco bubble in 2015 know the Yieldco Virtuous Cycle.

A Yieldco’s stock price rises

It issues new shares, and invests the money in renewable energy projects.

Because the stock price is high, it is able to buy more project cash flow by issuing fewer shares than it has in the past.

Cash flow available for distribution (CAFD) per share increases, despite the increasing number of shares outstanding.

Yieldco management sets a target for continued rapid annual distribution growth, which can be met either by further share issuance (if...

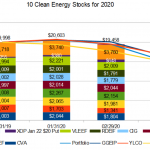

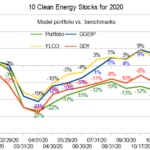

10 Clean Energy Stocks: Returns Through February/ Poll

by Tom Konrad Ph.D., CFA

I'm experimenting with how to display the returns of the 10 Clean Energy Stocks model portfolio. My Patreon supporters seem fairly evenly split between the two options show below, so I'm opening the poll up to my broader readership.

You can see the two most popular options below (with real return data through the end of February) and take the poll here.

Comments are welcome as well.

DISCLOSURE: Long all stocks in the model portfolio.

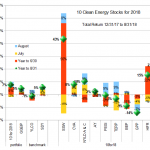

Ten Clean Energy Stocks For 2018: Second Quarter Earnings

Tom Konrad Ph.D., CFA

July and August saw some mild recovery for the stock market after a difficult first half of 2018. Clean energy income stocks continue to lag the broader market, but my Ten Clean Energy Stocks model portfolio has managed to maintain its lead over its broad market benchmark.

Through August 31st, the model portfolio is up 7.5%, compared to its broad dividend income benchmark SDY, which is up 5.3%. Its clean energy income benchmark YLCO is down 1.2, even after dividend income. The private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP), is slightly behind the...

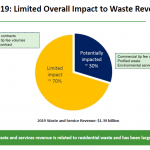

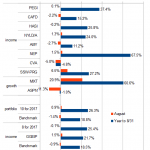

Covanta and Green Plains Partners Don’t Let A Crisis Go To Waste

by Tom Konrad, Ph.D., CFA

Last week, two of the stocks in my Ten Clean Energy Stocks model portfolio cut their dividends. Covanta Holding Corp (CVA) dropped its quarterly payout from $0.25 to $0.08 (a 68% cut) while Green Plains Partners (GPP) slashed its quarterly distribution from $0.475 to $0.12, a drop of 74.75%.

Before reducing their dividends, both companies had payout ratios near 100%, meaning that substantially all of their free cash flow was going to pay dividends. In general, companies are very reluctant to cut their dividends because it is a signal that their management thinks they cannot grow...

January Performance: 10 Clean Energy Stocks for 2021

You can find the original list here. I'll be doing commentary on individual stocks as there is news. The first of these is on MiX Telematics (MIXT) earnings, first published for my Patreon subscribers on January 28th and copied below. A note on Scorpio Bulkers (SALT) from February first will be published here tomorrow.

MiX Earnings

MiX Telematics (MIXT) reported earnings this morning . The numbers showed improvement over the previous quarter, but a decline over the previous year due to the covid crisis which was exacerbated by the strengthening dollar.

The results were pretty much what I expected when I added...